Going short takeaways, the frustrated consumer & new data could signal a rise in UK interest rate

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Furlough

The Bank of England (BoE) provided a shock last month when it opted to hold the base rate at a record low 0.1% despite multiple signals from officials that a hike was close. Comments since have suggested a significant hurdle hadn't been cleared, namely what impact the end of the furlough scheme on September 30th would have on employment.

Well, yesterday early estimates from the ONS suggested employers added a further 160,000 people to the payroll in October. Median monthly pay is up 4.9% compared to the same month a year ago and now stands 7.8% higher than at the onset of the pandemic. The unemployment rate is now just 4.3%.

More than a million people moved jobs in the third quarter and a record 400,000 said they had resigned, which suggests the mass reassessment of work and lifestyles remains underway, however it's increasingly clear that the huge pandemic-induced government stimulus has worked as intended. A December hike in the base rate is by no means a foregone conclusion, but yesterday's data has unquestionably dialled up the pressure to act.

Green premiums

Landsec published its half year results yesterday and alongside them came a pledge to invest £135m to significantly decarbonise its portfolio by 2030. The programme will see 24,000 tonnes of carbon emissions removed from the company's operations - equivalent to over 35,000 return flights from London to New York.

The move will enable Landsec to stay ahead of the future non-domestic Minimum Energy Efficiency Standards, which require an EPC 'B' certification by 2030. There is also evidence that 'green' buildings command significant premiums - for BREEAM ratings of Very Good, Excellent and Outstanding in prime London locations those premiums range between 3.7% and 12.3%, according to Knight Frank research.

The frustrated consumer

US retail sales hit a record in October as consumers splurged on electronics and home improvements. At first look, the data looks like it flies in the face of recent drops in sentiment that suggest consumers are increasingly concerned about the economic outlook in the face of rising inflation.

However, upon reflection it's understandable. Consumers have accumulated record savings during the pandemic and are ready to start spending. This tallies with Stephen Springham's latest research from the UK leisure sector - freed from the shackles of lockdown, the UK consumer’s response has been to go out and spend, rather than retreat. Stephen notes that in previous recessions, spending has been used as an antidote to wider malaise.

Meanwhile Wall Street has had a good year. A separate release from compensation firm Johnson Associates suggests year-end bonuses for Wall Street staffers are set to be the highest since 2009.

WFH

Making lockdowns liveable has been a profitable endeavour - see the valuations of companies from Zoom to Netflix and Peloton. Several fund managers have launched thematic funds since the onset of the pandemic, enabling retail investors to buy shares in a range of companies that gained from enforced working from home.

This is a revealing piece in this morning's FT: two thematic WFH funds have moved in opposite directions since the start of the year, with Direxion's product climbing 18% and BlackRock's IWFH fund falling 10%. The reason for the disparity can be found in their holdings - Direxion's is heavy on companies that enable remote work, while BlackRock's is packed with consumer orientated businesses spanning streaming to takeout and video games.

While the momentum towards being back in the office builds, Lee Elliott notes in his React News column that we are only just starting out on the road to hybrid work, with managers and employees working out how this all lands in the long-run. The outlook for companies that aid this process looks to be positive.

The new order

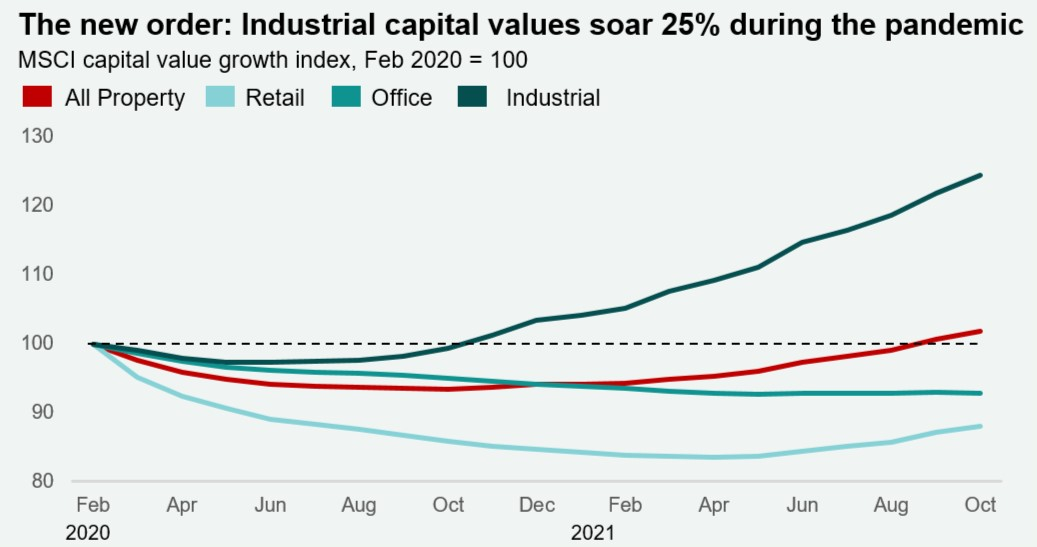

Chart of the day (see below) comes from Will Matthews: industrial capital values have soared 25% during the course of the pandemic.

It's easy to see why. Across Europe, internet & mail order retail growth was another 10% higher in August 2021 than it was in August 2020. Meanwhile, some €38.3 billion was invested into the European Industrial and logistics sector during the first nine months of the year, a record for that period.

In other news...

Tilda Mwai on the war for talent fuelling new office space demand in Africa’s cities.

Andrew Shirley's latest Rural Market Update on seaweed, COP26 and a rural reposte.

Elsewhere - the CPA's Noble Francis on construction costs (Twitter), the US residential perspective on net zero (NYT), Zooming from the office is the worst of both worlds (NYT), private jet rush prompts plane shortage as rich dodge airline woes (FT), and finally, Shell plans to move its headquarters to the UK (BBC).