The purposeful office

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

WFH

A survey of more than a thousand employers by the Chartered Institute of Personnel and Development provides a fascinating snapshot of evolving attitudes to remote work.

To some extent people seem to be getting the hang of it. Two-fifths of employers say homeworking or hybrid working has increased productivity, while only 18% take the opposing view. Flexible working has become something of a core talent retention tool and more than half of employers say they make policies clear in job adverts to attract staff. The pandemic has clearly prompted a reset in working culture that extends well beyond remote work, and employers report offering a range of more flexible methods, from flexitime, to compressed hours to job sharing and career breaks.

Still, many surveys of this nature report a steady softening of attitudes and this one is no different. Organisations expect around a fifth (21%) of their workforce to work from home all the time once the crisis is over, while they expect 40% of their workforce to work from home on a regular basis (at least once a week). Those measures have come down from December's readings of 28% and 45% respectively.

Tall buildings

We talked on Monday about the slowdown in the construction of tall buildings in London. The pipeline of 20 storey-plus buildings contracted year-on-year in 2021. New planning applications put forward by developers and new construction starts - bellwethers for the state of the market – also came in lower than long-term trends.

The shift is largely down to a slowdown in inner London, where the pipeline contracted to 355 buildings. The pipeline in outer London rose 6% to 228 buildings last year and now accounts for 39% of the total, up from 37% a year ago and 36% in 2019. Newham, with 46 tall buildings, has the largest pipeline in outer London, though other ‘hotspots’ are emerging including Ealing (39), Brent (31), Croydon (28) and Barnet (27).

These are overwhelmingly residential-led schemes. A combination of factors is likely to be underpinning this shift, including comparatively lower land values — which can make sites more viable to build — as well as ongoing large-scale regeneration projects in outer boroughs. Higher density schemes are also likely to be viewed by local authorities as a means of meeting housing targets and accommodating the capital’s continuing growth, as well as supporting the Mayor to fulfil his pledge of protecting the Green Belt.

More broadly, a move towards outer London is consistent with the wider trend in the London development market in recent years, with applications and permissions in inner London having dropped significantly. The new London Plan, adopted in March 2021, emphasises the potential for “appropriate intensification” in outer London boroughs, particularly for housing, and is likely to lend further momentum to the trend. You can download the report here.

Mixed-use

London's developers have for several years been producing innovative mixed-use neighbourhoods – see King’s Cross, Battersea and what’s coming in Brent Cross and Tottenham. The onset of the pandemic and the resulting changes to lifestyles have significantly swelled the pool of demand for genuinely mixed-use schemes that blend home, work and leisure activities.

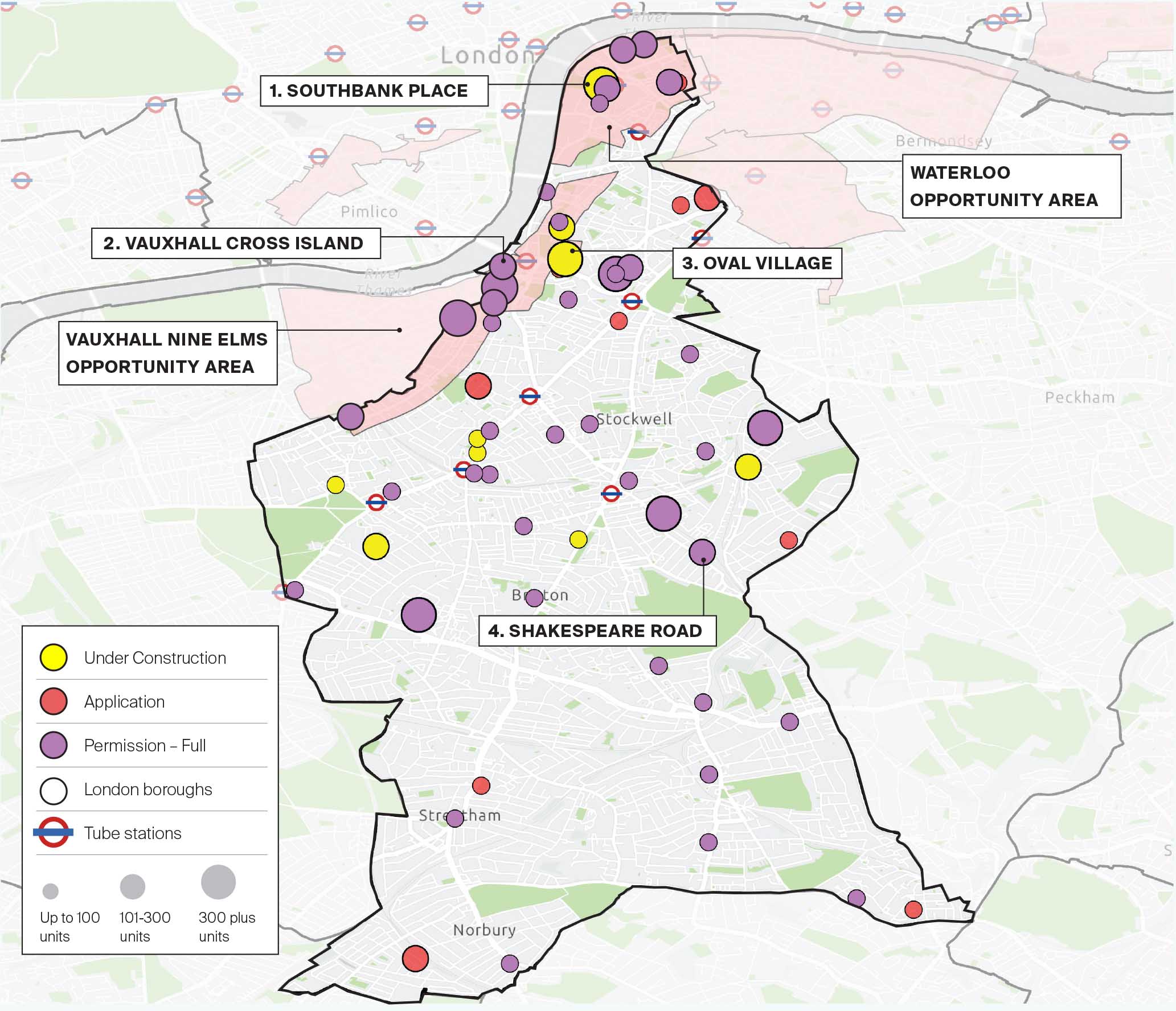

Anna Ward takes a closer look at Lambeth. The pandemic resulted in a 20% fall in housing deliver in the borough during the 2020-2021 financial year, but two designated development opportunity areas are expected to create 24,500 new jobs over the next two decades and, in turn, stimulate a surge in new homes delivery (see map). Emerging mixed-use developments in the borough include Berkeley’s 1,300 home Oval Village in Lambeth, which also comprises 100,000 sq ft of commercial space.

The London Plan suggests Lambeth will require 1,335 homes respectively every year for a decade in order to keep up with demand. Our analysis of the current development pipeline in Lambeth identifies 7,896 units with planning permission granted and 1,430 currently under construction which will be delivered over the coming years.

Italy's revival

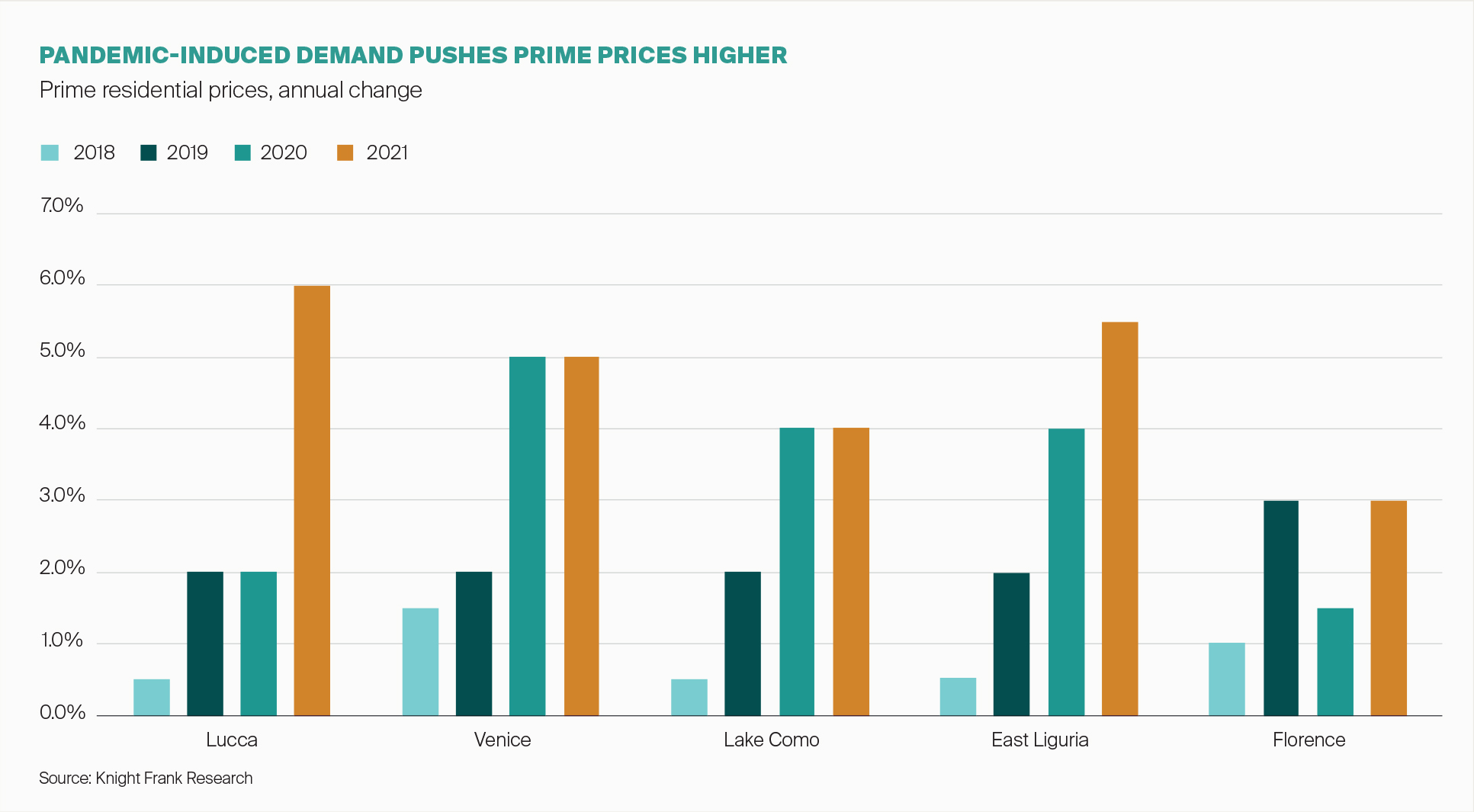

Italy's housing market is gaining momentum after spending much of the decade at the bottom of Knight Frank’s house price rankings.

Residential sales increased 22% in the first half of 2021 compared to the same period in 2019 and the discount achieved by the average buyer – the gap between the price marketed and the price paid – fell from 12% in 2019 to 9% in 2021 according to the Banca d ’Italia.

The pandemic has undoubtedly been one of the deciding factors. Space, views, culture, history, good food and a healthy lifestyle all are in abundance and northern Europeans empowered to work remotely have been buying in numbers.

A favourable tax regime is helping, too. Since 2017, residents, both domestic and international, can opt for a flat tax regime paying a single figure of €100,000 each year on all their non-Italian sourced income, instead of paying ordinary tax rates. The initiative is open to any new residents that have not been subject to Italian tax for nine out of the last 10 years.

The country is already home to 17,359 ultra-high-net-worth individuals – those with more than $30 million and that figure is set to rise by 14% in the next five years.

In other news...

Taylor Wimpey on resilient demand for new homes (Trading Update), the City of London is the most popular choice for foreign investors (Times), UK pay settlements reach highest level since 2008 (Reuters), China policymakers disagree on easing measures to counter property slump (FT), and finally, the ECB opens the door to a July rate rise while stressing contrast with US (FT).