CRE investment, the allure of specialist sectors, and dollar dominance

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Volatile equities and bonds support the case for UK CRE

Commercial real estate currently offers an attractive alternative to riskier assets such as equities and even safe haven assets including government bonds. Over the month of April, the US Nasdaq composite contracted 13.3%, its worst monthly decline since the GFC, while UK and US 10-year government bond yields have softened to their highest level since 2015 and 2018, respectively. Furthermore, All UK property total return was 24% in the 12 months to March, while FTSE 250 total returns were just 0.5%. Will investors act? Some already have - UK commercial real estate investment totalled £14.4bn in Q1 2022, a 22% increase on Q1 2020 and 24% above Q1 2019.

Specialist sector investment rallies

UK Specialist sector investment increased +55% over the 12-months to Q1 2022, totalling c.£21bn. The UK Healthcare sector has been and is expected to remain a strong driver of this growth. A survey conducted in our latest Healthcare capital markets Healthcare report found that there is currently over £6bn of capital available and committed for surveyed investors to deploy on care assets. The demand for the Healthcare sector exemplifies the investor appetite for more diverse specialist assets, that are less exposed to the ebbs and flows of the economic cycle.

Dollar dominates

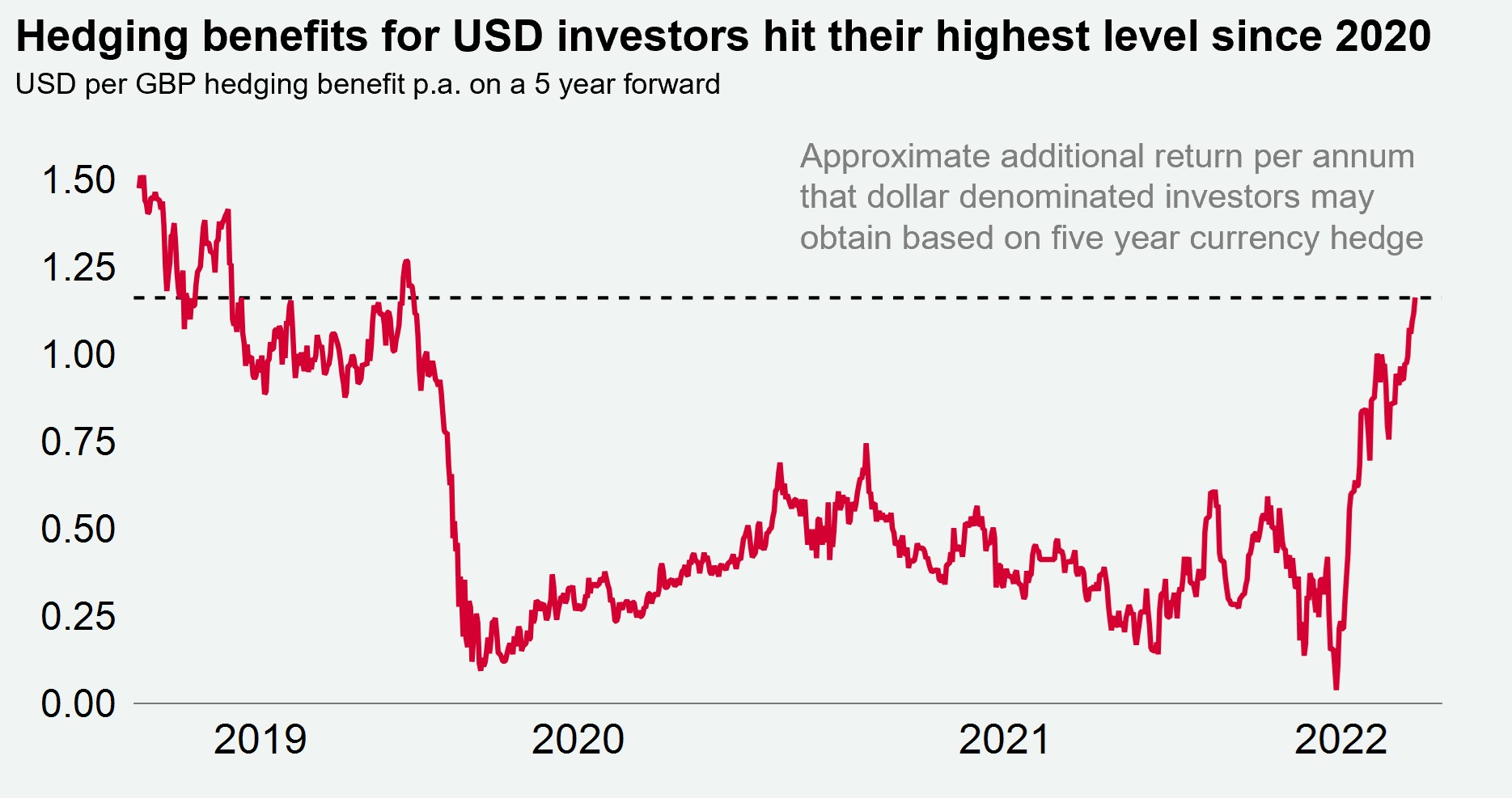

The US dollar index, which measures the currency against a basket of six others, has hit its highest level in over 20 years, up c.8% YTD. Currently, sterling is at $1.26, down from $1.37 in January, making UK assets significantly cheaper for US investors. This backs the chorus of those who already expected 2022 to see significant corporate M&A activity. Cheaper sterling is also supportive of our forecasts which indicate that US investors will be the greatest source of cross border investment into UK CRE this year. Additional impetus will come from annual currency hedging benefits for US dollar denominated investors into the UK, which are at 1.16%, their highest level since January 2020.

Download the latest Dashboard