Record levels of offers accepted a month after lockdown lifted

The ratio between asking prices and achieved prices is narrowing as traction returns to UK property markets

3 minutes to read

Offers are being accepted at record rates in UK property markets as traction returns and downwards pressure on prices eases in the first month since market lockdown measures were lifted.

The number of offers accepted outside the capital in the week to 6 June was the highest on record, and up 52% compared to the five-year average, as vendors agreed deals against a backdrop of narrowing price discounts and pent-up demand. In London, the figure was 34% above the five-year average and the third highest weekly figure this year.

“Enquiry activity has been extraordinary. I’ve never been contacted by so many people that want to live outside London,” said Damian Gray, head of Knight Frank’s Oxford office. “Vendors are generally listening to advice and a lot of the property being brought to market now is being priced more realistically. Buyers meanwhile are happy to pay the right amount and go for it.”

Restrictions on UK property transactions were lifted on 13 May following an eight-week period during which physical viewings ground to a halt and demand remained muted. As the UK emerges from lockdown and the wider impact on the jobs market becomes clearer, this will have a bearing on the performance of the housing market.

For now, pressure from buyers that has built since the end of March has only bolstered pent-up demand that has formed against a backdrop of tax changes and political uncertainty over the last five years.

The number of new prospective buyers continues to increase. For markets outside London in the week ending 6 June, the figure was the highest it has been since May 2018 and was 14% ahead of the five-year average. In London, the number was 54% ahead of the five-year average but lower than levels recorded at the start of this year when the post-election bounce had an impact.

The reason that markets outside of the capital are currently setting records comes down to price said David Peters, head of Knight Frank’s Country Business.

The average discount to the asking price for sales outside London is 1.2% since the market re-opened. That compared to 2.4% during the market lockdown. In London, the average discount has narrowed to 5.5% from 6.4% over the same period.

“What this reflects is that prices outside London have been more realistic for a longer period of time and are therefore now showing more resilience,” said David.

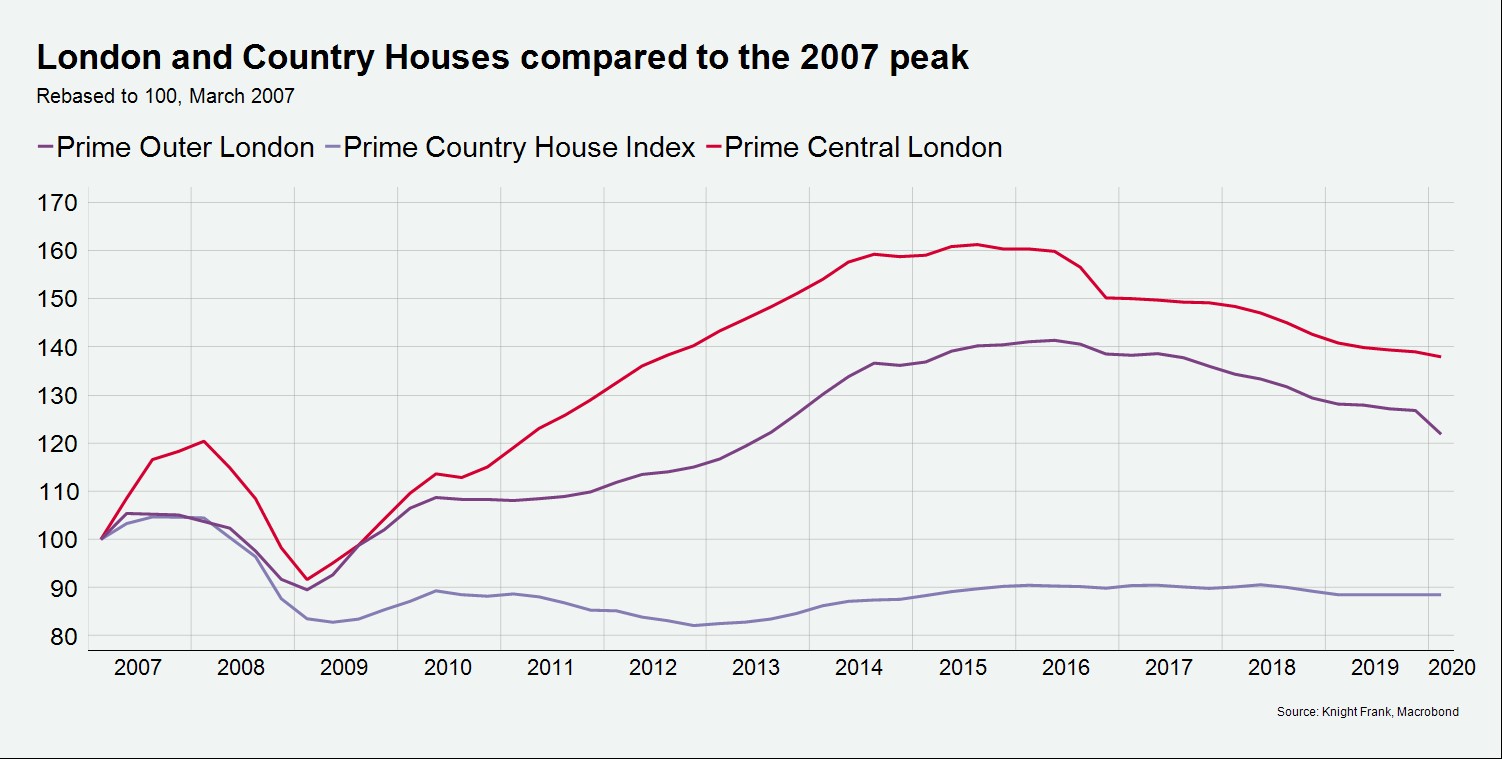

House prices outside the capital peaked in the third quarter of 2007, however they remain below this high point and growth has been subdued in recent years. Meanwhile, London prices are now between 20% and 40% above the pre-financial crisis peak of 2007, as the chart below shows.

This price differential has been allied to a trend for more buyers to seek outdoor space. While web views for London properties were 13% below the five-year average in the week ending 6 June, outside London there was a 13% increase.

“I had two offers in lockdown and advised the vendors to hold their nerve,” said Shaun Hobbs, head of Knight Frank’s Basingstoke office. “That really paid off with better prices in the end,” he said.

Relatively tight supply levels have also put a brake on downwards price pressure in the first month since the property market re-opened but more balance should return in coming months.

New instructions to sell in London and Country markets were 4% ahead of the five-year average in the week to 6 June. That compared to a figure of -60% in the first full week of trading after market restrictions were lifted.

For more information on how property markets are faring post-lockdown, listen to Knight Frank’s IntelligenceTalks podcast. In a recent episode we heard Luke Ellwood, Harry Gladwin and Julia Robotham on whether the recent increase in interest for country properties is merely a trend, or here to stay. Listen on Apple Podcast , Spotify or Acast