Emerging strong – £4 billion of UK hotel transactions in 2021

The sizeable weight of capital invested demonstrates the resilience and long-term well-being of the UK Hotel sector.

5 minutes to read

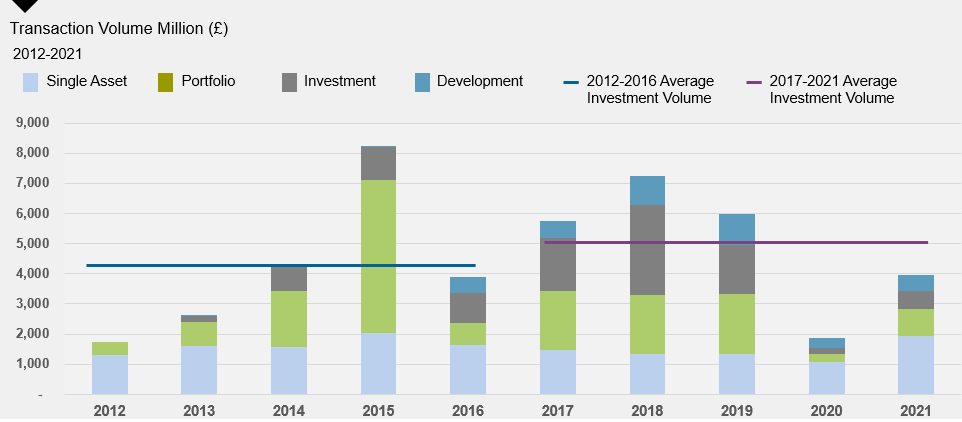

An impressive £4 billion of UK hotel transactions in 2021, emphasises the growing investor sentiment and optimism over the long-term prospects for the sector. The underlying drivers of increased hotel demand, the continued improvement in profitability and visibility for future trading, have all contributed to the improved sentiment towards the sector.

This past year has illustrated the strong resilience in the UK hotel sector, from both an operational and property perspective, but has also magnified the importance of investing in well-located assets, benefitting from multiple demand generators, combined with strong management and leadership.

Whilst it is undisputed that the UK hospitality industry has been one of the hardest hit sectors throughout the pandemic, the trade-off is the potential for more promising investment opportunities, that would have remained dormant had this health crisis not prevailed.

Strong domestic leisure demand drives hotel transactions

Knight Frank research reveals that the composition of transaction activity in 2021 was vastly altered compared to historical trends. In total, some 150 single asset hotel transactions took place in the UK with a guide price of over £2 million, equating to approximately £1.9 billion. This represented a 58% increase in the number of deals and 46% increase in transaction volume, compared to 2019 and is the highest level of single asset activity to take place since the record-breaking year for hotel investment in 2015.

This level of investment demonstrates that the pandemic has acted as a catalyst for hotel transactions taking place at the lower end of the market, with a diverse range of investors, both domestic and from overseas. Strong domestic leisure demand has resulted in an exceptional level of distinctive assets being sold, in terms of their unique location, heritage, building fabric, history and positioning relative to their local environment. Knight Frank recorded over £625 million of hotels transactions in 2021 of independently operated hotels located in regional UK, with a guide price of over £1.5 million. This represented an astounding 385% increase compared to transaction volumes in 2019.

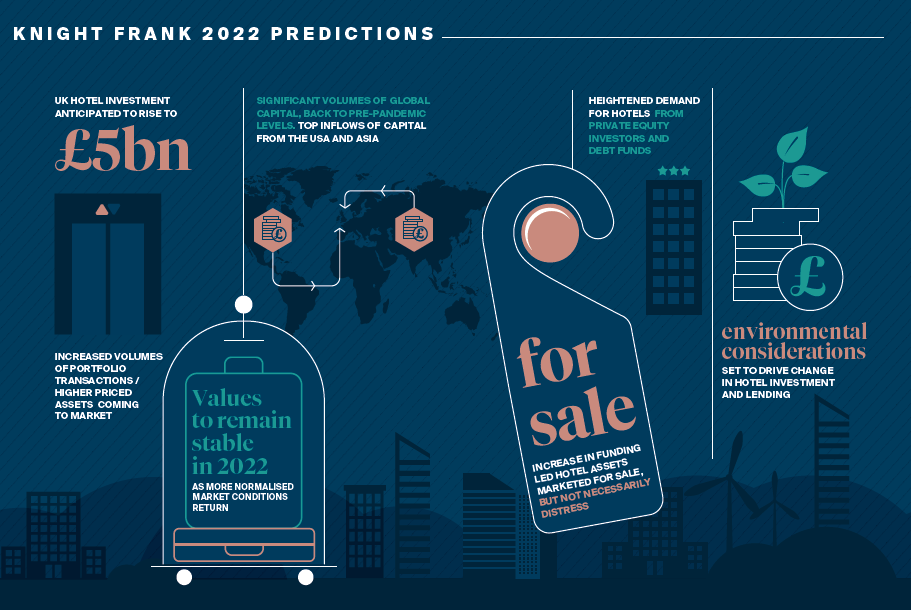

Increased volumes of portfolio transactions and higher priced assets set to transact in 2022

In 2021, only three single asset hotel transactions took place, priced above £100 million. The largest single asset hotel to transact during 2021, involved the acquisition by the Singaporean-based Fragrance Group of the 906-room Holiday Inn Kensington Forum in London for £355 million.

The £115 million acquisition by Cerberus Capital Management and Highgate Hotels of The Dorsett City London was the second largest hotel to transact at £431,000 per key, whilst the sale of The Belfry Hotel & Resort for £140 million to Cedar Capital Partners and Goldman Sachs represented the largest single asset hotel acquisition in regional UK, at £432,000 per key.

Portfolio activity in 2021 accounted for just 23% of the total UK hotel transaction volume, totalling less than half the level of portfolio investment achieved pre-pandemic in 2019. The two largest portfolio deals to transact in 2021 - Henderson Park’s acquisition of 12 Hilton hotels (Project Conrad) and MCAP Global Finance’s acquisition of 17 Holiday Inn and Crowne Plaza branded hotels (Project Horizon) accounted for almost 75% of the total UK portfolio activity, which totalled approximately £900 million.

Increased volumes of portfolio transactions and higher priced assets are set to transact in 2022, with various portfolio deals currently being marketed for sale or under offer and market forces coming into play, leading to increased availability of assets for sale.

Hotel Investment Trends 2022

Unequivocally, it has been a testing time for hotel owners and operators as the pathway out of the pandemic has taken many unpredictable turns. Had the level of government support not materialised, the dialogue concerning distress could have been very different.

Transactional activity will be driven by a range of factors including, a greater level of asset rotation, as investors prioritise stalled exit plans or bring new assets to market, to take advantage of the upturn in the investment cycle. A greater level of funding-led sales is also anticipated, but this does not necessarily mean distress. Instead, lenders will exert greater control over their loan books, forcing owners to review their level of indebtedness and prioritise investment plans.

Looking ahead investors will need to remain increasingly alert to the various headwinds affecting the hotel sector, specifically the upward pressure on wages brought about by the ongoing shortage of labour and the forthcoming rise in the National Living Wage; the increase in the cost of sales and rising energy costs, all have the potential to adversely impact profits and the ability to drive high level of returns.

Henry Jackson, Knight Frank, Head of Hotel Agency, said:

“With the setback of the Omicron variant having now passed, the strong flurry of transactional activity that occurred during the final quarter of 2021 is expected to continue in the months ahead. Facilitated by an extended period of uninterrupted trading in 2022, improving debt markets and attractive sector diversification, these are all factors that will help lure investment, with best in class assets offering strong liquidity and competition in the market.

The desire to travel and staycation in the UK is expected to continue to boost regional performance, along with continued recovery in corporate and MICE demand. The return of international travellers will further boost trading performance in London and city centre hotels throughout the UK. Whilst the sector is facing a sustained period of economic pressures, current market dynamics are likely to ensure a positive year ahead for the UK hotel transactional market, with volumes anticipated to rise to £5 billion in 2022.”

Philippa Goldstein, Senior Analyst, Head of Hotel Research at Knight Frank, said:

“The appetite for hotel investment witnessed during the final quarter of 2021, is testament to the level of interest and capital available from well-funded investors, eager to establish a presence in a sector that has proven its resilience. Looking ahead, staying alert to the various headwinds affecting the hotel sector will be essential. The pandemic forced owners and operators to properly understand the cost structure and with the current inflationary environment, this will further encourage operators to think creatively about increasing efficiency to help maintain or improve margins.”