Forecasting future capital flows

Using a bespoke “capital gravity” model, combined with our Knight Frank London investment data, we have forecast the likely source of flows of capital into London.

6 minutes to read

- £61.3 billion of cross-border capital could flow into London’s commercial market between 2021 and 2025, up from £55 billion in the period from 2016–2020

- Central London’s cross-border office investment activity could exceed £10 billion in 2021, up from £7.8 billion last year

- Spain and South Korea could be set to increase their investment into London, with up to £1 billion per annum on average forecast through to 2025

- The US is expected to be the single biggest source of investment over the next five years, accounting for £13.4 billion

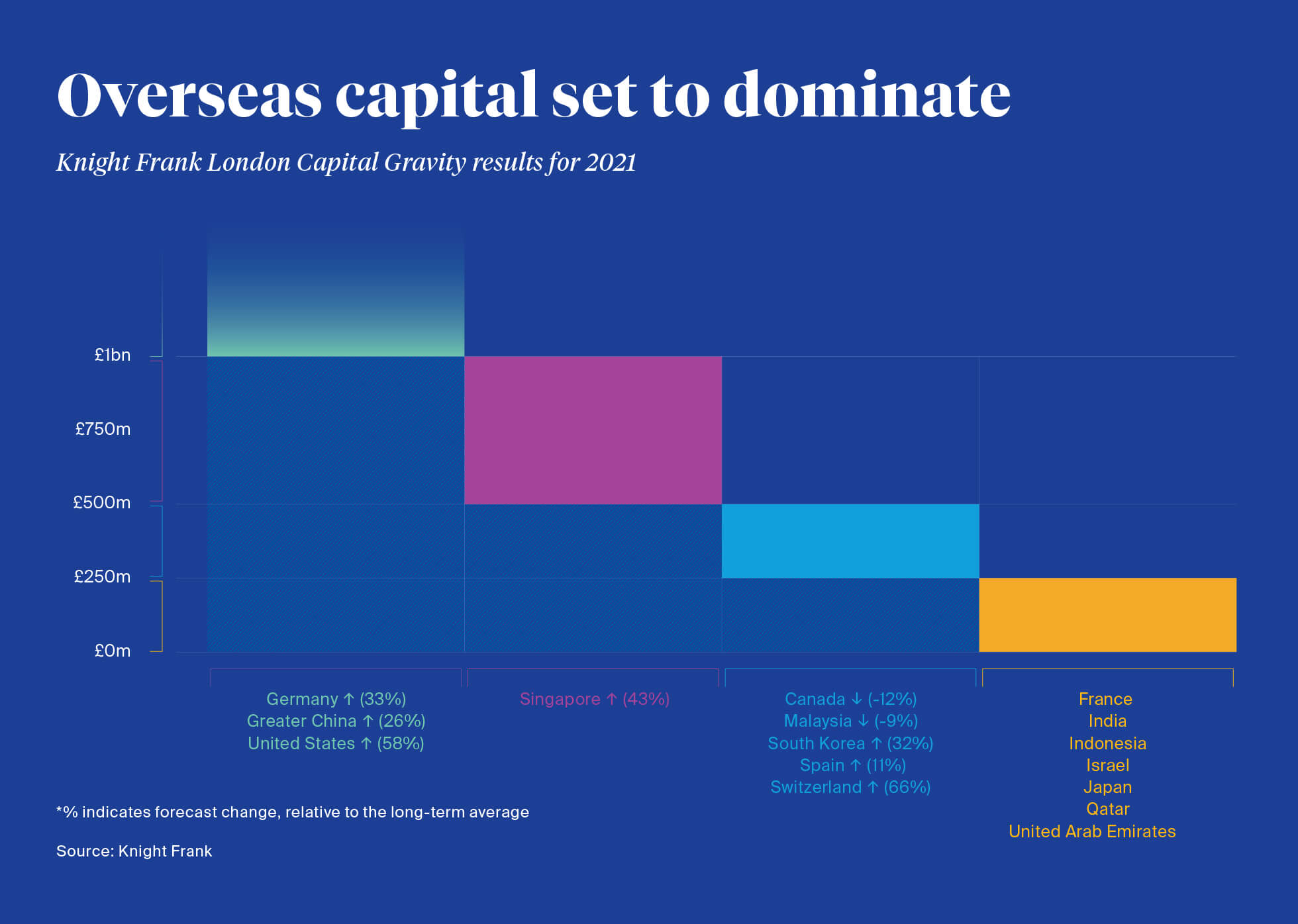

Overseas capital set to dominate

Our unique London Capital Gravity Model forecasts that central London’s cross- border office investment activity will reach almost £10.2 billion in 2021, up from £7.8 billion last year.

The model highlights the significant weight of overseas capital that we predict will target the London office market in 2021. The top sources of capital are illustrated below.

The Knight Frank London Capital Gravity Model explained

Gravity models are common in international trade, yet there has been little application of them to real estate investment. We first developed our Capital Gravity Model in 2018, using Poisson Pseudo-Maximum-Likelihood, a recommended method for estimating real estate capital flows (McAllister and Nanda, 2016). For The London Report 2021, we have gone a step further and used the model to predict the leading sources of cross-border capital specifically into London and also forecast the estimated size of these flows.

The model uses a combination of macroeconomic, financial, geographic and social data. As well as typical variables such GDP, foreign direct investment outflows, exchange rate and world share price index, we consider how close countries’ capital cities are to London and whether there is a shared border, in addition to whether there is a shared language, or other historic ties. We also include a “shock” variable, as the period being forecast follows a significant disruption. A variable to capture capital controls, such as those in place in Greater China, has also been incorporated.

London: The global player

In our global Active Capital Model (in our Active Capital report), we predict that global cross-border flows will target safe-haven locations and flows between “near neighbours”. The UK, of which London is the major market, is forecast to be the second largest destination for cross-border real estate capital globally during 2021, after the US.

View Active Capital

Looking back through previous cycles, the most historically resilient country for investment into the office sector, is the UK, driven by London. The UK (or London?) has uniquely been in the top five destinations of global cross-border capital in every quarter but two since before the global financial crisis.

Read: Private wealth remains focused on London

The “safe-haven advantage”

Our London-specific Capital Gravity Model demonstrates that the London gains from being perceived as a safe haven and a global player on the world stage, benefiting from relative liquidity, transparency and market familiarity for many investors, as well as time zone and language benefits.

Reflecting this resilience at a city level, the results of our Global Capital Tracker Survey show a 5% reduction in the potential spending power of international investors this year at £46 billion. This compares with a global reduction in cross-border office capital of around -40% according to RCA.

Read: London investment set for a rebound in 2021

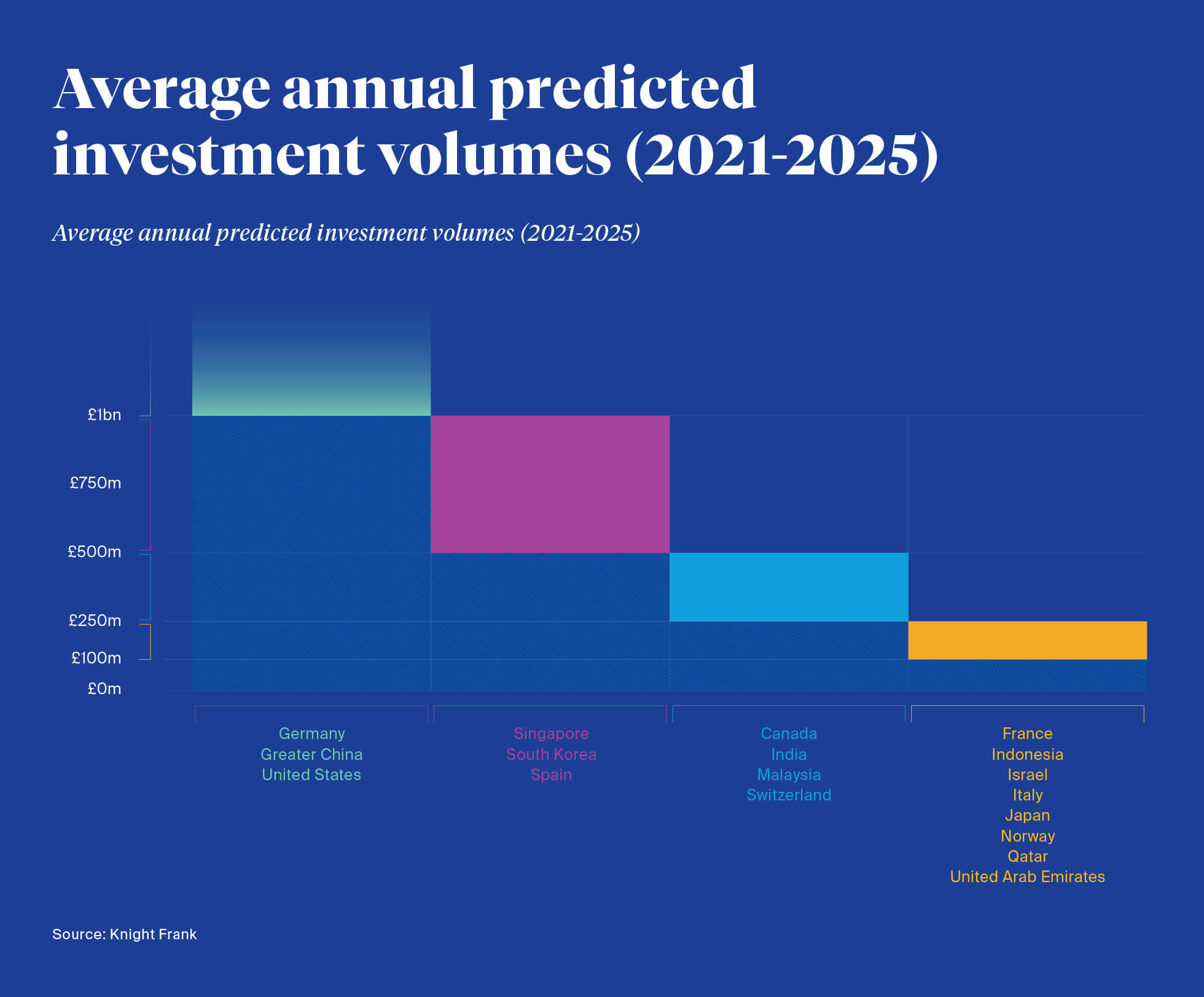

Over the longer term (2021–2025) we forecast for Spain and South Korea to increase their investment into London further, with the potential of up to £1 billion per annum on average forecast between 2021 and 2025.

We also forecast India to increase its capital deployment over time, rising to a predicted $504 million of investment into London by 2025.

US and Greater China top potential sources of future capital

Over the five-year forecasting horizon between 2021 and 2025, investment from the US is expected to reach £13.4 billion, positioning the country as the single largest source of potential capital flows into London’s office market. Greater China (£11.9 billion), Germany (£7.5 billion), Singapore (£5 billion) and South Korea (£3 billion) are expected to round off the top five biggest sources of investment.

In total, £61.3 billion of cross-border flows are expected between 2021 and 2025, up from £55 billion between 2016 and 2020.

The importance of currency hedging

While we have incorporated a shock dummy to take into account the fact that our forecasts follow a dislocated economic period, it is useful to consider what else might influence investment volumes over the coming year.

Rotation of assets can be one such factor. £12.8 billion in London office assets exchanged hands in 2016. On the basis of a five-year hold or financing period, at least some of these assets could be approaching the end of their fund life or business plans, or face refinancing requirements in 2021, encouraging a return to market.

“Dollar denominated or pegged investors who targeted London in the latter half of 2016 could look to crystallise a currency gain during 2021.”

Currency and currency hedging could also influence investment volumes into the UK. On the basis of a five-year hold, 2016 was really a year of two halves for sterling. The first half of 2016 saw the pound above US$1.40, before depreciating to as low as US$1.23 in the latter half of the year. Dollar-denominated or pegged investors who targeted London in the latter half of 2016 could therefore look to crystallise a currency gain during 2021 if sterling holds its strength, while some un-hedged investors who invested when sterling was stronger could look to hold assets longer to avoid potential currency losses.

While currency hedging benefits for a dollar-denominated investor into the UK on a five-year swap basis remain relatively subdued when considered over time, the situation is improving. Compared with autumn 2020 when the currency hedging benefits of a US dollar-based investor into the UK was as low as 0.25% per annum, hedging benefits have improved to circa 0.65% per annum. While this is lower than the 0.80%–1.60% per annum hedging benefit range seen five years ago, which encouraged dollar-denominated and pegged investors to the UK and specifically London, the improved hedging benefits, combined with a desire to deploy capital into relatively liquid, income-producing locations, should help support cross-border investment into London.

“London could benefit from an acceleration of diversification out of oil and into income-producing cross-border real estate.”

The impact of oil prices

Oil prices could also impact sources of capital flows. While oil prices had lifted back above US$50 per barrel at the time of writing, they remain below previous levels.

Combined with the deflationary environment some Middle East oil-producing countries are seeing, London could benefit from an acceleration of diversification out of oil and into income-producing cross-border real estate.

Interestingly, while the United Arab Emirates (UAE) (11th place) sits just outside the top ten largest likely capital sources, the Gulf Cooperation Council quintet, comprising the UAE, Saudi Arabia, Bahrain, Kuwait and Qatar together are forecast to spend a little over £2.7 billion on London offices, making the group the fifth biggest source of likely investment.

The outlook for London as an investment hub

In a globally stressed environment, the safe-haven properties of London, combined with strong innovation factors, support the city’s resilience. This, combined with financial, relationship, cultural and geographic factors support the case for London to be an ongoing major global destination for cross-border capital.

Read: London - city of innovation

Read: Themes shaping London's office investment market