Debt Advisory Market Update – October 2020

It’s clear that with Brexit around the corner and continued pandemic measures, the market is currently approaching everything with caution. We are seeing, however, some clear trends around the polarisation of lender appetite to different sectors - logistics and private rented being bright spots. We’ve also seen elevated activity from debt funds, giving welcome liquidity to highly leveraged transactions. So we’re coming into Q4 with a positive outlook.

5 minutes to read

After a short break during the summer months the debt market appears to have stabilised, with the majority of lenders actively seeking new financing opportunities. However, with Brexit around the corner and new government measures being implemented to reduce the infection rate, the market is approaching everything with caution.

The trends we began to see emerge during the summer are continuing; polarisation of lender appetite towards different sectors coupled with a flight to quality. Logistics and the private rented sector are emerging as clear favourites from a financing standpoint and despite the A Level results debacle, the student accommodation sector has made positive steps forward. Many operators have achieved up to 90% occupancy levels despite a lower number of international students making it to the UK for the start of the Autumn term. Lenders appear to be taking the view that for the student accommodation sector, this year will be challenging in terms of occupancy, but that going forward the sector will demonstrate resilience.

In terms of lender types, the debt funds have been incredibly active over the last few months, with one fund reportedly having looked at over £4bn of new transactions since April, a marked increase on any previous year. This has proved to be a welcome source of liquidity particularly for highly leveraged transactions and development finance requirements where the more traditional lenders have retrenched.

At the end of July all the major UK clearing banks announced higher provisions for bad debts (see page 4 for more detail). This will undoubtedly impact their approach to considering new lending opportunities for the foreseeable.

All of that said, the Knight Frank Debt Advisory team is coming into Q4 with a positive outlook. Requests for residential development finance are increasing and investment activity is beginning to pick up, with a myriad of new deals hitting the market during the first week of September. Lenders and borrowers are seeking ways of navigating the new environment and adapting to what will be the new normal.

Bank Debt Provisions

Rise in loan loss provisioning

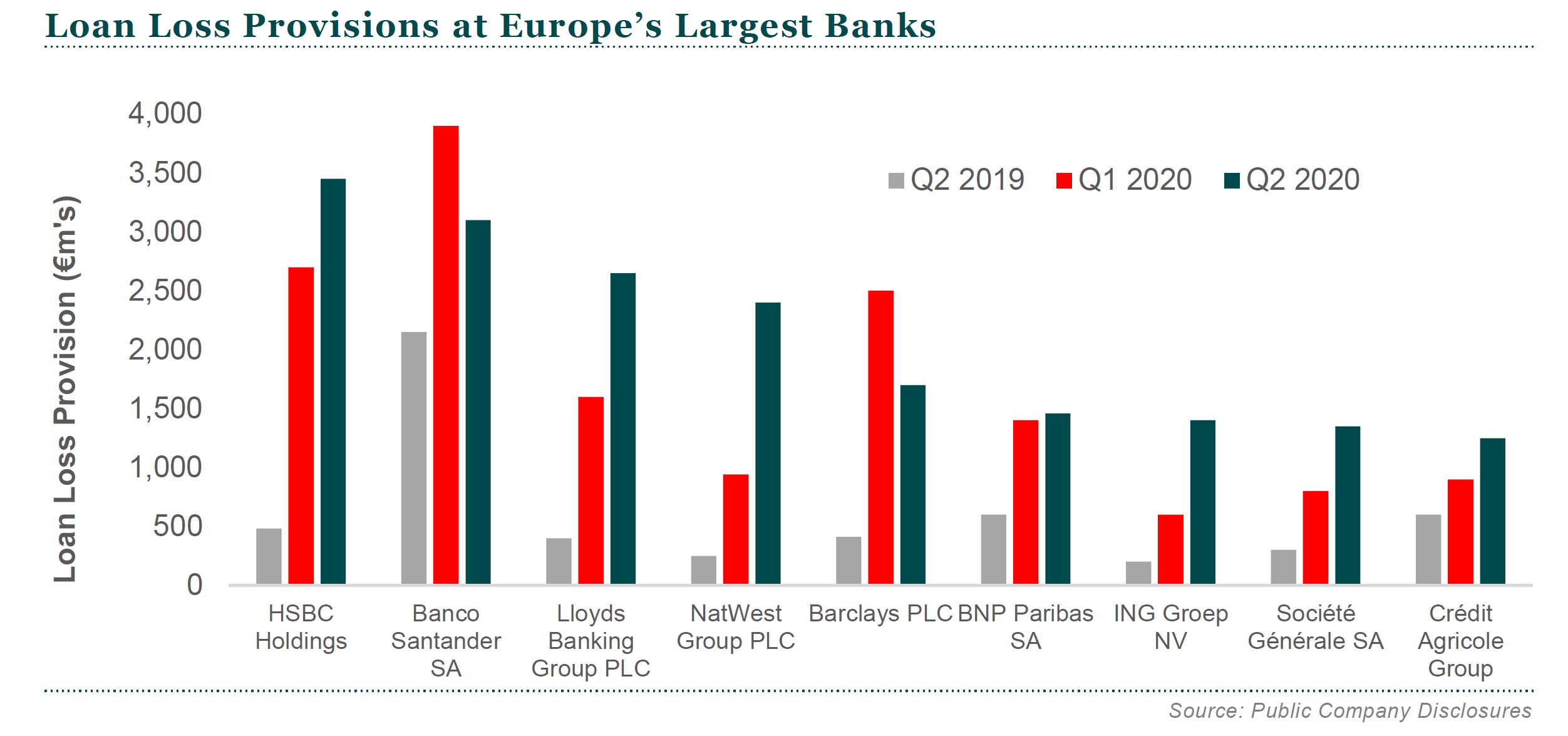

Over the past two quarters, clearing banks across the UK and Europe have reported a dramatic increase in loan loss provisioning and impairment charges. This is the biggest set of loan provisions since the 2008 09 financial crisis as lenders deal with the fallout from the COVID induced economic slowdown. Partly driven by revised accounting standards which now require banks to account for loan losses earlier, banks are braced for ‘significant deterioration’ in the economic outlook over the next 6 18 months as government employment and business support schemes are wound down.

The chart below indicates the large increase in loan provisions reported by European Banks in 2020 to date. For instance, a large UK clearing bank reported a c.550% increase in loan loss provision across their corporate and real estate exposures in the first half of 2020, compared to half year 2019. It is important to note, expected loss models differ across banks and are largely driven by internal assumptions regarding economic outlook and default probability across sectors.

A rise in credit impairment charges is consistent across all major global banks and while banks are well capitalised to withstand these forecasted losses, loan loss provisioning directly impacts profitability and erodes bottom line results. In this prolonged low rate environment, there is now pressure on banks to keep costs low and be more vigilant and selective with new business opportunities in the coming quarters.

Impact on borrowers

Increased provisioning will undoubtedly impact the clearing banks’ appetite for commercial real estate lending in the short medium term, which will present an opportunity for alternative lenders to fill the gap in the market. While banks are open to considering new lending opportunities, burdened by profitability concerns they are now more selective and conservative (lower leverage and restrictive covenants) when financing new transactions.

At Knight Frank Debt Advisory we have seen a 60% increase in development finance requests (by market value) in the past six months since the onset of COVID 19. This is compared to the corresponding period in 2019, across the UK and continental Europe in the following key sectors; residential, student accommodation, speculative office and speculative logistics development.

Developers and investors who previously relied on their relationship banks to provide competitive finance are now turning to debt advisors to introduce them to alternative sources of capital and secure financing at higher leverage levels, in particular for development projects.

Interest Rate Movements

Fall in Benchmark rates

Since the onset of COVID-19, LIBOR benchmark rates and three and five year GBP LIBOR swaps have fallen markedly as the UK financial markets adjust to the pandemic. Similarly, in the European financial markets, EURIBOR benchmark rates and three and five year EURIBOR swaps have fallen further back into negative territory. Three month LIBOR and three month EURIBOR rates are forecast to bottom out around Q1 2022, rising very gradually thereafter see GBP LIBOR and EURIBOR Forward Rates chart below.

For core real estate assets in the most favoured sectors (i.e. logistics and residential), the fall in LIBOR benchmark rates and swap rates has more than offset the corresponding increases in loan margins for new deals, therefore resulting in a lower ‘all in’ rate.

Zero LIBOR Floors

In the UK, loan agreements typically include a zero LIBOR floor to protect lenders in the event that three month LIBOR falls into negative territory.

What does this mean for borrowers with LIBOR swaps?

Under normal market conditions where LIBOR is positive, the borrower will pay LIBOR and the applicable loan margin and will receive LIBOR and pay the fixed swap rate to the swap counterparty. This means that the floating LIBOR element is effectively cancelled out.

However, where the loan facility includes a zero LIBOR floor and LIBOR falls into negative territory, the negative LIBOR rate won’t be ‘netted off’ the margin, therefore the borrower must pay the negative LIBOR amount to the swap counterparty in addition to the fixed payment amount under the swap agreement.

This causes a LIBOR disparity between the swap and the loan facility and, consequently, the effective ‘all in’ rate paid by the borrower will increase by an amount equal to the negative LIBOR rate.

To mitigate this risk, borrowers can buy an interest rate floor, the cost of which is typically paid upfront as a ‘one off’ premium or baked into the cost of the existing swap rate.

Download the full note

If you have any questions please don’t hesitate to get in touch with a member of the Debt Advisory team.