Saudi brands dominating retail market

Local restaurants are proving popular as the food & beverage scene thrives amongst rapid lifestyle retail development growth in Riyadh.

3 minutes to read

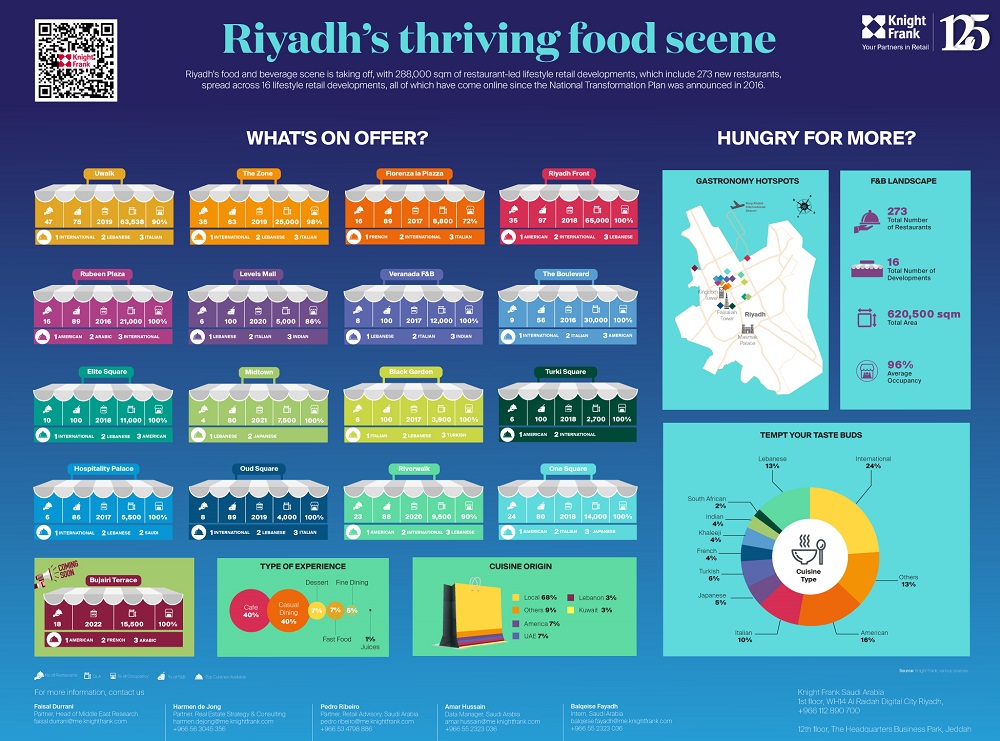

Riyadh’s food and beverage scene is thriving with 288,000 sqm of restaurant-led lifestyle retail developments, which include 273 new restaurants, spread across 16 lifestyle retail developments coming to market, since the National Transformation Plan was announced in 2016.

Faisal Durrani, head of Middle East Research, Knight Frank, explained: “The government’s vision to transform Riyadh into a new cosmopolitan business hub for the region is bringing into focus the city’s public realm and lifestyle amenities. These key ingredients that define a city’s habitability are slowly starting to fall into place in Riyadh. The Kingdom’s capital is beginning to morph into a foodie’s treasure trove and we’re not done yet. Bujairi Terrace at Diriyah Gate will add a further 15,000 sqm of lifestyle retail space to the capital when its 17 restaurants open their doors in 2022.

“The café scene too is bustling with 40% of new outlets falling into this category, with UWalk becoming the nerve centre of Riyadh’s café culture, with 53% of outlets dedicated to coffee shops.”

Challenges ahead?

Knight Frank’s analysis reveals that the growing food & beverage (F&B) scene is being transformed by home-grown local restaurants and cafes.

Durrani added: “International restaurant brands are yet to arrive in a meaningful way, which is a double-edged sword. 68% of the city’s new restaurants and cafes are Saudi brands, 21% of which specialise in international cuisine. American food outlets account for 16% of F&B outlets, while Lebanese restaurants are the third most prevalent at 13%. Once news of the soaring demand for high quality restaurants catches the attention of global brands, consumers will benefit from additional options, but international F&B outlets will undoubtedly rival the local outlets in terms of cost, reputation and experience.”

For now, brands such as Magnolia Bakery from the UAE and Urth Caffe from the US have helped position these two countries as the second and third largest sources of restaurant chains, respectively, in Riyadh.

“This rapid growth is not without its challenges. Some lifestyle retail developments launched in 2016 or 2017 are already being usurped by newer, more modern lifestyle retail destinations, creating challenges for restauranters and landlords alike as vacancy rates in older developments creep up and footfall declines”, Durrani said.

All is however not lost, with retail operators still capable of clawing back market share.

Growing market dynamics

Pedro Ribeiro, head of retail advisory KSA at Knight Frank, explained: “It is very evident that the International F&B brand’s not yet operating in the Kingdom need to understand the growing market dynamics that are allowing the local outlets to flourish and expand not just locally, but regionally and globally as well.

International brands must adapt their proposition across the full spectrum to suit demand, both in terms of operational aspects, as well as the actual menu offering itself. It’s clear that demand for lifestyle retail in the Kingdom of Saudi Arabia is thriving and the key to their overseas’ brands success will be in finding the correct formula of both maintaining their international brand identity but adapting it to meet local customer requirements.”