Brexit: How British second home owners can stay longer than 90 days in the EU

Investment migration pathways and, for some, second passports from dual nationalities offer pathways to stay beyond the 90-day period.

4 minutes to read

The UK's decision to leave the European Union (EU) means Britons owning second homes in Europe will have to limit their stays to 90 out of every 180-day period.

For the majority of owners this isn’t a gamechanger, most spend around one to two months at their property each year, and although remote working is on the rise, many will also be keen to maximise rental income once the pandemic is under control and travel resumes.

For those that do want to spend longer than 90 days in their holiday home, what are their options?

I spoke with Katie Good of immigration specialists Fragomen who outlined their potential options:

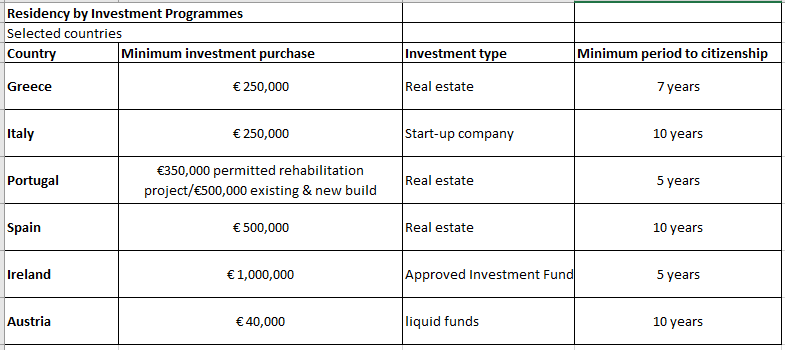

1. Residency by investment and Citizenship by Investment programmes

From 1 January 2021, as non-EU residents, Britons qualify for a number of investment migration pathways to residency or citizenship. Many of the European schemes were started after the global financial crisis in 2008 when southern European economies were in the midst of a debt crisis. As governments look to shore up their public finances we may yet see a new round of announcements post-Covid-19.

What’s the difference between residency and investment?

Residency by investment programmes, often known as Golden Visas, grant residency in return for an investment - usually a property purchase, job creation or a capital sum. Residency is usually granted for a temporary period and again adheres to the 90/180-day rule and whilst you reside in one country it also allows free movement within the Schengen area (26 countries).

In some countries you can apply for citizenship straight away (usually for a higher sum) whilst in others there is a requirement to have been a resident for a set number of years before applying. Citizenship enables the applicant to apply for a passport and offers more benefits and rights than residency.

How much do you need to invest?

The table below summarises the current investment landscape:

* If is recommended you seek advice from an immigration specialist as the investment criteria is subject to change

But, aren’t Golden Visas changing?

The EU and OECD are keen to impose greater regulation, but it is unlikely policymakers will halt the initiatives entirely. Malta and Cyprus have paused their citizenship schemes whilst Portugal is changing the focus of its programme from 1 July 2021. After this date the Golden Visa will no longer apply to Lisbon and Porto but focus instead on lower density inland regions.

2. Long-term visas or work permits

A number of EU countries are still formalising the criteria on which long term visas will be based for British applicants. In extenuating circumstances such as medical or changes to travel plans due to Covid-19 it’s likely Britons could apply to stay beyond the 90-day period but this will vary from country to country and often an in-person interview will be required. It is not yet clear whether staying longer than the allotted 90-day period due to a property purchase would be sufficient grounds for a long-term visa application.

In most cases, applicants will need to prove that they have a regular income, in Spain it is a minimum of £2,000 a month for an individual and an extra £500 a month for each member of the family.

In Portugal, a minimum annual income of €7,200 is required when aplying for the D7 Visa which provides residency status to non-EU / EEA and Swiss citizens, as well as retirees.

3. Dual nationality? Why it’s worth checking your family tree

Finally, it’s worth considering the “citizenship by descent” option.

An ancestor’s country of origin may open up an EU passport and a route to citizenship.

Citizenship can come from a mother, father or grandparent’s nationality. Most countries go back only one generation, meaning at least one of your parents must be from an EU country to be eligible for citizenship in that country, but in a few countries, grandchildren can qualify.

What impact will the new rules have on second home hotspots in the EU?

Mark Harvey, Knight Frank’s Head of International sales comments: “The pandemic has only highlighted the desirability of a lifestyle property, we witnessed a 50% increase in enquiries for European properties in 2020 and although the new 90-day rule may curtail some homeowners plans, for those working in the UK or with children at school here, the 90-day rule is unlikely to impact significantly.”

If you’re interested in progressing plans to buy in Lisbon or Porto as part of the Residency by Investment initiative before the 1 July 2021 deadline do get in touch with Oliver Banks who can share his insight and offer virtual viewings.