Positive signs for prime country markets despite uncertainty

Price adjustments in the country house market attracted more buyers to some markets between June and September, leading to a moderation in price declines.

2 minutes to read

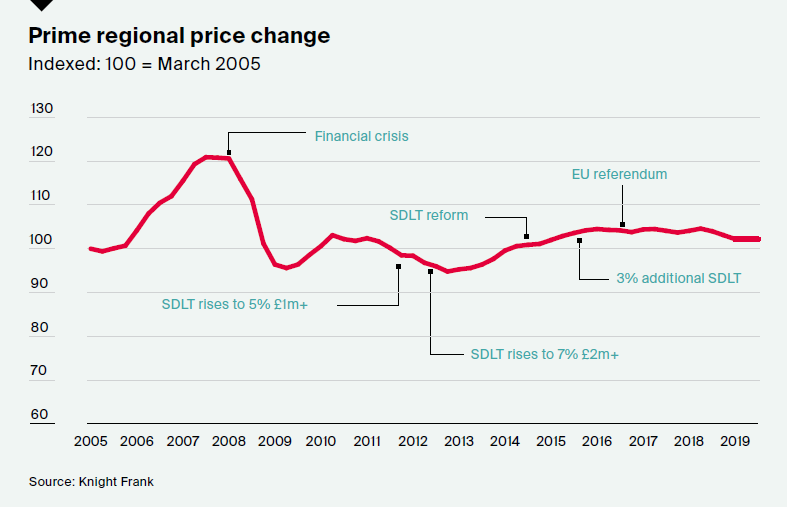

Average prime country values in England and Wales declined 0.1% during the quarter, taking the annual change to -1.7%, up from -2.3% in Q2.

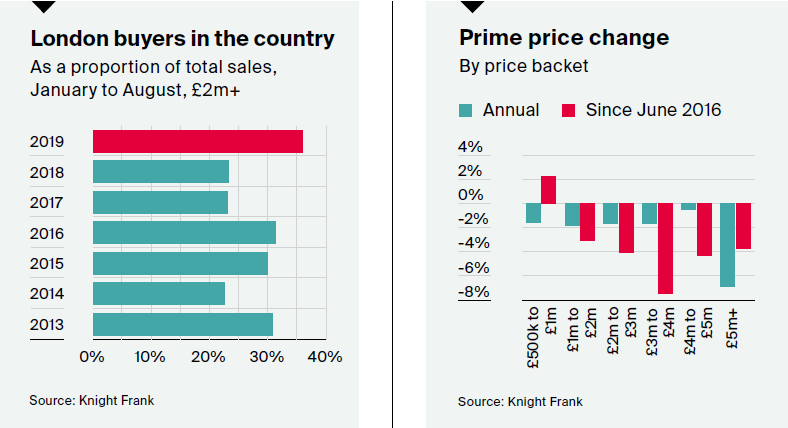

As prices have adjusted to reflect market conditions over the last 3 years, agents report a rise in buyer activity as they perceive value in certain locations. This is particularly the case in higher price brackets, with Knight Frank sales data showing a notable increase in transactions for properties valued at £3 million or more since the start of the year, compared with the same nine-month period in 2018.

Value at the top end

In the market for homes priced at £2 million or more, average prices are now 6% lower than they were at the time of the EU referendum. Values are still, on average, 20% below the market peak in 2008.

Political rhetoric has ramped up in recent weeks, and uncertainty surrounding the UK’s future relationship with the European Union and what this may mean for the economy continues to be the biggest single constraint on prime markets.

"Buyers are increasingly discerning and vendors have to make sure they present, and ultimately price, their property accordingly."

_Ed Rook, Head of Country Department,

Against this backdrop, however, sales activity has been relatively resilient. This has been helped by a more active market in prime London, given that the flow of buyers from the capital continues to be a key driver in prime country markets.

Price falls in the prime London market have started to moderate, and buyer interest is reaching record highs. Knight Frank buyer data shows that the number of Londoners who purchased properties valued above £2 million outside of the capital between January and June 2019 was at its highest level for any corresponding period since 2011.

Outlook

The number of prospective buyers currently looking to purchase a property in prime country markets with Knight Frank with a budget of at least £2 million is 9% higher than at the same point in 2018, which suggests a robust level of demand within this market.

However, despite strong demand, supply remains constrained as vendors hesitate due to the political uncertainty. Whilst this is likely to put a floor under pricing to some extent, prime markets will remain price sensitive for the remainder of 2019 and 2020.