Hotel Dashboard - UK Hotel Market Recovery December 2020

The ongoing and tightening of social distancing restrictions throughout the UK are proving to be particularly challenging for the hotel sector.

2 minutes to read

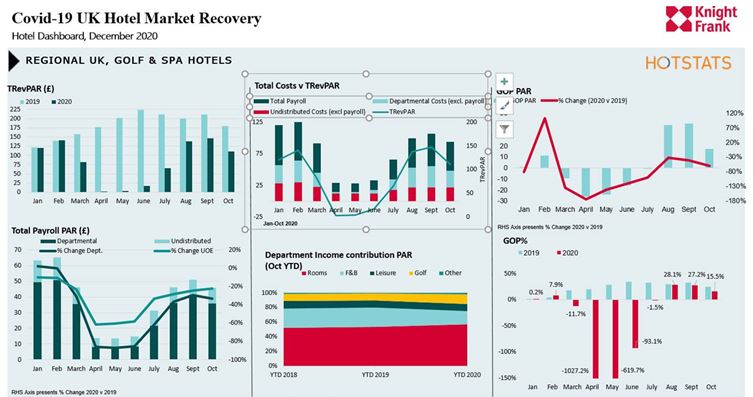

In our December edition of the Hotel Dashboard, we provide our latest opinions and outlook for the UK Hotel sector, together with a more detailed review of regional UK trading performance. Specifically, we compare the performance of two hotel datasets - Regional UK, Upper-Midscale Hotels and Regional UK, Golf & Spa Hotels.

Download the Knight Frank Hotel Dashboard.

- Staycation demand in the UK hotel market is likely to remain substantially above the historical long-term levels throughout 2021. With strong pent-up demand, the summer months have the potential to generate higher performance than in 2020.

- Hotel operators are reporting healthy forward bookings for the spring and summer months of 2021, boosting customer confidence by providing flexible booking options.

- Whilst the flexible furlough scheme has been a lifeline for many hotel owners, for the month of October the scheme was the most costly, with employers’ contributions rising to 20% of the unworked hours. This additional cost is evident in the October trading performance data.

- HotStats data reveals that despite Regional UK TRevPAR falling by 20% during October, total departmental operating payroll PAR declined only marginally, averaging between 3%-10%. As such the Rooms profit margin declined by over 30% across all regional UK hotel datasets.

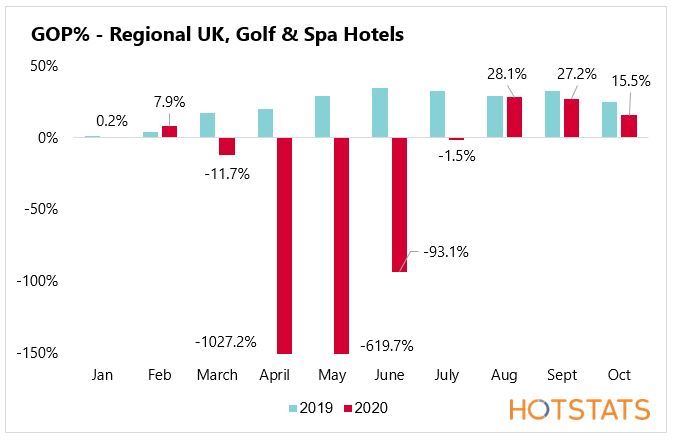

- The month of October witnessed a sharp decline in GOPPAR across all hotel datasets, with select service and upper-midscale hotels recording a 77% decline month-on-month, to less than £2.0 PAR and full-service upper and upper-upscale hotels both recording a loss for the first time since July.

- The Golf & Spa hotel dataset achieved the strongest GOPPAR of all hotel datasets for the month of October, of £17 PAR.

- The dataset for UK-Extended Stay/ Aparthotel sector continues to outperform the sector, achieving GOP% of 33.0% for the month of October.

“With large areas of the country now falling within the highest tiers of restrictions, up to 25% of UK hotel supply may be forced to close. Many of these hotels are likely to remain closed into Q1-2021, with January and February traditionally periods of lower hotel demand.

October trading data suggests that deeper payroll efficiencies were necessary, in line with declining monthly revenues. Restructuring of personnel and changing the way in which hotels operate are likely to have far reaching impact on the sector across all hotel classes, ensuring that hotels continue to be profitable at a time of lower income levels.”