Inflation accelerates again, tracking beneficial owners and a €100bn year for residential investment

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Inflation accelerates again

Consumer price inflation hit 5.5% in the year to January, a new 30-year high. That's up from 5.4% in December, according to official figures published this morning.

As Bloomberg notes, the data will pile pressure on the Bank of England to carry out a 50 basis point rate hike on March 17th. Inflation has now overshot forecasts in each of the past four months. Pricing in financial markets suggests the base rate will hit 2% this year, the highest since the onset of the financial crisis.

The CPI data comes hot on the heels of official labour market figures showing a shrinking workforce, record levels of vacancies and rising pay.

Who owns what

"We're...making sure that we take steps, or take even more steps, to unpeel the facade of Russian property holdings whether in this city or elsewhere," Boris Johnson told reporters yesterday, amid continuing uncertainty as to whether Russia will invade Ukraine.

Plans for a beneficial ownership register have been bouncing around Westminster since 2016. Consultations have since come and gone, as has a promise that a register would be operational by 2021. When questioned in 2020 and 2021, the government referred to its previous statements and said it would legislate "when parliamentary time allows”, see this useful summary from the House of Commons library.

London Mayor Sadiq Khan added extra pressure last week. A register may appear in the Economic Crime Bill, due to be published at some point this year. Tory MPs last month called for the revival of the bill, which has been beset by delays. Russia/Ukraine tensions have clearly given the issue renewed momentum.

Buying beds

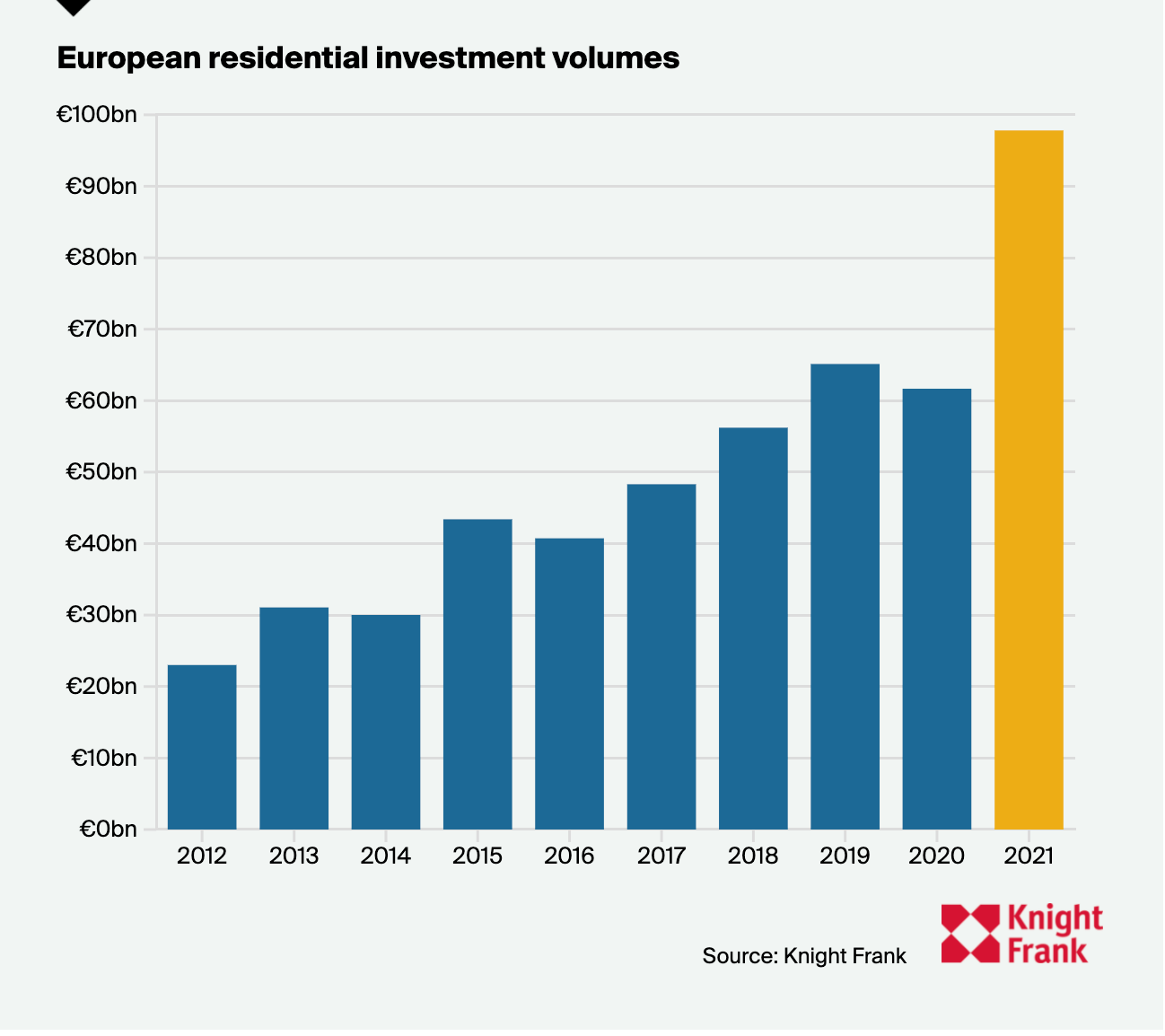

Just shy of €100 billion of assets were traded in the European residential investment sector in 2021, up 60% compared to a year earlier, according to analysis of RCA data. That amounts to 29% of all real estate investment by value across the continent, on par with investments in offices.

The sharp uptick was supported by a handful of large portfolio deals, including Vonovia’s acquisition of Deutsche Wohnen for close to €28 billion and Heimstaden’s acquisition of the Akelius residential portfolio for €9 billion. The sector encompasses student housing, multifamily, single-family rental, co-living, and seniors housing.

Germany was the largest single market for European residential investment, with 2021 volumes reaching €53 billion. Second to Germany is the UK, with over €12 billion invested, an increase of 6.6% on 2020 levels. However, in relative terms, the most significant increase in investment has been in the Nordics, with Sweden, Denmark, and Finland doubling 2020 levels to a combined 2021 total of €19 billion.

With inflation on the rise and bond yields at historic lows, the defensive benefits of investing in beds are set to continue as investors look to rental income as a hedge against inflation. See the full analysis for more. Also in the news today: L&G to plough £2.5bn of pension cash into homes for rent (FT).

Lingering for longer

Tom Bill checks in on the long road back to supply and demand normality for the UK housing market.

While supply is improving fitfully - the number of sales instructions in January was only 4% down on the pre-Covid five-year average - demand is consistently strong. The number of new UK prospective buyers in January was 54% above the five-year average.

The laws of supply and demand suggest that 2022 will be another strong year for transaction numbers and prices.

In other news...

The age of anti-ambition (NYT), Kyoto to tax empty houses as Japan’s population shrinks (FT), Blackstone doubles down on logistics (FT), the ECB can't ignore house prices (FT), and finally, Airbnb cashes in on trend for longer breaks (Times).