Daily Economics Dashboard - 6 January 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 6 January 2021 2020.

Equities: In Europe, stocks are higher this morning with gains recorded by the DAX (+0.8%), STOXX 600 (+0.7%), CAC 40 (+0.7%) and the FTSE 250 (+0.2%). In Asia, the CSI 300 (+0.9%), Topix (+0.3%) and Hang Seng (+0.2%) all closed higher, however the S&P / ASX 200 (-1.1%) and the Kospi (-0.7%) were down on close. In the US, S&P 500 futures are -0.3%.

VIX: Following an -8.5% decline over yesterday, the CBOE market volatility index has decreased a further -0.9% this morning to 25.1. This remains above its long term average (LTA) of 19.5. The Euro Stoxx 50 volatility index has also decreased this morning, down -8.9% to 23.0, below its LTA of 23.9.

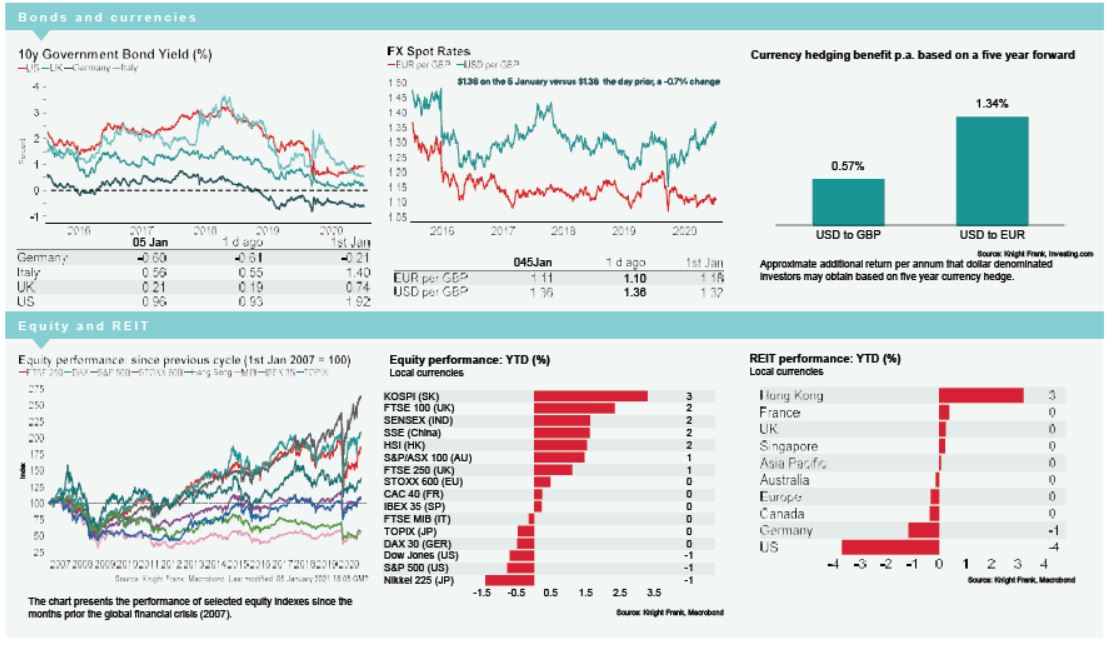

Bonds: The US 10-year treasury yield has softened +7bps to 1.03%, the first time it has been above 1.00% since March 2020. The UK 10-year gilt yield and the German 10-year bund yield have also increased +5bps and +3bps to 0.26% and -0.55%, respectively.

Currency: Sterling has appreciated to $1.37, while the euro is currently $1.23. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.57% and 1.34% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased +3.2% on Tuesday to 1,418, its highest reading since mid October and the largest daily increase in over three weeks. The growth in the index was supported by capesize rates, which increased +4.5% yesterday to their highest level in over two months.

Oil: Brent Crude and the West Texas Intermediate (WTI) have increased +1.9% and +1.2% to $54.59 and $50.53 per barrel, respectively.

Rhodium: The price of Rhodium, a metal used in catalytic converters necessary to meet stricter clean air legislation, has hit a record high of $17,790 an ounce, an increase of more than +200% since the March 2020 low.

Control of US Senate: In the wake of the Georgia run-off elections, the probability of the US Republican Party maintaining control of the US Senate is currently 4%, down from 64% last week, according to Predictit. The likelihood of the US Democratic Party gaining control of the Senate is 96%, up from 39% one week ago.