What impact will the election result have on US housing markets?

Property markets and investors like certainty. Protracted legal appeals would add a further dimension to what has already been a turbulent year for the US as a result of the Covid-19 pandemic.

3 minutes to read

That said, volatile equity markets and a weaker dollar would highlight property’s appeal as a safe and tangible asset class not just to domestic buyers but overseas investors too.

The year to date

Perhaps counterintuitively, the housing market has been a bright spot for the US economy since Covid-19 hit the country’s shores. During lockdown many homeowners re-evaluated their lifestyles and chose to relocate or upgrade their homes particularly given the demise of the traditional five-day commute.

Mortgage applications reached an 11-year high in June, residential sales were up 21% in September year-on-year and nationally prices in the mainstream market are rising at an annual rate of 6% according to S&P Case Shiller.

In the luxury segment, from Palm Beach to The Hamptons and Aspen, resort markets are having their moment in the sun with record sales being agreed as residents consider a primary residence in the some of the country’s traditional second home hotspots.

A Biden Victory

A Biden presidency is likely to see some form of national lockdown imposed which may lead to a hiatus in the housing market, although it is possible that viewings and transactions may still be permitted.

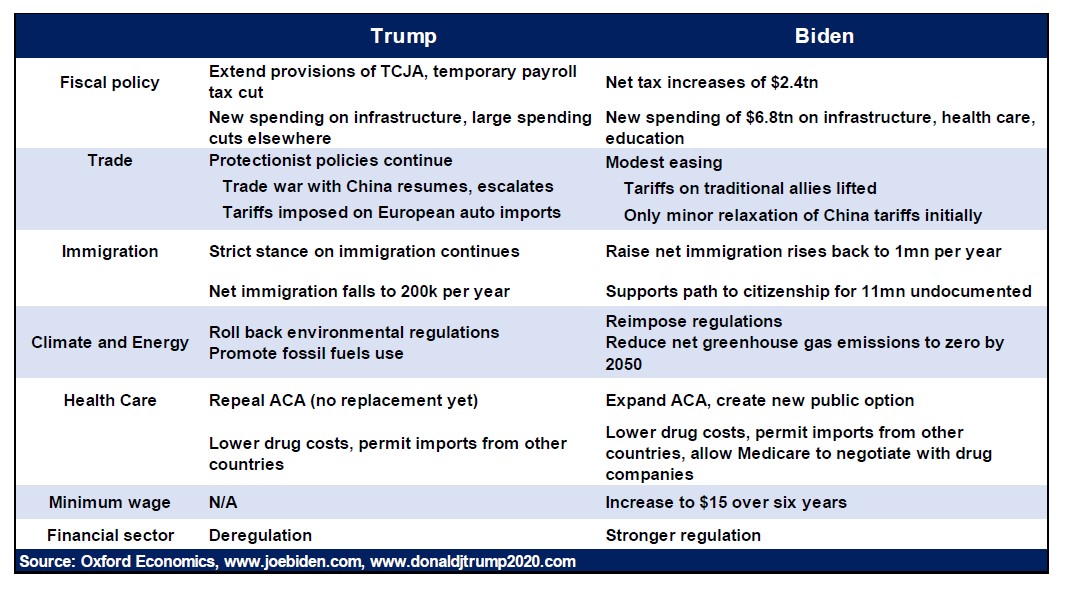

Biden’s tax plans include higher income taxes for individuals earning more than $400,000 per annum, while capital gains tax (CGT) for those earning over $1 million per annum, would rise from 24% to 40%. Lawyers and appraisers saw a significant rise in requests for estate changes over the summer months as Biden moved ahead in the polls.

There is some concern amongst the wealthy that an exemption allowing individuals to leave up to $11.58 million to heirs, free of estate or gift taxes, could be cut before it expires in 2025.

In terms of Biden’s immigration policy, it could, in the short term, increase unemployment rates but long-term increase housing demand and with supply at historic lows this could lead to stronger price inflation.

The Democratic candidate has pledged to help first-time buyers via a down payment tax credit of up to $15,000, he plans reduce racial disparities in the housing market and would offer low-income renters a tax credit enabling them to pay a maximum of 30% of their income on housing and utilities.

The green agenda would be at the heart of a Biden presidency which would see the construction industry incentivised to deliver sustainable homes with a greater reliance on green energy. Biden aims to cut the carbon footprint of the country’s buildings in half by 2035.

A Trump victory

A second Trump presidency would largely see the status quo prevail with the State and Local Tax (SALT) deductions remaining in place - underlining the low-tax appeal of states such as Florida. However, deeper tax cuts, lighter regulation and over $1 trillion investment in infrastructure is also expected.

An eviction moratorium that came into force in September preventing tenants losing their homes during the coronavirus pandemic would also remain in place.

Trump has mooted plans to privatize Fannie Mae and Freddie Mac, the two US mortgage finance giants that almost collapsed back in 2008. By privatising the two institutions, it is hoped the risk to taxpayers of future potential bailouts would be reduced. Critics fear the move could increase borrowing fees and limit mortgage availability.

2021 and beyond

Whoever wins, the next President is likely to face a divided Congress. If Trump wins he will have to contend with a House run by Democrats, whilst if Biden wins and the Republicans hold the Senate, it is unlikely his big fiscal plans will be rolled out. However, we do expect to see a Covid-19 fiscal package announced in the coming weeks to support local authorities and small businesses.

Investors and homeowners look set to be able to rely on cheap finance in the coming years with Oxford Economics forecasting that interest rates will remain close to zero until 2024 and quantitative easing is set to continue.

Sign up our US Research or get in touch to discuss any property requirements you might have.