Global Residential Market Outlook - 7 May 2020

A roundup of the latest data and insight on key global residential markets

5 minutes to read

In the last week several countries have taken tentative steps towards reopening their economies. Contact-tracing apps are being trialled in some countries and talk of opening key flight routes are ongoing.

Against this background, we published two key datasets - our Prime Global Cities Index and our Prime Global Forecast.

The Index results provide a valuable steer as to how prime markets were performing in the run up to the Covid-19 crisis – measuring price growth in the year to the end of March 2020. Of note, is the downturn in several Asian markets in the first quarter with Bangkok registering the largest price declines.

Our prime forecast offers our clients a view as to where our research teams envisage prime prices are headed in 2020 and 2021. This is based on market fundamentals such as demand and supply, mortgage rates but also the scale of the crisis in their markets and the government stimulus measures and support packages in place. Perhaps not surprisingly, we expect prime prices to decline in 16 of the 20 cities we track this year, but this trend is expected to be reversed in 2021 with 14 cities expected to see positive price growth.

Our survey respondents confirmed a degree of optimism in relation to sales with the majority of cities expecting sales volumes to start to recover in the second half of 2020, although 35% think it will be 2021 before transactions reach pre-Covid-19 levels.

Below we present the latest residential news and data from across the rest of our network.

Residential digest

Asia Pacific

My colleague, Nick Holt's weekly update from China, reveals Knight Frank’s teams across the country are seeing more activity. Residential activity continued to pick up in April underpinned by developers offering discounts and the existing demand/supply imbalance in Tier-1 cities.

Beijing, Shanghai and Guangzhou reported an uptick in sales volumes in the week ending 30 April but this is in contrast to South East Asian markets where the number of residential transactions continues to moderate in most major cities.

In Australia, most buyers are adopting a ‘wait-and-see’ attitude, prices are holding firm, although new listings have started to decline at a time when they usually strengthen ahead of the winter months.

Plans are afoot to resume unrestricted travel between Australia and New Zealand as the two countries look to create a ‘Trans-Tasman travel bubble’. A Covid-19 contact-tracing app is operational in Australia and due for release in New Zealand in the next two weeks.

Europe

As we reported in last week’s update Germany, Portugal, Italy, France and Spain are starting to reopen their economies, following in the footsteps of Austria, Denmark and the Czech Republic.

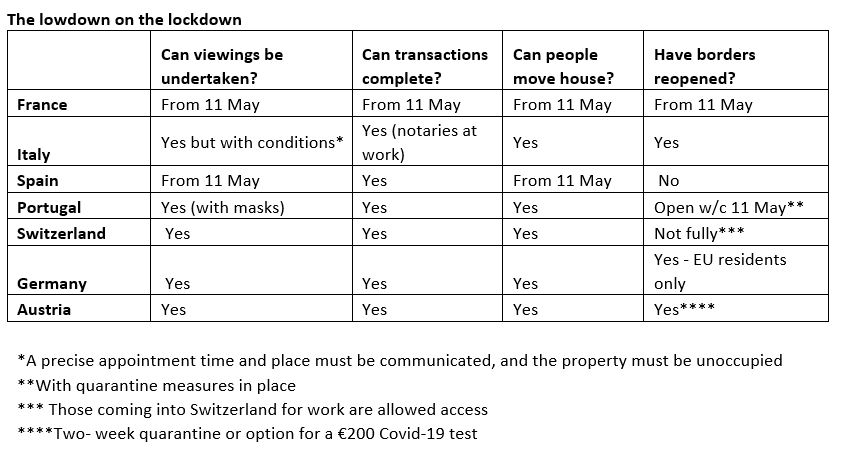

The table below summarises what this means for property markets across Europe’s key economies. Next week is a critical date for France and Spain with viewings recommencing, although still in line with social distancing guidelines – transactions can complete, and people will once again be able to move house.

Such changes will have a multiplier effect on other industries such as builders, solicitors and removal companies.

As we highlighted in our prime forecast, we expect Europe’s usual seasonal lull in August to disappear as the property market starts to find its feet and tries to make up for lost time.

Inevitably, Europe’s holiday rental market has taken a significant hit during Spring, but initial data from Airbnb reveals an uptick in bookings in a number of European countries in recent weeks, in particular in Denmark and the Netherlands. We expect rental demand to be a lead indicator of buyer demand although the likelihood is domestic demand will return first across both segments.

One market that saw an abrupt end to its season was the Alpine ski market. In France, ski lifts were closed from 15 March meaning resorts lost out on the lucrative Easter period but data from our colleagues at Cimalpes who operate across The Three Valleys reveals that rental enquiries for the 2020-21 winter season are only 75% down on where they were this time last year suggesting a degree of resilience.

The US & Canada

In the US, some states are starting to reopen their economies with Texas amongst the first whilst California will begin easing restrictions from Friday.

Mortgage rates hit an all-time low last week in the US which may bolster demand when the recovery emerges. The 30-year fixed mortgage rate averaged 3.23% in the week ending April 30 — down from 4.14% a year ago, this represents the lowest rate since Freddie Mac began tracking in 1971.

In Canada, Quebec and Alberta have so far set out more detailed plans for re-opening than Ontario or British Columbia, although Quebec has seen the highest number of Covid-19 cases. Routine healthcare, non-essential manufacturing, construction and retail look likely to be the sectors to re-open first.

The latest data from Vancouver shows that whilst sales in April dipped 40% year-on-year, listings are declining at a similar rate which may help support prices once the crisis is over.

Middle East

This week, my colleague Flora Harley provided a deep dive into the Dubai market highlighting that public transport, some restaurants, cafes, malls and offices have begun to reopen under 30% capacity and social distancing measures. This is reflected in Google mobility data which shows increased visits to locations across recreation, parks and retail sectors - though all remain well below pre-pandemic levels.

Data digest

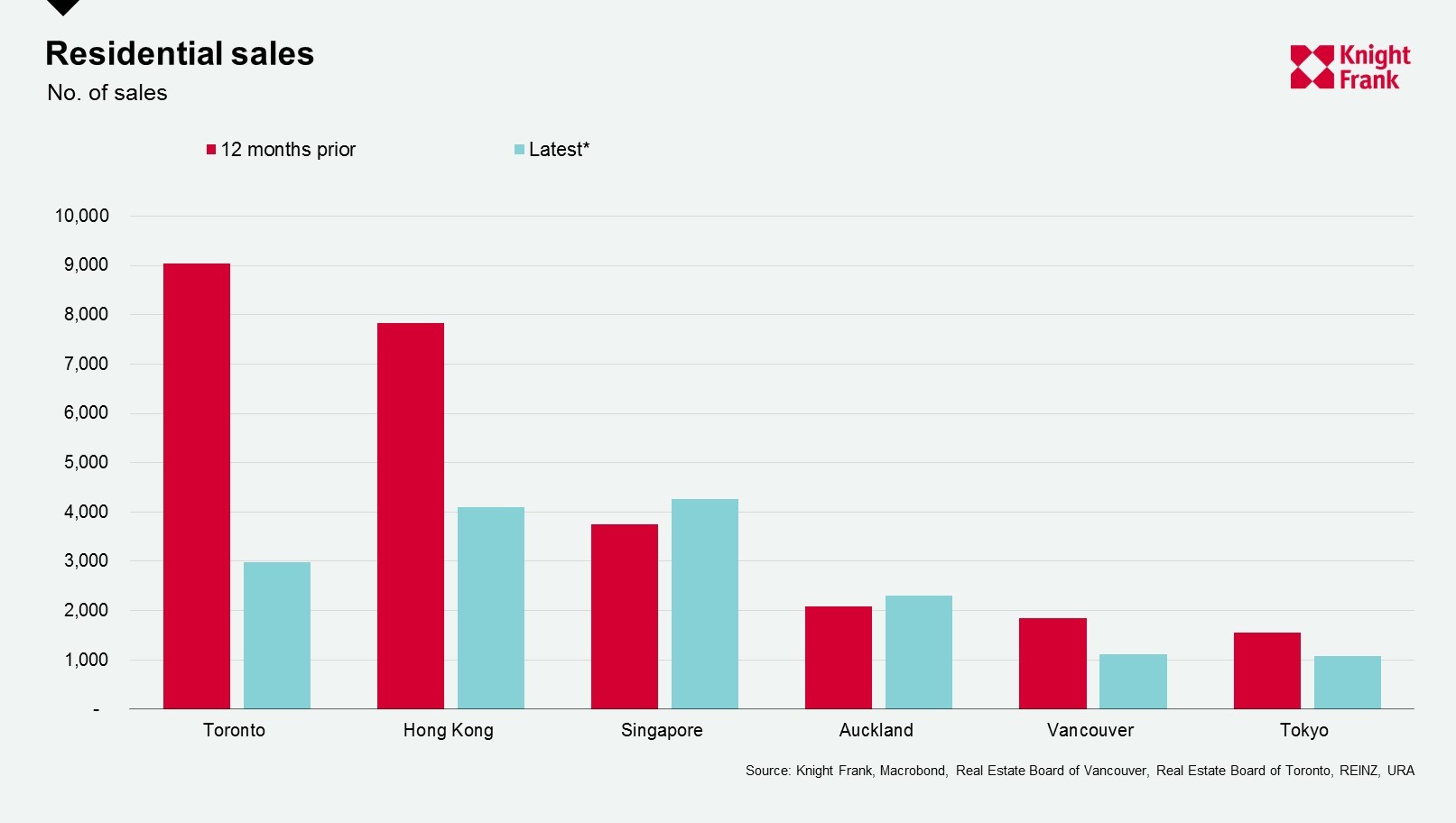

A brief look at the latest sales data that has been published so far for March and April shows a mixed picture. Singapore and Auckland were the only cities to have seen a rise in activity although in both cities Covid-19 cases at the end of March remained low.