Property market continues to recover from Covid-19 slump

June transactions up month on month but 36% lower than the same period in 2019

1 minute to read

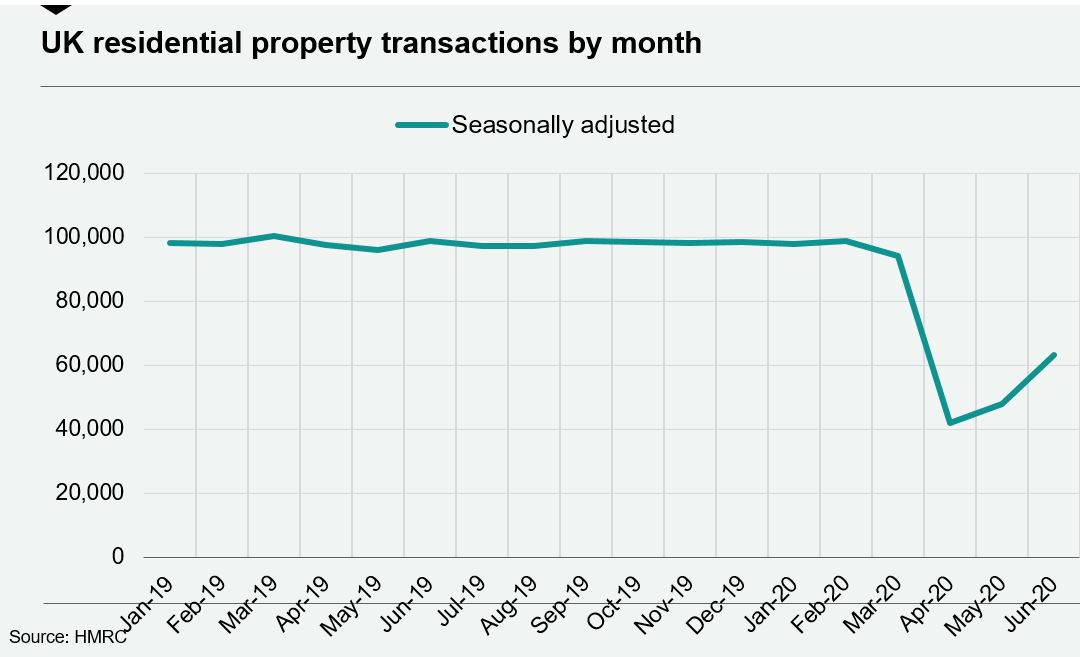

The property market’s recovery continued in June with transactions 32% up on the month before, according to provisional government data.

The 63,250 residential property transactions in June compared with 48,450 in May, the point at which transactions increased again having bottomed out in April after the UK was placed into lockdown on 23 March.

Restrictions on the housing market were lifted in England on 13 May and subsequently for other parts of the UK, with Scotland’s market reopening on the 29 June.

“The property market continued its return towards normality in June,” said Tom Bill, head of UK residential research at Knight Frank. “Both supply and demand have risen strongly since the April low-point and leading indicators of activity are as strong as they’ve been in years, which suggests exchanges will continue to climb.”

The figure for June is 36% lower than 12 months ago, but the decline is narrower than in May, which was 50% lower than the figure recorded in 2019.

Following the re-opening of the English market in mid-May there was a surge in activity that saw several records broken during June.

At present a seasonal lull this month or in August is not expected, with new supply in the first week of July three times higher than the first week of the year. The stamp duty holiday announced last week makes this even less likely.