Global Residential Market Outlook

With the economic landscape changing on a daily basis, we present a roundup of the latest data and insight and provide our outlook for key global residential markets

4 minutes to read

Residential digest

Against an uncertain backdrop, housing markets are adapting, but in the same way that lockdown rules and the ability to transact has varied significantly from country to country and even city to city, the path out of lockdown will be gradual and phased and critically will vary from location to location.

At the prime end of the market, despite the advent of virtual viewings, the loosening of travel regulations will be critical to future overseas demand and market traction. At a domestic level, governments’ stimulus packages will go some way to bolster weakened employment markets and consumer demand.

Asia Pacific

A week ago, there were positive noises emanating from Asia with traffic levels and city mobility data from China showing a gradual return to normality. Even property sales were following an upward path. However, whilst China looks to be seeing improving transactional data, economic and housing market data from Hong Kong and Singapore looks to be stuttering following the resurgence in Covid-19 cases recorded in the last week. These are in part imported cases, which, as a result, may lead to a tightening of border controls once more.

In Australia, construction sites remain open as workers have been classified as an essential service by the government. UBS expects housing starts to fall from around 174,000 in 2019, to around 120,000 in 2020, whilst some analysts believe the government's stimulus measures (A$198 billion) and leniency from the banks could help prevent forced selling by home owners despite a sharp rise in the unemployment rate.

New Zealand, increasingly held up as an example of how to get Covid-19 management right, is moving from alert level 4 to alert level 3 on 27 April, this means estate agents will be able to transact once more. Auckland saw sales increase from 2,762 in January to 3,870 in March, a rise of 40%, driven primarily by domestic demand - foreign buyers have been barred from purchasing existing homes since 2019. Reduced exposure to foreign demand, its low level of Covid-19 cases (1,451 at 22 April) and an advanced phased plan for easing out of lockdown may insulate the New Zealand market from significant price reductions.

Europe

In Europe, some of the hardest-hit economies including Italy and Spain are seeing their number of new Covid-19 cases decline and a gradual, phased reopening is expected in April and May although borders are likely to remain closed for some time.

Source: Bloomberg

Some media reports suggest estate agencies, notaries and land registries will be amongst the first to reopen alongside shops and potentially cafes and restaurants. The recovery in Europe’s prime markets will be strongly linked to the relaxation of international travel guidelines and the latest forecasts from KPMG suggest it may be 2021 before we see these fully return to normal.

In Madrid, the construction industry is back to work with 26,713 new homes now back on track. In Vienna, as elsewhere, we expect domestic buyers to drive the recovery initially. Across Europe, the usual seasonal dip in sales activity observed each August might not occur this year as markets start to find their feet.

The US & Canada

Prior to Covid-19, we saw evidence of strengthening demand in the New York market as buyers looked to capitalise on lower prices.

Should the crisis lengthen, developers will see inventories expand, increasing the likelihood of price reductions in the new-build sector - an appealing prospect for some buyers given interest rates are back to historic lows.

Much coverage has been given to jobless claims which have accelerated to 22 million, but US claim numbers, unlike those in Europe, include furloughed workers.

Vancouver, one of the few market where sales data is available for March 2020, shows a 17% increase in sales numbers month-on-month.

Trends to monitor

- The strength of the USD and dollar-pegged currencies means some buyers are still seeing a currency play.

- A sudden decline in holiday rentals is likely to see landlords switch to long-term leases in those markets with steady demand from domestic tenants.

- Some prime buyers may start to prioritise second home markets they can access by road or rail from their country of residence.

- In countries where bans on moving to second homes are in place we may see HNWIs review the size and location of their primary residences, prioritising outdoor space and potentially rural or mountain locations. Tuscany, Provence and Mallorca are seeing some of the highest enquiry numbers since the outbreak of Covid-19.

Readying for reopening

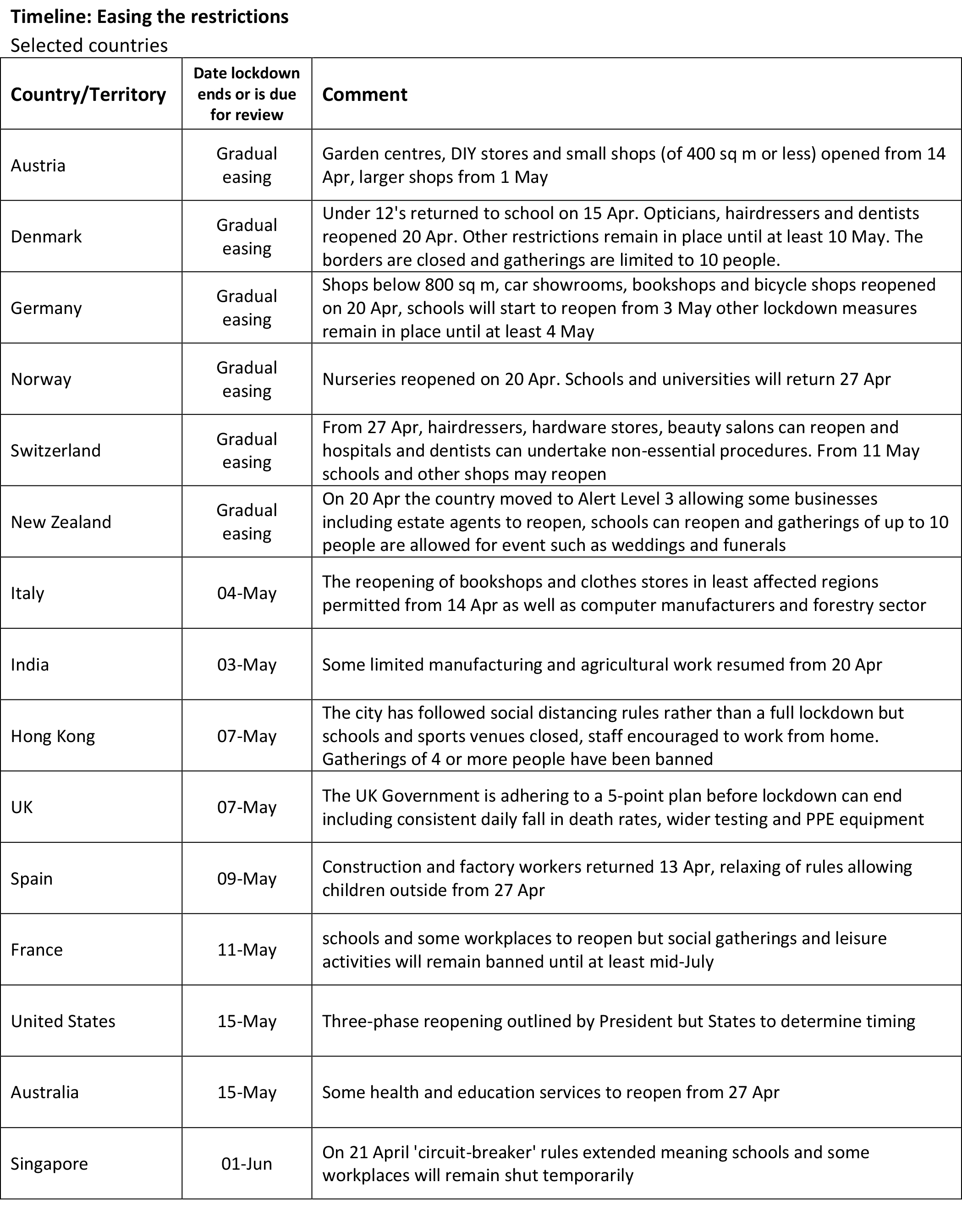

Moves are now afoot across a number of countries to start reopening their economies, but the process will be slow and gradual. The World Health Organisation (WHO) has said that to reduce the risk of new outbreaks, measures should be lifted in a phased, step-wise manner, with a minimum of two weeks between each phase. Any subsequent flare up in infections will see a return to tighter measures.

Below we collate the latest announcements on the easing of lockdown rules.

Sign up to receive our daily roundup of economic and housing market analysis here