Covid-19 Daily Dashboard - 9 December 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 9 December 2020.

Equities: Globally, stocks are mostly higher. In Europe, the DAX (+1.0%), STOXX 600 (+0.5%), FTSE 250 (+0.4%) and the CAC 40 (+0.3%) have all recorded gains this morning. In Asia, the Kospi added +2.0% on close, lifting its year to date gains to +25%. The Topix (+1.2%), Hang Seng (+0.8%) and S&P / ASX 200 (+0.6%) also closed higher, while the CSI 300 was the exception, closing -1.3% lower. In the US, futures for the S&P 500 are +0.2%.

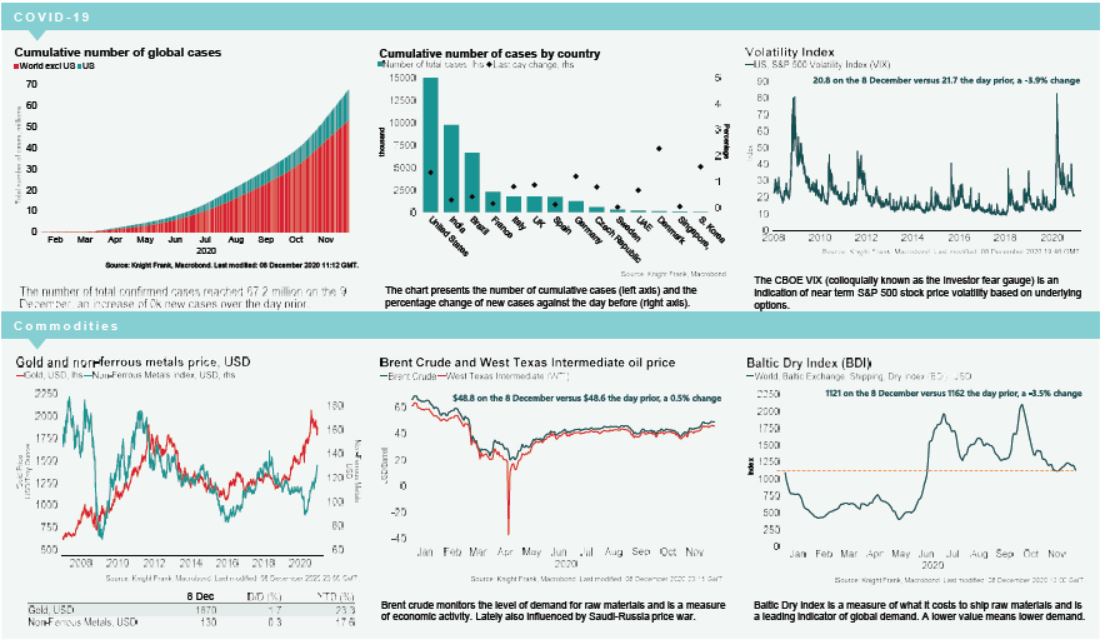

VIX: Both the CBOE VIX and the Euro Stoxx VIX are now at their lowest levels since the end of February this year sitting at 20.6 and 20.0 respectively.

Bonds: The US 10-year treasury yield has softened +2bps to 0.94%, while both the UK 10-year gilt yield and the German 10-year bund yield are up +1bp, to 0.27% and -0.60% respectively.

Currency: Sterling has appreciated to $1.35 while the euro is currently $1.21. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.48% and 1.36% per annum on a five-year basis.

Baltic Dry: The Baltic Dry decreased -3.5% yesterday to 1162, the largest daily decline in 19 sessions and the lowest the index has been in nearly three weeks. This decline has predominantly been driven by the capesize index, which contracted -10% over the day and has now fallen to its lowest level in circa six months. Year to date gains in the index are at just +3%, following cumulative declines of -47% since 6th October.

Gold: The price of gold increased +0.4% over Tuesday to $1,870, which brings year to date gains to +22%.

German Exports: German exports increased +0.8% over the month of October, marking its sixth consecutive monthly increase. The country’s exports to the Eurozone were down -6% on an annual basis, while exports to non-eurozone countries were -2% lower over the year. The US remains as Germany’s largest export market, despite a -10.5% decline in exports in October 2020, compared to October 2019. China has now overtaken France as Germany’s second largest export market, following a +0.3% annual increase.

Brexit: There is currently a 64% likelihood of a trade deal between the UK and the European Union being signed in 2020, according to Oddschecker. This compares to 81% one week ago and 69% last month.