Prime waterfront properties worth nearly 70% more than their inland counterparts

Prime waterfront properties across Australia are worth an average 69% more than their inland equivalent in 2020, trending upwards from 63.1% one year ago, according to the latest research from Knight Frank.

3 minutes to read

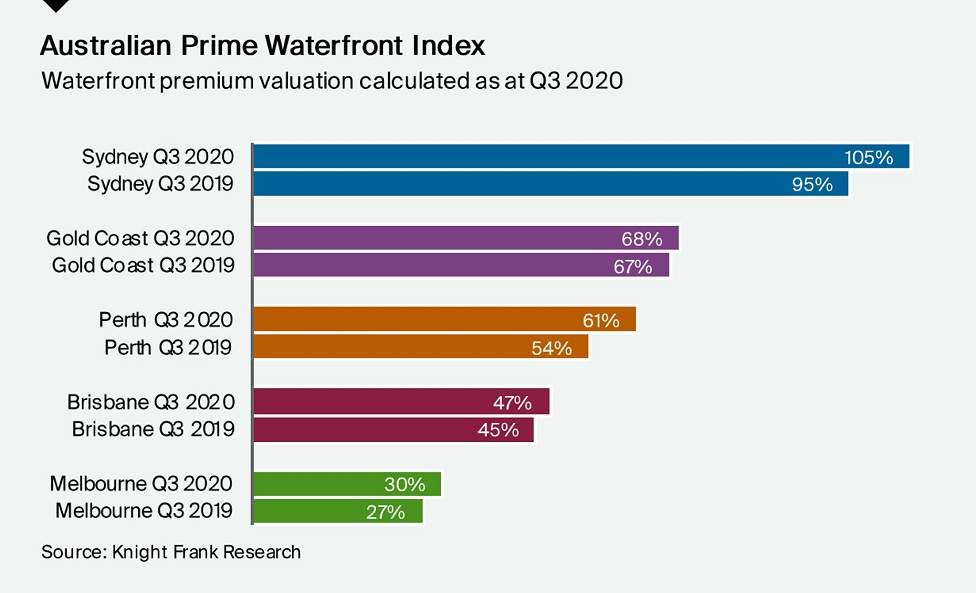

The Australian Prime Waterfront Index, which measures the uplift a waterfront location can add to a property’s value across Australia’s major cities, found all five analysed recorded an uptick in their waterfront premium – including Sydney, Perth, Melbourne, Brisbane and the Gold Coast.

Sydney continues to be the leader, recording a 104.7% waterfront premium in Q3 2020, up from 94.9% one year earlier.

The Gold Coast was next, with a premium of 68% (up from 67%), followed by Perth at 61% (up from 54%), Brisbane at 47% (up from 45%) and Melbourne at 30% (up from 27%).

Knight Frank’s Head of Residential Research, Michelle Ciesielski said the steepest uplift was recorded in Perth off the back of a strengthening economy, as the city saw its waterfront premium grow by 7.5% over the year to Q3 2020 from 53.6% to 61.1%.

“Melbourne saw a rise in its waterfront premium from 27.3% to 30.4%, with the city recovering back to Q3 2018 levels, as residents recoup from a lengthy pandemic lockdown where waterfront properties are increasingly likely to become a more desirable setting to spend time at home.

“Prime residential markets in Brisbane and the Gold Coast have been widely performing well as popular with both relocating interstate families and downsizers.

“Although many of these budgets would allow for the price point of a waterfront property in these cities, buyers took a more conservative approach in 2020 to record only a slight rise in premium for a waterfront property on the Gold Coast of one per cent and two per cent on the Brisbane River.”

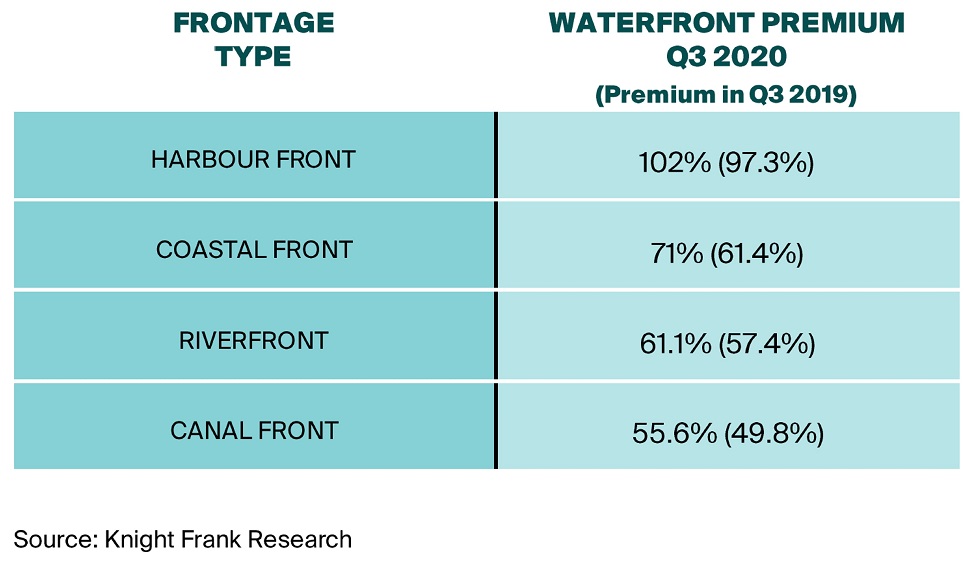

Knight Frank’s Prime Waterfront Index found harbour front properties commanded the largest premium, and the strongest growth in premium, at 102% in Q3 2020, growing from 97.3% one year earlier.

Over the same time a coastal frontage rose from 61.4% to 71%, riverfront rose from 57.4% to 61.1% and improving considerably, frontage canals - most prominently on the Gold Coast - grew from 49.8% to 55.6%.

Potential uplift in property value for an Australian absolute waterfront of this frontage, as at Q3 2020

Knight Frank’s Head of Residential in Australia Shayne Harris said of the total number of super-prime sales in Australia in the year ending Q3 2020, absolute waterfront sales made up 33%.

“Although this share of sales fell from 36 per cent in Q3 2019, the number of sales grew from 40 to 46, demonstrating the strength of the wider super-prime luxury market,” he said.

“The distribution of waterfront sales varied, with harbour front holding the most share with a little over half, while coastal and river frontages had one-fifth of sales each and properties with canal frontages accounted for nine per cent of sales.

“Over the past five years, the average super-prime waterfront sale price has shifted higher by 43 per cent.

“In Sydney the average sale price was $21.5 million in the year to September, while Brisbane followed with $17.6 million and Melbourne at $16.5 million.

“In the same time frame, Perth’s average sale price was $13.4 million and the Gold Coast was $12.7 million.”

Mr Harris said super-prime waterfront property tends to be the most liquid in nature, so in times of economist uncertainty, such as during COVID-19, it can be a great investment.

“It’s likely further demand will come over the coming months and years,” he said.

“In the middle of this year, a Knight Frank global buyer survey revealed 40 per cent are more likely to buy a waterfront residence than prior to COVID-19, reflecting the change in buyer’s attitudes towards securing a resort-like lifestyle at home.

“Privacy is also in demand, with 52 per cent saying it’s more important, so waterfront properties are sure to push beyond the 55 per cent premium currently paid for private beach access.”