It’s a seller’s market in the Country as spring approaches

Supply continuing to build but buyer demand remains heightened

2 minutes to read

Buyers need to be on their toes at present to bag their dream property, with strong competition and only a modest increase in supply outside London during the first six weeks of 2022.

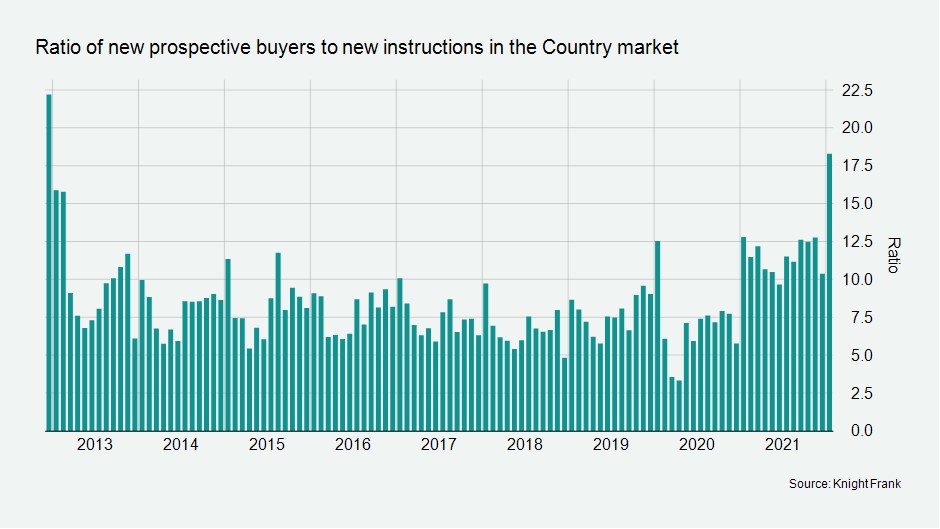

The ratio of new prospective buyers to new instructions climbed to 18.2 in January. This is the highest ratio of demand versus supply outside of London for nine years.

You’d have to go back to the year that London hosted the Olympics in 2012 to find the ratio higher at 22.2. This was a period where activity in the country market surged back as the shock of the global financial crisis and recession in 2008 dissipated.

Even as recently as January 2020, with the short-lived Boris Bounce in effect and momentum building ahead of the spring market that never was due to the onset of the pandemic, the ratio was 12.8 (see chart).

“Any house we’re launching is going very quickly. There’s been a breakdown of the usual seasonal trends and country sellers listing their properties ahead of the traditional spring market are being rewarded with good prices,” said Mark Proctor, head of the South West region at Knight Frank.

Given that the stamp duty holiday ended in September and Covid restrictions have been lifted, there was an expectation that the rebalancing of supply and demand would take place sooner. However, as we’ve previously explored, the impact of Covid will linger far longer in the UK residential property market than originally expected.

Part of the problem is a hangover from the stamp duty holiday last year, which saw some prospective sellers decide not to list their property due to a lack of properties to purchase, creating a vicious circle of low supply that hasn’t entirely disappeared.

It means that with demand having outstripped supply for the majority of last year, the amount of UK property for sale at the end of January outside of London was 33% lower than in January 2021.

However, with country house values close to their 2007 peak after the strongest price growth since the global financial crisis, supply is building as sellers look to take advantage of the strong market.

Market valuation appraisals, an indicator of future supply, were up 6.8% in January versus the five-year average, and have remained up throughout February. New instructions in the two weeks to 20 February were above the five-year average too. At the same time new prospective buyers increased by 42% in January versus the five-year average and the trend has continued through February.

“If you are looking to sell, now is the time to do so, as none of us know what’s ahead and at the moment you have a large choice of buyers and limited competition,” added Mark.