Knight Frank's Head of Farms & Estates takes the temperature of the current farmland market

Clive Hopkins, Knight Frank’s Head of Farms & Estates, takes the temperature of the current farmland market.

2 minutes to read

Earlier this year I was predicting that more land would have come to the market by now and that we would have a clearer picture as to where prices were heading.

That, however, was of course based on there being some clarity regarding the Brexit process, clarity that is still at the time of writing (13 May) sadly lacking.

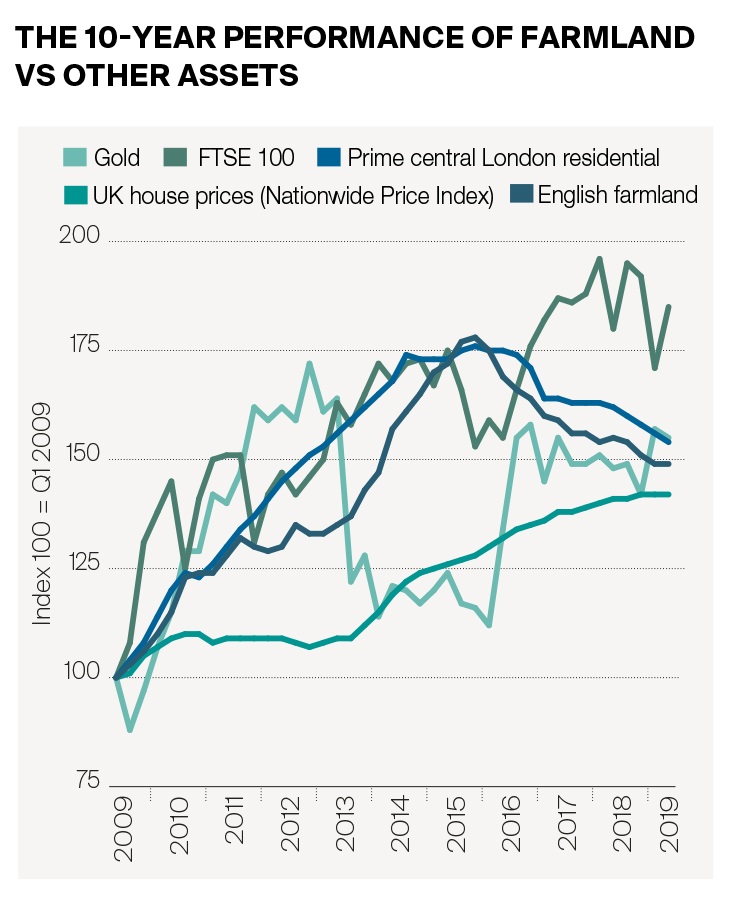

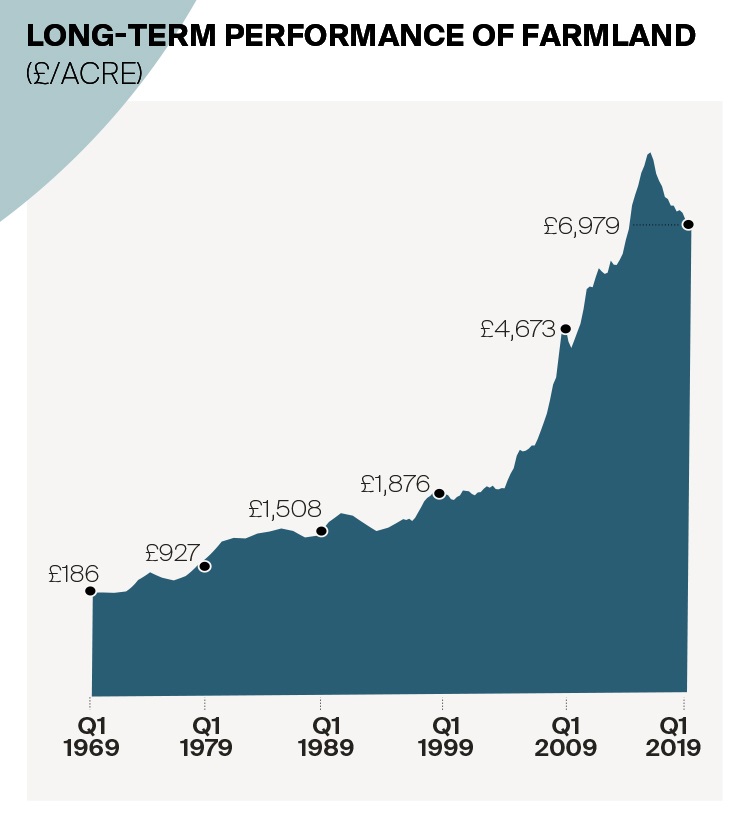

According to the latest results of the Knight Frank Farmland Index (to Q1 2019), average prices for bare agricultural land have been treading water so far this year, holding firm at just under £7,000 per acre, 5% lower than they were five years ago, but still 50% higher than in 2009.

Uncertainty among both vendors and potential purchasers has created a bit of a pressure cooker situation where only those strongly motivated to buy or sell are active.

My own feeling was that a Brexit deal of any form as scheduled would have allowed the market to let off steam and we might have even seen a slight bounce in values by the summer.

Not necessarily back to the highs of 2015, when our farmland index broke the £8,000/acre barrier, but perhaps enough to wipe out the 3% slide of the past 12 months.

But with the deadline for reaching a deal now extended to October it seems unlikely that we will see any meaningful movement in prices for the rest of the year.

By mid-May the amount of land advertised for sale publicly was well down on 2018 and I don’t see too many signs of this trend being reversed, although activity has picked up slightly.

Longer term, some commentators are arguing that Brexit will lead to an inevitable sharp decline in the average value of farmland. I’m not so sure that this should be taken as a given – regardless of whether we are in the EU or not, there are still plenty of reasons to own farmland and, as mentioned elsewhere in this report, there are other arguably more pressing challenges facing farming – but what I do believe is that the market will become even more variable than it already is.

For example, as area-based support payments are gradually scaled back, soil quality and productivity will become much more important to commercial farming buyers.

But that’s not to say only the best agricultural land will be in demand. As support shifts towards the delivery of environmental benefits, more marginal farms may well be able to create new income streams.

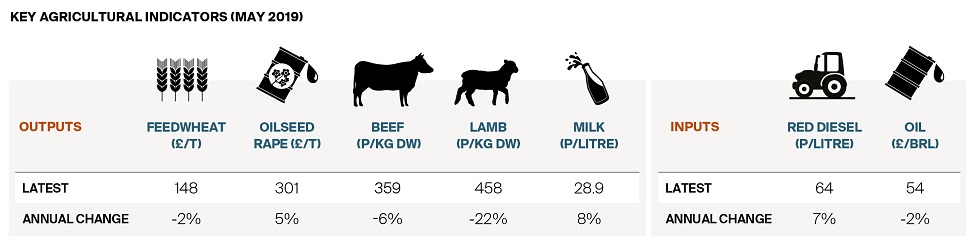

In the meantime, cereal prices are holding up and those high quality farms that do come to the market will sell well but until politicians in Westminster and Brussels get their acts together we can only wait impatiently for some kind of normality to resume.

Please contact Clive Hopkins if you are thinking of buying or selling an estate, farm or land.