Residential Investment: A new sector emerges

The Residential Investment sector is gaining traction in the UK. Investors looking for long-term returns are seeking out the opportunities afforded in the expanding private rented sector, especially purpose-built age-targeted accommodation.

2 minutes to read

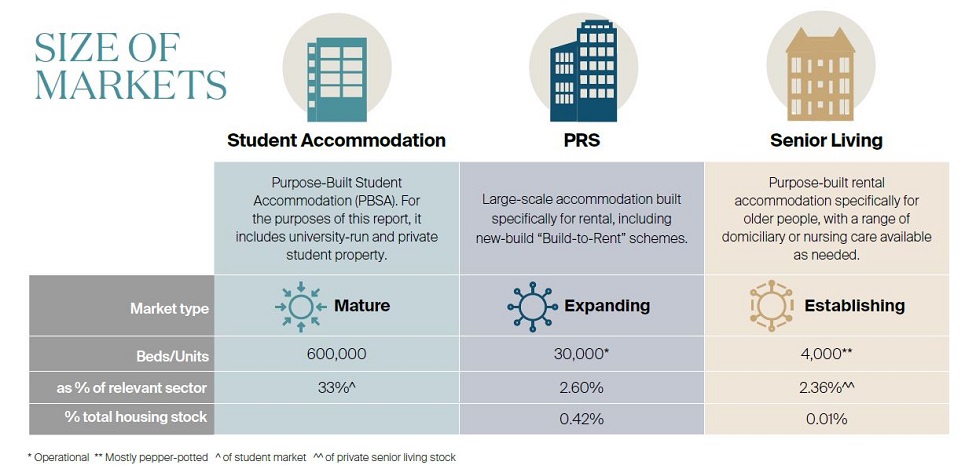

The Residential Investment sector, incorporating purpose-built Student Accommodation, investment-grade and purpose-built rented accommodation (PRS) and Senior Living has been expanding rapidly in the UK in recent years.

The myriad reasons for the growth of investment into income producing residential markets include a search for diversification, finding value in the granularity of occupiers that comes with individual units, demographic and tenure shifts and a housing policy landscape in the UK that is now embracing diversity of tenure.

Within the three sectors that make up Residential Investment, the fundamentals underpinning the markets are also varied, from educational factors in the Student Accommodation market to housing affordability and employee mobility in the PRS and the ageing population and limited care options in the senior rented sector.

To examine how these sectors will move over the next five years, we have undertaken a survey of 43 leading investors in Residential Investment, the largest survey of its kind and representing a combined £32 billion of investment.

An analysis of each market is shown below, and the report also includes our forecasts for the extent of growth in all three sectors by 2025. The PRS sector is expected to leapfrog Student Accommodation over this time-frame, with the sum of capital invested and committed in the investment-grade PRS rising to more than the total value of the Student Accommodation sector.

The combined value of the sectors in 2025, forecast to be £146 billion, means that the sector will start to close in on some of the commercial real estate classes by total asset vaue, cementing its place as an established mainstream asset class for global investors.

At a glance:

Residential Investment is merging as a leading real estate sector

Our survey of 43 leading investors, with a combined £32 billion already invested in Student Accommodation, PRS and Senior Living Rental, signals further growth London and Bristol identified as leading investment opportunities over the next five years, with Birmingham also a a strong opportunity area for PRS

Total size of sector forecast to reach £146 billion by 2025

This post first appeared in the The Residential Investment Report 2019 which examines the trends across age-targeted institutional rental accommodation across the UK.