Confidence sours, students return and the UK's house price map is redrawn

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Confidence sours

Does the Bank of England need to raise interest rates to reign in inflation? Or will consumers get so worried about inflation that they'll stop buying things, thereby solving the problem?

It could go either way. The GfK Consumer Confidence Index, released overnight, fell to -19 in January from -15 in December. That's the lowest reading since February 2021, when the country was in strict lockdown. GfK's client strategy director Joe Staton says pessimism is likely to linger once Omicron passes due to worries about the cost-of-living squeeze, which is likely to affect people for months to come.

Andrew Bailey, Governor of the Bank of England, is certainly coming around to the view that confidence is being hit to the degree that it will begin weighing on inflation: "If you get pressure on cost of living, pressure on real earnings, that will tend to restrain demand in the economy... and that could lead to an output gap opening up, and it could eventually of course lead to higher unemployment and that would bring inflation down," he told parliament's Treasury Committee on Wednesday.

The next decision on interest rates is due on February 3rd.

As you were

The scrapping of work from home guidance has led to an immediate return to pre-Christmas, largely hybrid working policies. Take (Times) your (FT) pick (Reuters) of stories from this morning's financial press and you'll find broadly the same approach - companies in financial services are leading calls to repopulate offices.

The ending of Plan B restrictions is a “relief”, Knight Frank’s Alistair Elliott, tells the Times. “This time I don’t think there’ll be a return [to restrictions]. We’ve really got to assume that this is now the point of no return and we can really gear up to get our cities back to life, which is much-needed.”

Students return

The 2020-21 academic year was largely a year to forget for the UK student market. Both occupancy levels and rent collection fell below expectations as learning shifted online and restrictions on movement hampered students' ability to travel.

This academic year (2021-22) has seen confidence return. The number of purpose-built student bedrooms completed more than doubled last year to 30,000, lifting the total number to 700,000. A further 21,000 beds are in the pipeline for the year ahead, which would take the total value of the market to £72 billion. Deal volumes in 2021 climbed 35% on the previous year and came in 6% higher than 2019 levels.

Investors are looking past short term instability to focus on the market's long term growth prospects. The latest applications data from UCAS suggests student numbers have recovered to higher than pre-covid levels. Accepted applicants from outside the EU are up 3% year-on-year. Meanwhile, a coming demographic bulge in the UK among university-age students is expected to increase the number of 18-year-olds in the UK by more than 160,000 over the next decade.

Redrawing the map

The combination of the race for space, a stamp duty holiday and an ongoing affordability squeeze has altered the landscape for UK house prices. Tom Bill weighs up the impact here.

House price growth in London was under-performing the rest of the country before the pandemic as the affordability squeeze meant a growing number of people were leaving the capital. The stamp duty holiday clearly accelerated the process of levelling-up between London and the rest of the country.

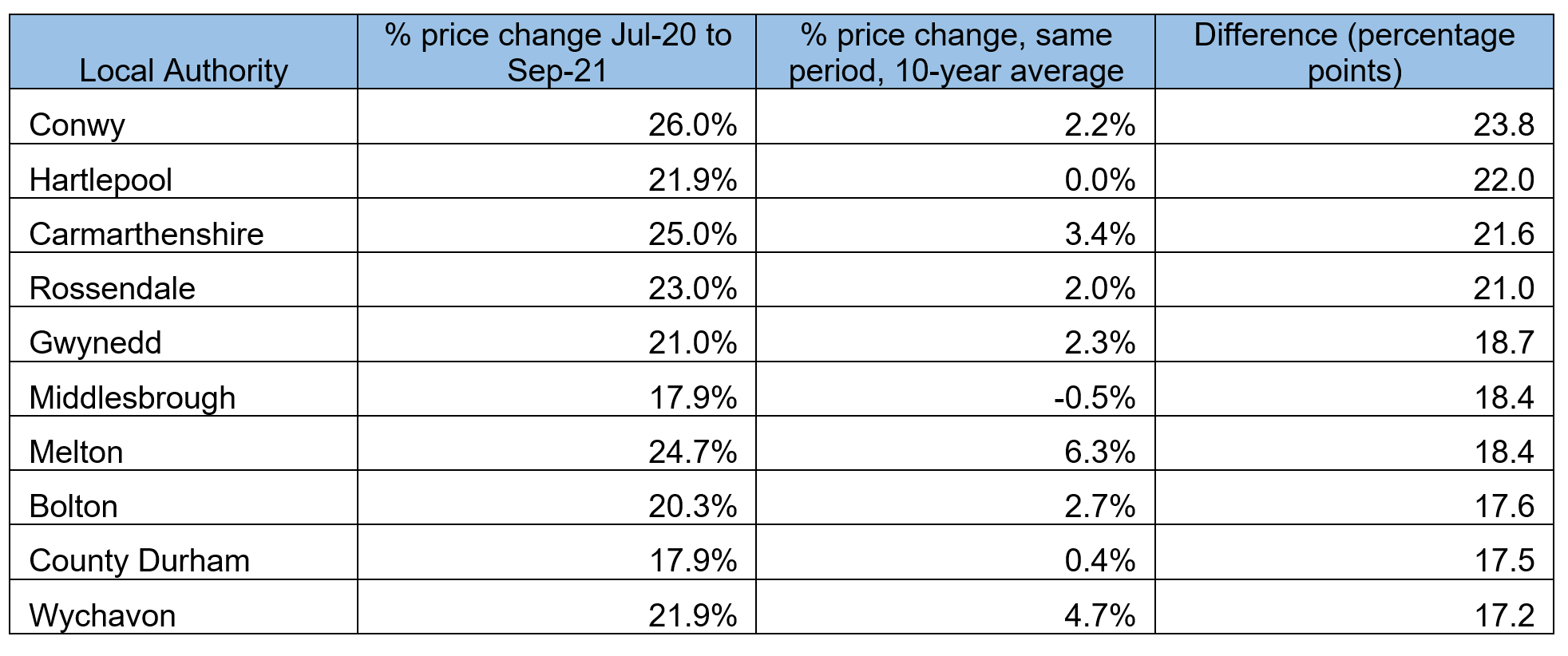

The areas that saw the largest price growth during the stamp duty holiday versus the ten-year average are listed below. The bottom ten include London boroughs that saw rapid gentrification and strong house price growth before the pandemic, including Hackney, Newham, Lewisham and Lambeth. The average property price in each UK region in September 2021 was the highest it has been compared to the London average in at least six years.

Clearing

The European Union will extend permission for banks in the bloc to continue using clearing houses in London for a further three years from June.

The squabbling over clearing has become deeply bureaucratic, technical (and boring), but we occasionally touch on it in these notes because there are aspects that are significant - namely the slow transition from the grandstanding of 2016 to pragmatism that is forming today. Banks understandably hedged their bets in the run up to the Brexit vote by setting up multilateral trading facilities on the European mainland in the event the most pessimistic predictions came to pass.

Those venues are quietly being dismantled - see Morgan Stanley in Paris, and, though this process has some way to run, London's place as the region's dominant financial hub remains largely unchallenged for the time being.

In other news...

The latest edition of Country View, showcasing the most aspirational country properties and lifestyles from across the UK, is now out.

Elsewhere - UK dining and spending edge up after Omicron slide (Reuters), falling shipping rates point to end of the great supply chain crisis (Times), and finally, Germany wants to attract 400,000 skilled workers from abroad each year (Reuters).