Global Residential Outlook – 2 July 2020

A roundup of the latest data and insight across key global residential markets

6 minutes to read

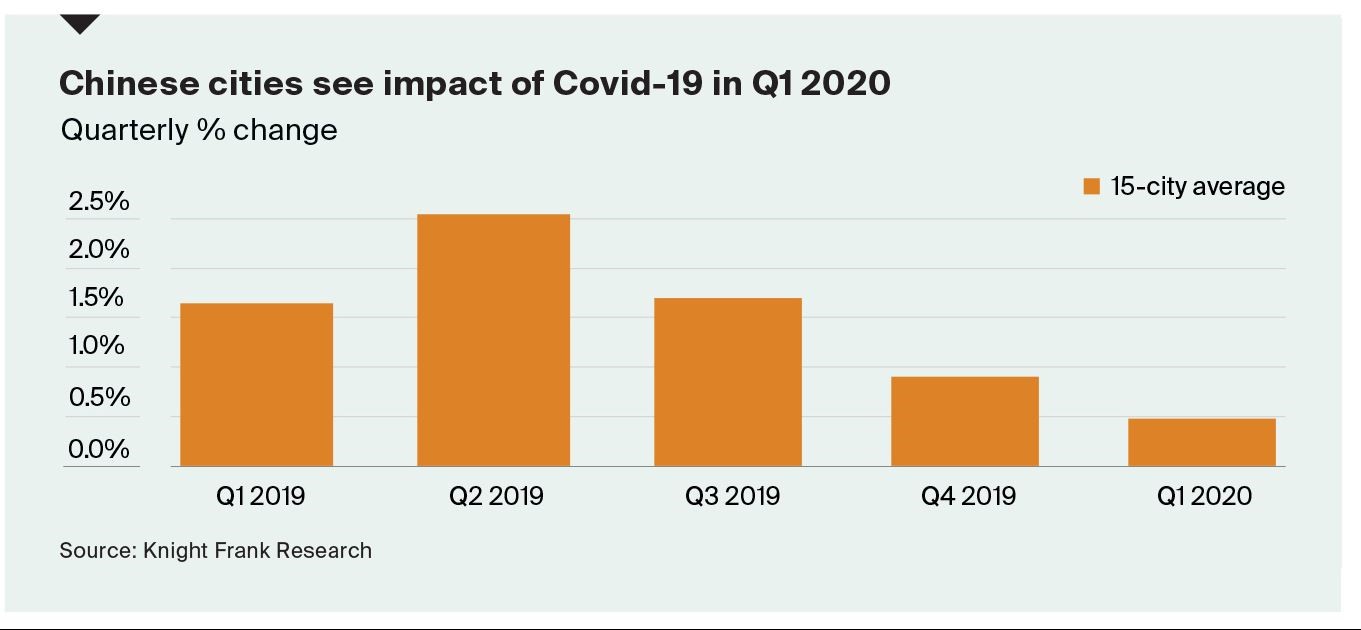

Residential Digest

- Knight Frank's Global Residential Cities Index tracks the movement in average prices across 150 cities worldwide. Manila led the global rankings on an annual basis, with Budapest out in front for Europe.The data is backward looking measuring annual price growth to Q1 2020, a time when Covid-19 was at its peak in Asia but yet to take its toll on large parts of Europe, North or South America. The latest data shows average prices across the Chinese cities tracked moderated in the first three months of 2020, averaging growth of just 0.4%.

Need to know

- The global coronavirus death toll surpassed 500,000 on Sunday, with the total number of cases standing at more than 10 million, according to Johns Hopkins University. Previous outbreaks in Beijing and Germany are under control although cities such as Leicester in the UK and parts of Melbourne in Australia are back under lockdown. Brazil, Mexico, India and South Africa are currently seeing an acceleration in cases.

- An announcement by the UK Government on the opening of key air bridges was expected this week but may now be delayed. Separately, the EU has agreed a travel deal allowing 15 nations (plus four European microstates) to join the 27-member EU common travel zone. The 14 unconditional selections are believed to include Algeria, Australia, Canada, Georgia, Japan, Montenegro, Morocco, New Zealand, Rwanda, Serbia, South Korea, Thailand, Tunisia and Uruguay. China would be added if it offers the European countries a reciprocal arrangement.

- Arizona became the third US state, following Texas and Florida, to reverse its economic reopening, closing bars, gyms and cinemas this week. Washington State and San Francisco are also pausing their next phase of easing restrictions.

- My colleague Flora Harley's analysis of real time global economic indicators reveals air traffic across the 20 locations we track increased 30% on the same time last month whilst six locations - Shanghai, Madrid, Paris, Vancouver, Los Angeles and Vienna saw their average departures rise by double digits week-on-week. That said, air traffic forecasts are slowly being pushed out with RBC Capital Bank expecting it will be 2024 before international passenger numbers at Sydney Airport reach pre-pandemic levels

Europe

Since 11 May, when the French property market reopened for business, our 30+ strong office network in France have reported their busiest weeks for more than a decade. Prospective buyers are now struggling to find a rental property from which to conduct their search this summer as flights and holiday lets have been snapped up in recent weeks.

A new report confirms that Switzerland is the safest country post-Covid-19 reaffirming the view of many high-net-worth individuals. The latest data shows 24 prime sales above CHF4m were agreed in Geneva between 1 March and the end of June 2020.

Since the start of Covid-19 Southern European cities have seen a sharp increase in the supply of rental homes. Over 185,000 new properties have been listed for rent in Madrid, Barcelona, Milan, Rome, Porto, Lisbon and Athens since early March, according to the online platform BrainsRE, this may lead to softening mainstream rents in the coming months.

In Spain, average property prices reached €1,747 per square metre in Q1 2020, their highest level in eight years according to the Colegio de Registradores. Four regions accounted for almost 70% of Spain’s total sales in Q1 2020; Madrid, Cataluña, Andalucía and the Community of Valencia.

In the UK, Boris Johnson yesterday announced what he called the “most radical reforms of our planning system” since the Second World War. The government will widen the scope of commercial buildings - including recently vacant shops - that can be converted to residential use without planning permission, plus housebuilders will no longer require a “normal planning application” to demolish and rebuild vacant residential buildings if they are to be repurposed as homes.

Asia Pacific

Our latest Hong Kong report confirms that sentiment in the residential market improved in May although heightened China-US tensions weighed on the economic outlook. Evidence of pent-up demand post-lockdown is emerging with a number of new projects significantly oversubscribed. Transaction volumes increased 46% in May month-on-month to 5,984 sales. Prices remain resilient, edging 0.8% so far this year, according to the latest official residential price index.

This week the territory was also named the most expensive location for expats by Mercer in its Cost of Living Survey, a title Hong Kong has held for three consecutive years. Six of the top ten cities this year are in Asia.

| Rank 2020 |

City |

| 1 |

Hong Kong |

| 2 |

Ashgabat |

| 3 |

Tokyo |

| 4 |

Zurich |

| 5 |

Singapore |

| 6 |

New York City |

| 7 |

Shanghai |

| 8 |

Bern |

| 9 |

Geneva |

| 10 |

Beijing |

Source: Mercer Cost of Living Survey 2020

Following our own research into the attitudes of expats post-Covid-19, Victoria Garrett delves deeper into the challenges facing expats in Asia and explores what effect larger repatriation volumes may have on local property markets across the region.

A new corporate structure in Singapore was announced this week, designed to lure fund managers and family offices from low-tax jurisdictions such as the Cayman Islands and Luxembourg. According to the Financial Times, hedge funds, private equity firms and family offices from Asia, Europe and the US are poised to move assets to Singapore, after the city-state launched a corporate structure (Variable Capital Company) in a bid to become the region’s leading financial centre.

US & Canada

In Manhattan, our partners Douglas Elliman reported a 78% drop year-on-year in newly-signed contracts in June, a marginal improvement on May’s figure but with viewings only permitted from 22 June we expect it to be July before it feeds through into the market data. Strong demand for single family homes in The Hamptons, North Shore and Westchester continues unabated with many families that opted to rent during lockdown now looking to buy a second home in the vicinity.

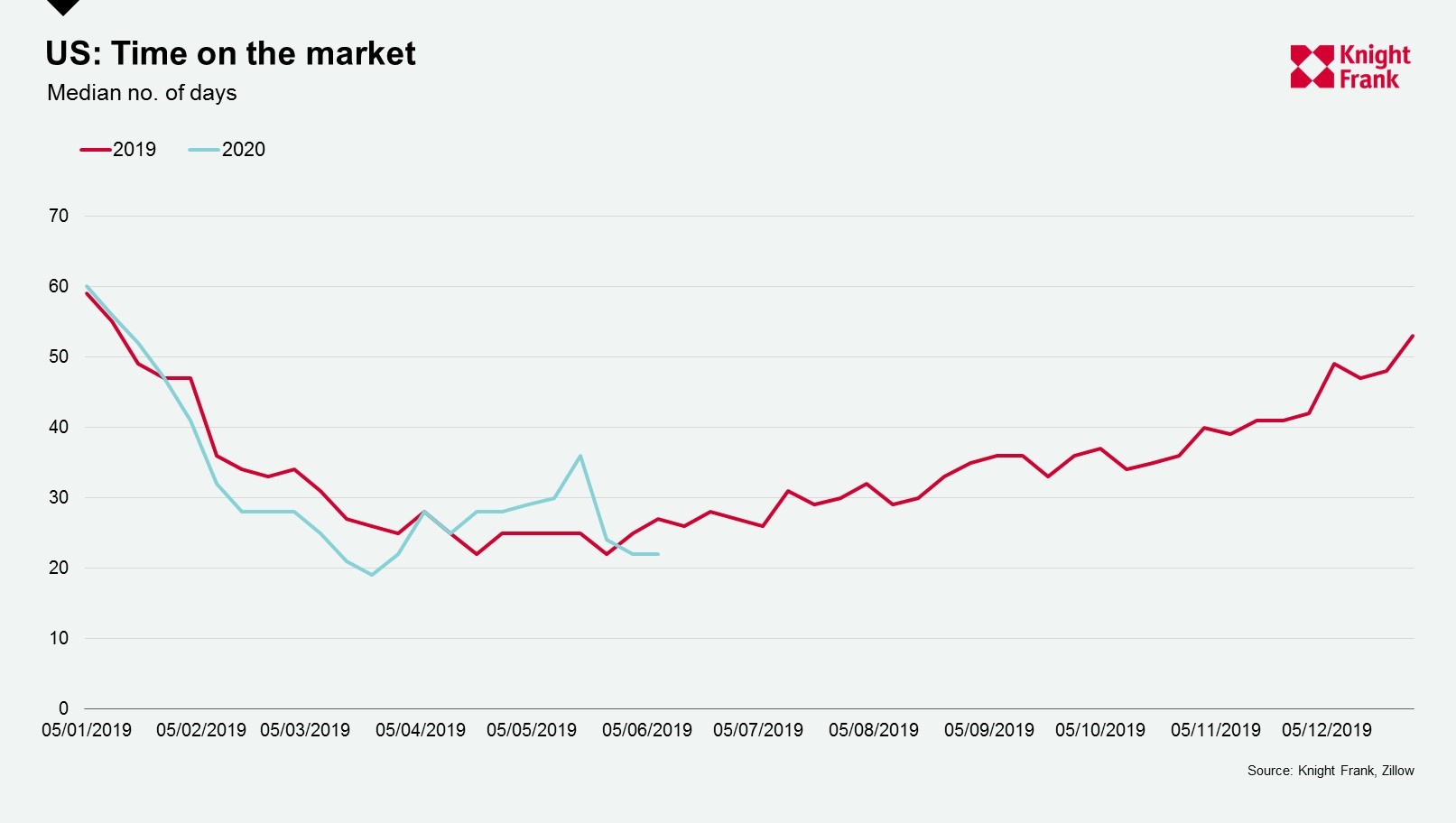

Although unemployment continues to be a drag on housing demand, there are two new datasets that suggest some resilience. Zillow has reported that the number of days between a property being marketed and going under offer is now lower than it was in June 2019.

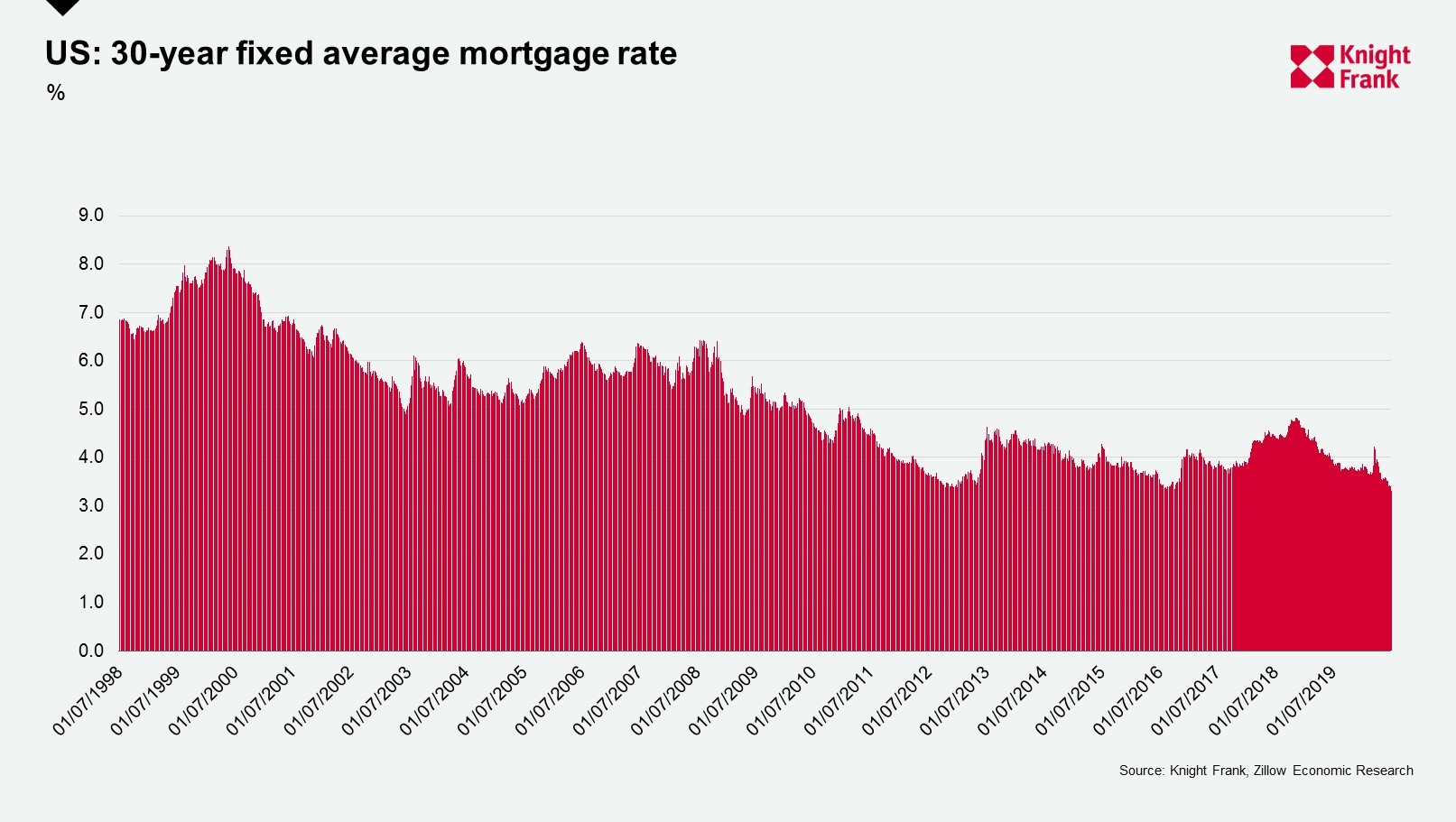

Secondly, pending homes sales increased 44% in May according to the National Association of Realtors. Although this represents the largest monthly increase since 2001, it remains below February’s total. A poll of economists by Reuters had expected the figure to be lower, leading some to believe the housing market may emerge from the recession faster than anticipated, particularly given mortgage rates are at record lows.

Middle East and Africa

In Uganda, our latest Kampala Market Update reports a 11% increase in apartment listings prompting some landlords to discount rents. The sector was already suffering with weak demand prior to the enforced lockdown which halted all sale and leasing activity and saw over 1,000 foreign nationals return to their home countries.

This week’s recommended listening

- In our new Intelligence Talks podcast, Anna Ward provides the view from Australia, where the Prime Minister is sticking with plans to further ease Covid-19 restrictions. Anna explores the trajectory of the property market recovery with Ben Burston, chief economist, Ben Schubert, national head of agency, and Andrea Roberts, national head of leasing. Listen on Apple, Spotify and Acast.

- At the end of 2019 we introduced Hermès handbags into our Luxury Investment Index (KFLII) and they were the year's top performer. Along with Anna Ward, Andrew Shirley revisits the topic with Christie’s head of Handbag sales Rachel Koffsky, Seb Duthy from Art Market Research and Associate Partner Flora Harley. Listen on Apple, Spotify and Acast