How ESG influences private investment in real estate

Do the wealthy care about ESG when making investment decisions?

Are those in some countries more interested than others?

1 minute to read

The latest findings of our Attitudes Survey for The Wealth Report 2022 show that overwhelmingly, private investors do care about ESG when making commercial investment decisions. While this awareness does differ by geographical region, overall 80% of respondents viewed ESG as important. The findings, reported in Four key drivers for ESG-related property investment, were taken from our annual survey of 600 wealth advisers who collectively look after £3.5 trillion capital.

The survey found that four out of five ultrahigh-net-worth clients were interested in ESG-related property investment, with ESG perceived as an opportunity to create and preserve wealth by over half (52%) of respondents. This ties in with our Active Capital research which found that prime central London offices rated “excellent” by green-rating BREEAM enjoy a 10% premium on sales prices compared with equivalent unrated ones. Similarly, in the Australian cities of Sydney and Melbourne, buildings with a 5+ NABERS green rating received a sales price premium close to 18%.

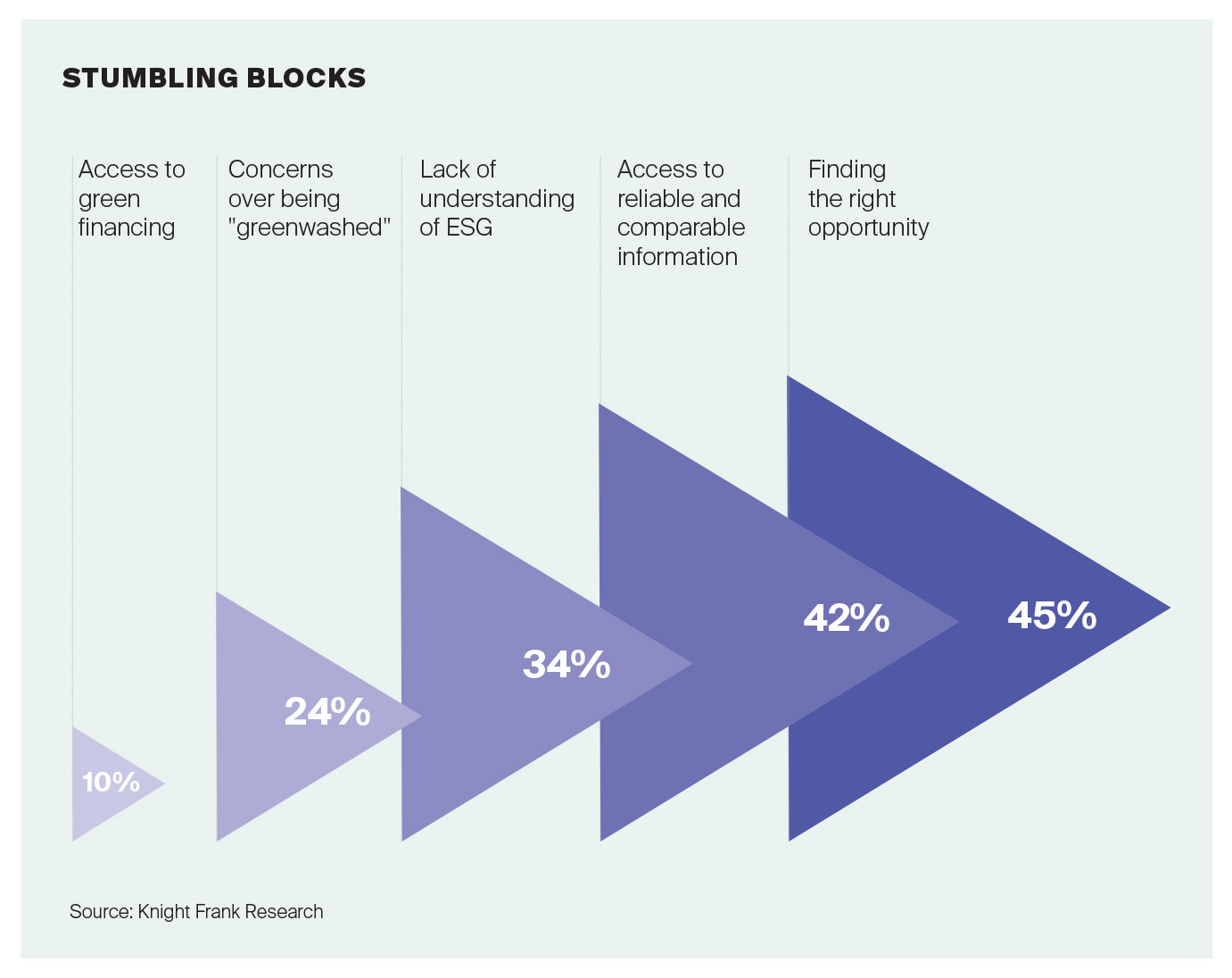

The key driver for this focus on ESG-related property investments is investors’ desire to future-proof their portfolio with 40% of respondents primarily concerned with protecting long-term returns, especially those investors from the UK, Latin America and Russia and CIS. A desire for impact and the opportunity for greater returns were the second and third key drivers with only 16% of respondents citing external pressure as the main reason pushing ESG up their agenda. Geographical variations exist: in Asia for example, only 10% of respondents said ESG was unimportant against a global average of 20%. Overall, private investors worldwide clearly care about ESG issues, yet they still face challenges, including accessing accurate information and sage advice to identify the best opportunities for investment and sourcing green financing.

Download the ESG Report 2022