Has the Bank of England overdone the gloom?

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

How bad is it?

The Bank of England yesterday voted to raise the base rate to 1%, its highest level for 13 years. All nine members of the Monetary Policy Committee voted to raise the rate. Three of the nine voted for a 50bps hike to 1.25%.

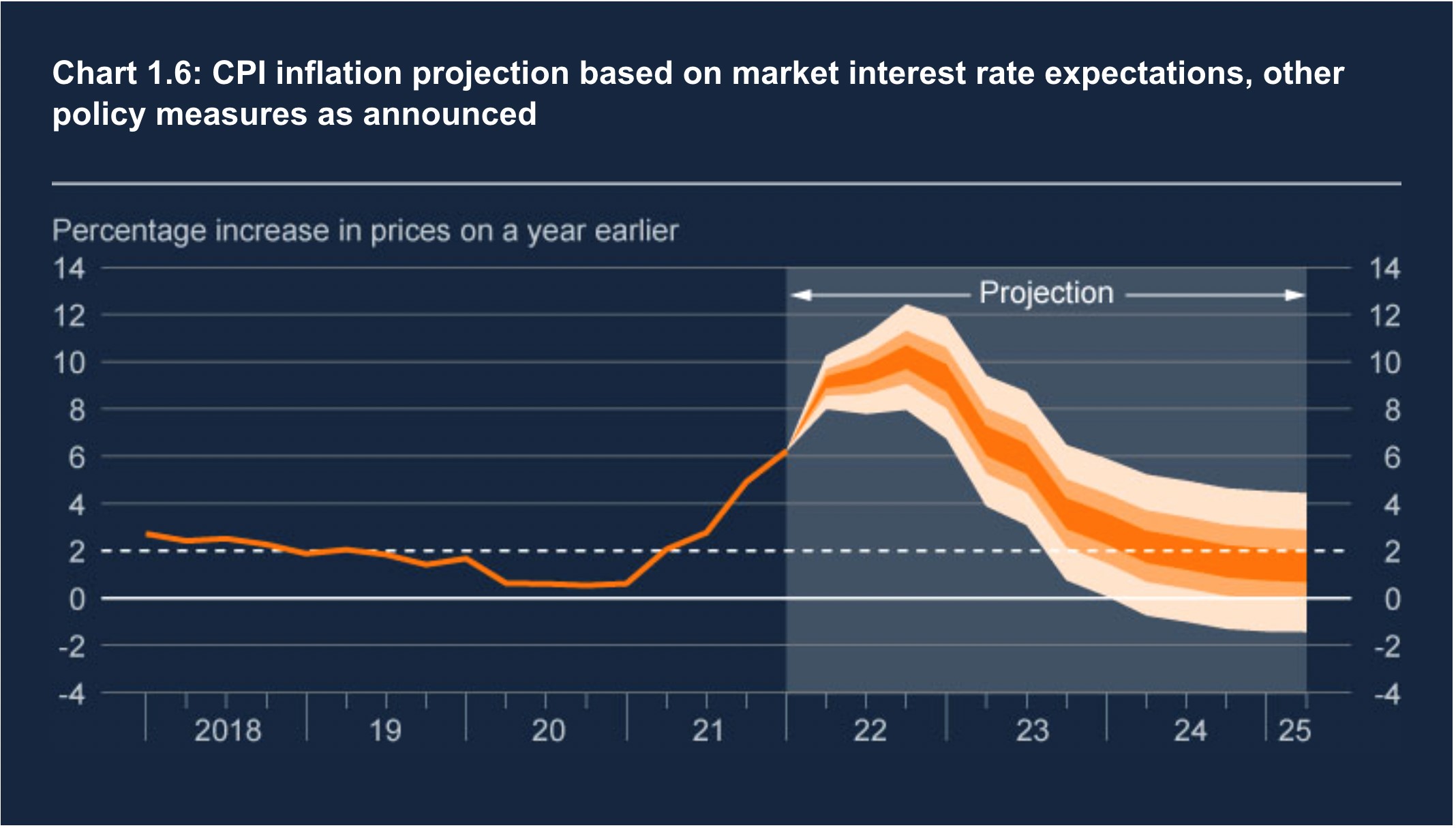

Projections published alongside the decision suggest that, from an economic perspective, we're in for a difficult 18 months or so. Inflation is set to peak at 10% later this year before falling back to the Bank's stated 2% target in about two years. The Bank maintained its forecasts for economic growth of 3.25% this year, but now believes the economy will contract 0.25% in 2023, down from an earlier forecast of 1.25% growth. It cut its growth projection for 2024 to 0.25% from a previous 1.0%. The pound endured its worst day for two years.

There are good reasons to believe these forecasts are unduly pessimistic and I'd argue that even the Bank agrees. The projections are based on the market-implied path of the Bank Rate hitting a little over 2.5% in mid-2023, which would be heavy handed to the point it causes inflation to undershoot the Bank's 2% target - hat tip to the Resolution Foundation's Torsten Bell and see chart below.

The Bank gently directs readers to its Market Participants Survey The median responses to that suggest the rate will hit just 1.5% in March next year, before edging up to 1.75% in 2024. We talked last week about divergent views on the path of the Bank Rate and how it influences our forecasts.

Mortgages

We all agree that more hikes lie ahead and the mortgage market is responding. Average mortgage rates jumped by the most in six years during March, according to data released by the Bank of England on Wednesday.

How vulnerable is the housing market to rising interest rates? Flora Harley offers some context.

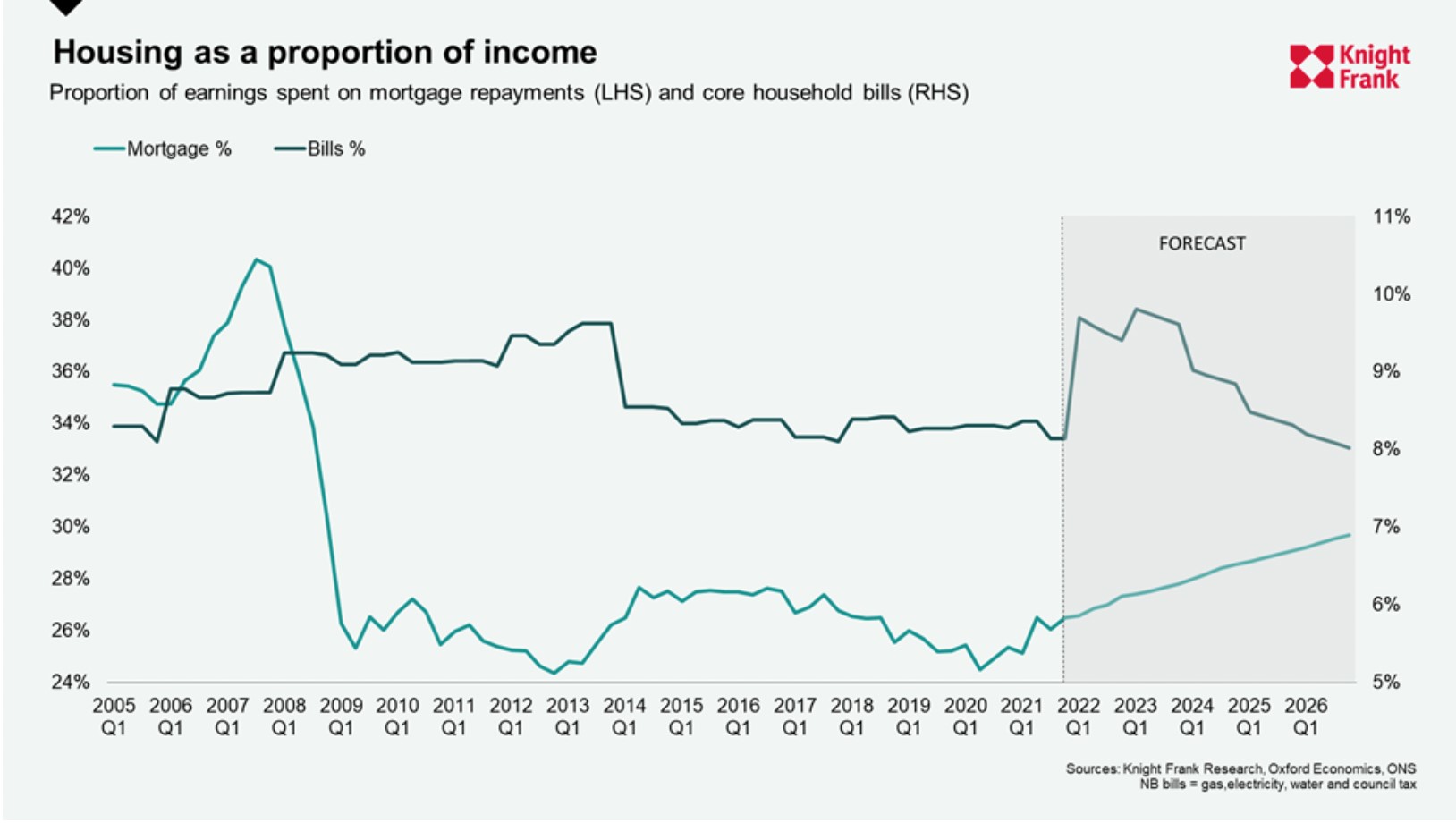

Borrowers were spending approximately a quarter of their monthly income on mortgage repayments when we looked at the issue last year. That compares to almost 50% in the run up to the financial crisis in 2007/8.

Utilising our latest house price forecasts and Oxford Economics forecasts for mortgage rates and wage growth, we expect the proportion of income spent on servicing a mortgage to rise to 30% by 2026. Meanwhile, spending on "core" bills will rise to 10% next year, from 8% today, before falling back again as energy prices normalise.

This is a real squeeze on incomes and it will act as a drag on housing demand, but not to a degree that threatens housing market stability. The cost of debt will remain very cheap by historic standards.

Prime London

House price growth is showing signs of calming - Nationwide reported that growth fell to 12.1% in April from 14.3% in March. Part of the reason is rising supply, which the RICS reported last month had increased for the first time in a year.

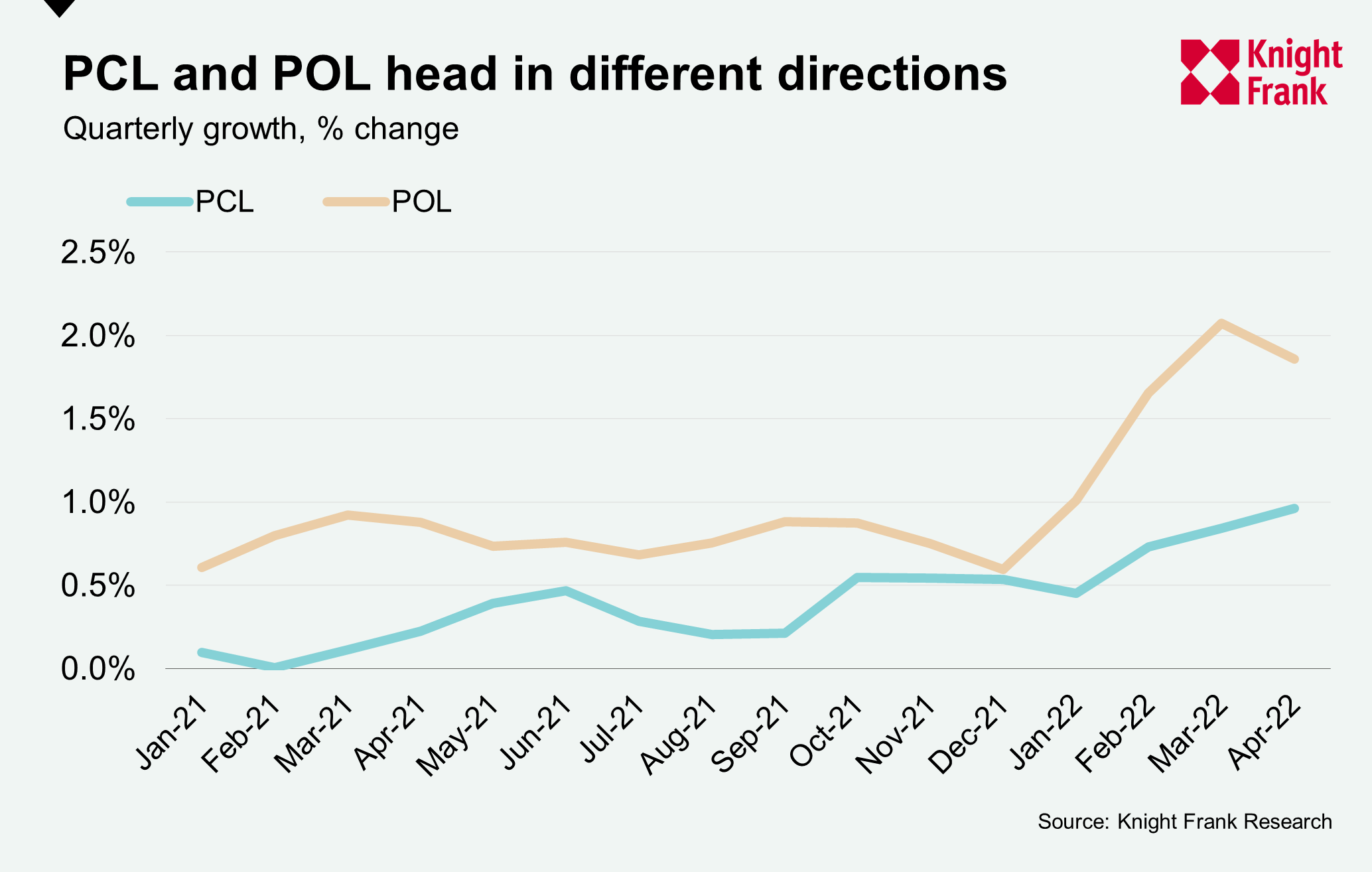

Prime outer London (POL) also looks to be peaking, according to new figures from Tom Bill. Average prices in POL rose by 1.9% in the three months to April, which compared to 2.1% in March. It was the first such slowdown this year, as the chart below shows.

Meanwhile, prime central London (PCL) prices remain in steady recovery mode, with quarterly growth reaching 1% in April, the highest such figure since July 2015.

“The property markets in central and outer London are increasingly on different trajectories,” said Tom Bill, head of UK residential research at Knight Frank. “Price growth in outer London is moderating as the race for space becomes less frenetic and rising mortgage rates and the higher cost-of-living take their toll. Meanwhile, prime central London is recovering after six subdued years and a relatively quiet pandemic, a process bolstered by the gradual return of international travel.”

Hotels

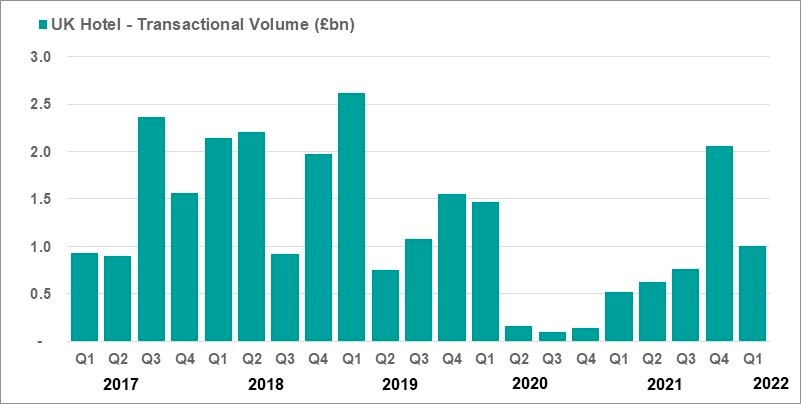

The UK hotels market has had a difficult pandemic but signs of a turn is attracting a wave of private equity investment.

Transaction volumes exceeded £1.5 billion for the first four months of the year, some 40% ahead of H1-2021, with two more months to go. Transactional activity has been relatively evenly split. London secured approximately £750 million of investment, whilst regional UK achieved more than £800m.

Philippa Goldstein notes that deals with private equity are being structured to allow for former owners and/or management to retain a vested interest in the day-to-day operations and future success of the businesses. Under new ownership, partnerships are expected to fund and deliver the next phase of growth, with the development or repositioning of sites.

Snoop Dogg’s metaverse mansion

In September, Snoop Dogg started building his own virtual world on the Sandbox platform, one of the world’s biggest metaverse firms. In December, a purchaser spent $450,000 to be his next door neighbour.

In a Wealth Report special episode of Intelligence Talks, we try to find out why. Anna Ward speaks to the man behind the launch of the Sandbox, Yat Siu. The Hong Kong based entrepreneur and angel investor is CEO of block chain and gaming firm Animoca Brands. Animoca, valued at $5bn, has pivoted in recent years towards blockchain, NFTs and the metaverse - buying up The Sandbox in 2018.

Anna is also joined by Knight Frank partner and Wealth Report deputy editor Flora Harley, who interviewed Yat for the magazine.

They discuss investor appetite for buying up virtual real estate, how dealmaking works in the Sandbox and how the virtual will influence physical real estate trading in the future. Listen here, or wherever you get your podcasts.

In other news...

Taking Centre Stage: Claire Williams on streaming wars and the UK film and television studio market.

Elsewhere - Britain's Barratt upbeat on housing demand, urges rethink on safety levy (Reuters), Fed makes biggest interest rate increase since 2000 (NYT), understanding yesterday's markets rout (FT), Derwent says the buzz is back (FT), and finally, Singapore's new rules on family offices (Bloomberg).