Global Residential Outlook – 23 October 2020

Key takeaway:

New data suggests several markets including London and Dublin are attracting overseas buyers despite the pandemic and the associated travel restrictions, with many considering the markets’ current value, currency play - and in London’s case, a pre-emptive move ahead of next year’s foreign buyer tax - key motivations.

3 minutes to read

Need to Know:

• Worldwide confirmed coronavirus cases surpassed 40 million yesterday, while active cases are around 10.3 million. Infection rates in Europe are now rising at over 150,000 a day. The United States, India, and Brazil remain the worst affected countries in the world.

• Italy was added to England’s quarantine list last week, which means the only countries the English can travel to without having to quarantine when they arrive or when they return are Greece (apart from Mykonos), Germany (if not from a Tier 2/3 location), Sweden, Gibraltar, Madeira and the Azores.

• Plans for rental control have been suspended by the Spanish Government until they can assess the market post the pandemic.

• Cyprus has suspended its “golden passport” scheme from 1st November 2020. The European Commission has begun legal action this week to investigate both Cyprus and Malta’s schemes.

• Air passenger demand is not expected to regain 2019 levels until 2023 according to Oxford Economics and the IATA. That said, Asia is seeing demand rise and globally, 50% of travellers surveyed expect to travel within 3 months.

• Singapore and Hong Kong will set up an air travel bubble to avoid quarantines, while a New Zealand-Australia bubble went into operation last Friday.

Residential digest

Europe

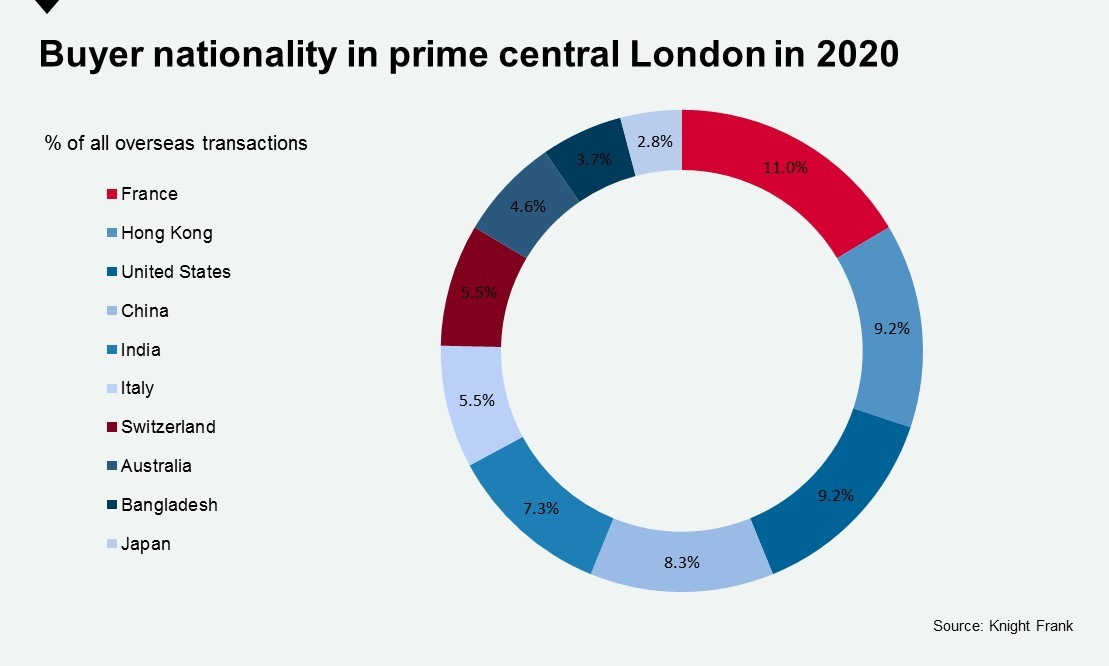

• New data from my colleague Tom Bill shows French buyers have jumped to the top of prime central London’s international buyer rankings. Buyers from across the English Channel made up the largest group of international purchasers in PCL during the first nine months of 2020.

• Despite moving to Level 5 this week, there is no sign of the new homes market in Dublin slowing down. The Knight Frank team agreed more than 30 sales in Dublin within a 48-hour window this week. According to Ray Palmer-Smith, “Most are local buyers but there is a steady flow of international interest, particularly expats looking to return home, particularly in the €1.5m+ range.”

Asia Pacific

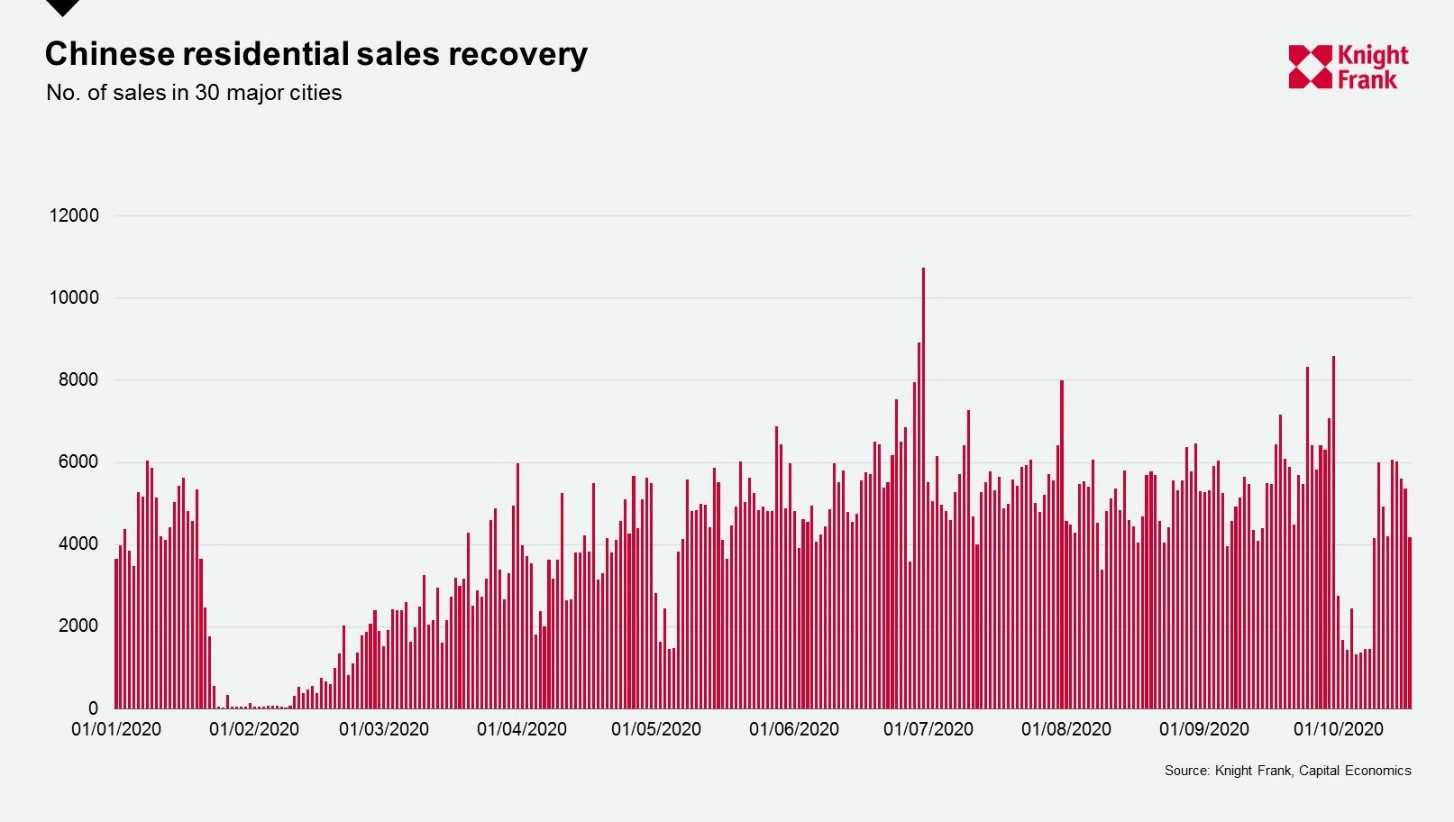

• Chinese sales in 30 major cities recovered quickly from the pandemic reaching 6,000 sales per day by early March, just over three months after the first recorded case in Wuhan. Daily sales reached their peak on 30 June 2020 exceeding 10,700 and the recent lull in activity is attributable to the Golden Week holiday period in early October.

US and Canada

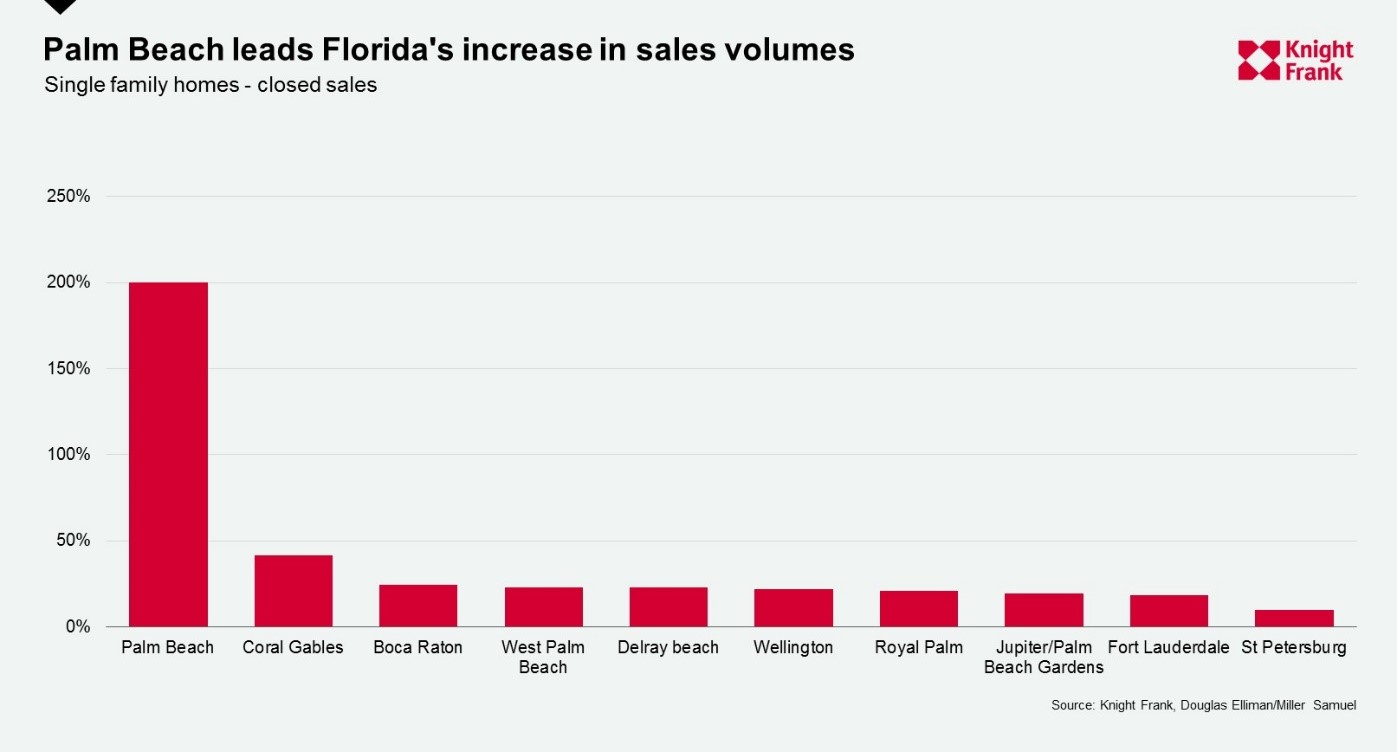

• In Florida, new data shows single family home sales in Pam Beach increased 200% between Q3 2020 and Q3 2019 according to our US partners Douglas Elliman/Miller Samuel. Single family homes registered the largest rise in activity across all of Florida’s prime neighbourhoods with all key markets seeing an increase in sales year-on-year.

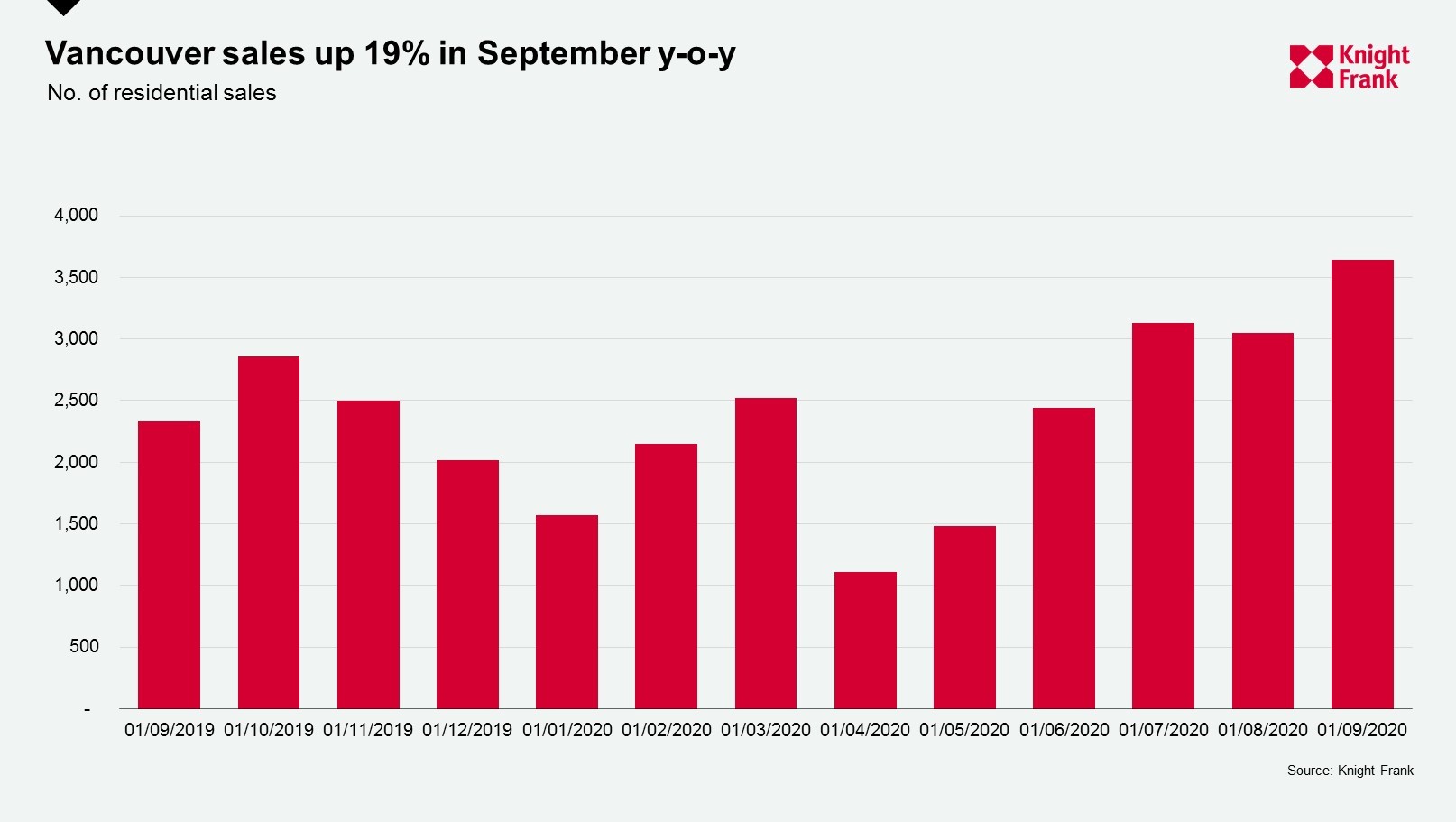

• In Canada average prices increased 1.1% in September, the second-biggest gain in the month of September for 22 years according to the Teranet–National Bank National Composite House Price Index. Meanwhile, in Greater Vancouver sales continue apace, up 19% in September year-on-year.

Middle East & Africa

According to the new North African Focus, whilst Covid-19 cases in Egypt and Algeria have stabilised, the number in Morocco continue to grow. All three markets are seeing mainstream residential prices decline. In Algeria increased supply, primarily because of the completion of government-backed social housing schemes, has led to softer pricing. Morocco has seen prices decline by 4% year-on-year and in Cairo, prices are down by 10% however prime rents surged by 20% in the year to Q3 2020.

Recommended listening

This week despite Boris Johnson telling the country last week to get ready for a no-deal, Toscafund Chief Economist Savvas Savouri believes an agreement will be reached. Here, he explains why he thinks the UK will exit the EU on friendly terms, while also analysing two other global issues: the upcoming US election and US-China currency trade tensions.

Against this backdrop our Head of Residential Research, Tom Bill, discusses how much momentum the UK property market will have over the next few months, and the international property buyers who are seeking to capitalise on Brexit uncertainty and a weak pound in the UK.

Click one of the links below to listen or view the series so far here:

• Apple

• Spotify

• Acast