The big squeeze, seniors housing, and residential’s strongest start to a year since 2005

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Momentum holds

UK house prices climbed 0.8% between December and January. That caps annual growth at 11.2% and marks the strongest start to the year since 2005, according to Nationwide. The market has largely shrugged off December's rise in the base rate and all the leading indicators suggest momentum is holding steady for the time being - for more on our outlook, see our updated House View.

Mortgage approvals for house purchase, another leading indicator, remained above the long-run average in December, according to Bank of England data published yesterday. Banks issued 71,000 mortgages to buyers, compared to the pre-pandemic monthly average of 66,700.

High street mortgage rates, though inching upwards, have held pretty steady since the BOE moved the base rate to 0.25% in December, which is supporting activity. The lenders have new targets at the beginning of the year and are eager to make headway in the initial weeks. That's likely to be a temporary reprieve, considering markets are pricing a hike on Thursday at a near certainty. Borrowers on variable rates, which amounts to about £300 billion in mortgage debt - about a fifth of the total - will see a near immediate increase in their outgoings.

The squeeze

The fact that mortgage borrowers face a multi-fold increase in interest payments over the coming months has commanded a relatively small slice of the national conversation amid the surging costs of energy and various household goods.

Evidence of the cost of living squeeze is everywhere this morning. Retailers are passing price rises onto consumers and shop price inflation hit 1.5% in January, up from 0.8% in December, according to figures from the British Retail Consortium. That's the highest rate of inflation since December 2012. Data from Kantar put annual grocery price inflation at 3.8% in January, up 0.3% from December - equivalent to £180 on the average household's grocery bill.

Two thirds of adults in Britain reported their cost of living increased in the past month, particularly due to energy bills, according to ONS figures published yesterday. More than half said they were spending less on non-essentials and about a quarter are dipping into their savings. That tallies with the BOE data showing the net saving rate fell to £3.2 billion in December, down from an average of £10.6 billion during the pandemic and below the pre-pandemic average of £5.5 billion.

We've talked about the potential for a "shock and awe" approach to combating inflation from the Fed in the form of a 0.5% rate hike in March. The Times has its own shadow monetary policy committee of former rate setters. Five of their nine members would vote to increase the UK interest rate to 0.5% from 0.25% on Thursday, while two would opt for a 0.5% rise to 0.75%. The other two would back a rise of 0.75% points to 1%.

Seniors housing

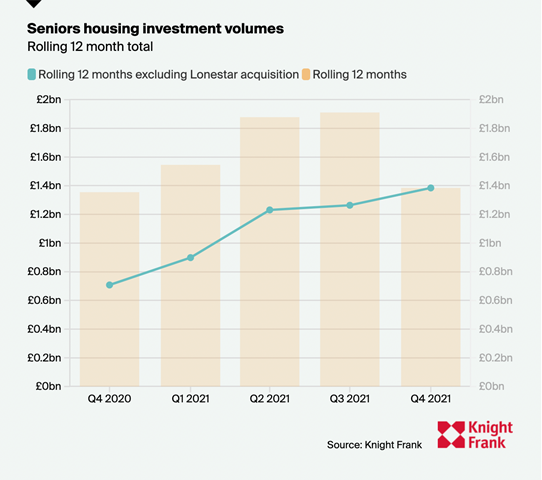

Investors spent £1.4 billion in the UK seniors housing market during 2021, beating last year's record by 2.2%.

The number of deals agreed climbed by 15% year-on-year, reflecting the fact that 2021 was a far more active market for investment than in 2020, when total spend was dominated by Lonestar’s £647 million acquisition of McCarthy Stone (accounting for c.40% of total investment - see chart). Excluding this deal from the figures means investment was up by more than 50% year-on-year.

As well as existing investors looking to build scale, last year saw a number of new entrants to the market including Blackrock, Macquarie, M&G and Natwest. There were also a handful of notable deals for rental-only platforms, including M&G’s investment into the Birchgrove portfolio, and Brigid Investments funding a portfolio of rental housing operated by McCarthy Stone. See this piece for more analysis.

In other news...

Clustering of innovative companies in high-growth sectors has been placed front and centre of UK industrial policy. Where are they likely to form and what is their focus? Jennifer Townsend shares a detailed analysis of the UK’s main office markets and identifies the top five verticals ranked by % venture capital investment and the key sectors listed by inward investment agencies. Link here.

Elsewhere - how energy efficiency is affecting the mortgage market (FT Adviser) UK factory output rises at fastest rate in six months (Reuters), Virgin Money mortgage book shrinks despite roaring UK housing market (FT), and finally Eurozone regains pre-crisis GDP level despite winter slowdown (FT).

Photo by Robert Bye on Unsplash