Wealthy buyers with urban aspirations fuel global super-prime sales

Cities are springing back to life as vaccinations ease restrictions, with wealthy buyers returning in record numbers.

4 minutes to read

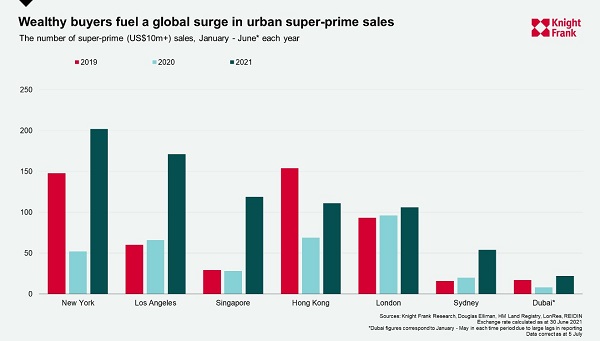

Some 785 super-prime (US$10m+) sales took place across seven global cities during the first half of 2021, despite the presence of a complex patchwork of travel restrictions. That’s only 10 fewer than the whole of 2020, more than double when compared to the same period a year ago and up 52% on the corresponding months in 2019.

Wealthy buyers spent some US$13.8 billion on snapping up homes across New York, Los Angeles, Hong Kong, London, Sydney, Singapore and Dubai during the period. Each market has its own unique drivers of demand, whether that’s recent price corrections, lifestyle advantages offered by geographic features such as beaches and green space, or the emergence of a new breed of super prime development. However, all share common themes – namely, rapidly improving sentiment amid the reopening of cities and a unified shift in lifestyles as the wealthy seek out larger homes and more amenity rich locations.

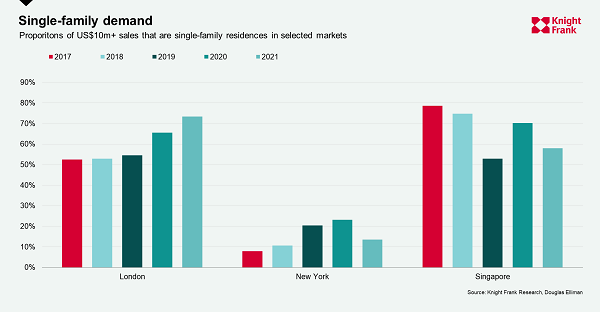

New York was the most active super-prime market during the period, with 202 sales above US$10m. The city is experiencing a rapid reopening. As Liam Bailey noted last month, The state has now vaccinated 70% of its adult population. Traffic is close to pre-pandemic levels. Restaurants are crowded, flights are packed – even Yankee Stadium is back at full capacity. Interestingly it has been apartments in demand with their share of super-prime sales rising from a low of 77% in 2020 to 86% in the first half of 2021.

Los Angeles has also seen a flurry of activity at the top end with 171 sales so far in 2021 – almost three times the same period last year. This follows the strength of the wider prime market in Los Angeles in the wake of the pandemic given its lifestyle offering. There are opportunities for large spacious homes, inside and outside, and weather that allows for year-round use of outside space which is drawing in domestic and international buyers.

We are seeing similar themes in Sydney. In early 2021 sales more than doubled to 54 from 20 in the same period of 2020 and just 16 in the first half of 2019. With Australia’s international borders unlikely to open without restrictions before 2023, Sydney’s ultra-wealthy are building their property portfolios at home. That includes upsizing family homes and purchasing homes for future generations as there is a perceived notion that prices will continue to rise. In addition, for the first time settled sales in the super prime Crown Residences at One Barangaroo have been captured within the period.

Singapore’s super-prime segment has been gaining momentum. There have been 119 sales above U$10m in the first half of 2021, undoubtedly boosted by the 20 units in Eden averaging US$11m each. This is more than four times the same period last year and almost more than sold in all of 2020 and 2019 combined. Singapore has cemented itself as a safe place for wealth, given how it handled the pandemic and economic fallout.

Hong Kong has seen US$2.4 billion transacted so far this year, well above the US$1.4 billion in the same period of 2020. The territory has seen a rebound in transaction volumes with prices now around 3% from their historical peak following a fall of 7% in 2020.

London’s super-prime market was the most active in 2020 out of our cities. The first six months of 2021 has seen sales 10% higher than the same period in 2020 with 106 and 96 sales respectively. Space and single-family residences, houses (detached, semi-detached and terraced), have been highly sought after with their share of super-prime sales rising to 73% up from around 55% in 2019. This level of activity has also seen prices in prime central London registering the first annual growth for five years in May.

In the quest for lifestyle blended with urban amenities, Dubai’s super-prime market has been extremely energetic in 2021 with 22 in the first five months of 2021 (data is delayed by a month) up from 6 in the same period of 2020. As one of the more affordable luxury markets, in Dubai US$1million gets on average 165 square meters of prime property, properties in this market segment come with an abundance of space.

Cities are returning to life as the vaccine roll out picks up speed, which is giving wealthy residents greater confidence to move in prime central locations. With the search for space and wellbeing factors driving decisions, and the prospect for some reopening of borders in the latter half of the year, we expect super-prime sales to end 2021 on a high.