Investing amid peak uncertainty

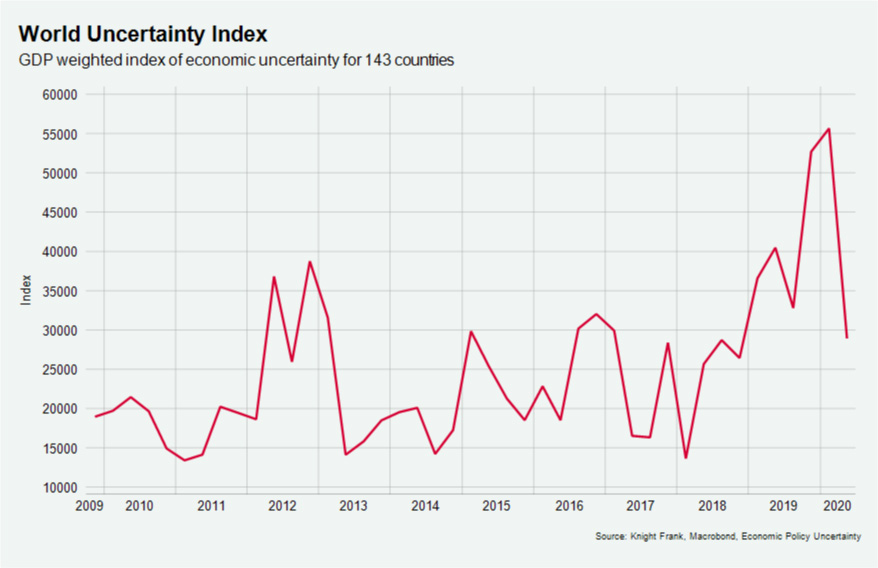

Global uncertainty has been building over the past four years but the pandemic highlights that a ‘black swan’ event can happen at any time. The crisis has brought the need for diversification and effective portfolio positioning into sharp focus.

2 minutes to read

Takeaways

- $338bn of unspent capital is targeting real estate, we expect an increase in competitive bidding for the right assets

- Lingering political uncertainty fuels the need to diversify across geographies, assets and liquidity

- There is a flight to safety. This is evident across both commercial investment and occupier markets, where it is clear that demand for prime assets remains relatively stronger than for those of a poorer quality, as well as in commodities such a gold, which has reached record prices this year

The amount of unspent capital looking to target real estate markets, an estimated $338bn is looking to be deployed by private equity funds alone. There is significant demand for the right asset and we expect an increase in competitive bidding for these. When this is released, competition among investors could rise, sitting on the fence and waiting for certainty that may never could lead to missed opportunities.

Brexit remains in the spotlight for the UK, the US presidential election is only a matter of months away and growing social unrest has continued in many economies. This political uncertainty means it is impossible to know how tax, immigration, trade and other policies may play out, which is likely to fuel desires among investors to diversify across geographies, currencies, assets and liquidity. For example, with the unknown future of agricultural policies in the UK, landowners need to be forward-thinking to shape their own future by cooperating with others to deliver large- scale environmental benefits.

Business sentiment and confidence has been dented and may remain low in the near term amid heightened political uncertainty and the continued threat of a second wave. This could delay capital expenditure and investment. In an environment where margins are being squeezed and for many the cost of maintenance has increased, there could be more distress and less investment.

Yet this current environment could offer some interesting opportunities: for some investors, perhaps a better chance of acquiring assets amidst a period of reduced competition, or for businesses that still own their property, a chance to capitalise on the relative lack of investment stock in the market by undertaking a sale and leaseback and freeing up funds.

Andrew Sim, Head of Commercial for Knight Frank, notes “given the continuing very low interest rates and the volatility of asset classes such as equities and bonds, investors continue to see value in direct real estate assets in Super City locations such as London, Paris, Tokyo, New York and San Francisco.

We are also seeing an increasingly diversified range of asset classes attracting investment. As well as the continued focus on offices, evolving asset allocation strategies are targeting industrial/logistic real estate and specialist sectors such as student, healthcare and the private rented sector. Sectors characterised by underlying long term structural and demographic changes.”