Buying land in the Metaverse, the fate of hybrid work and the Fed prepares for shock and awe

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The Metaverse

People are excited about buying property in the Metaverse. 'Land' prices are soaring and people are opening estate agencies. This makes sense. After all, if you don't have a digital house, where are you going to hang your $2.7 million Bored Ape Club NFT?

It's easy to joke, but serious investors are investing serious money into land plots. Retailers including Adidas have purchased in The Sandbox, according to this long read in the FT today. Shopping in the metaverse makes sense - “We can do it together without being in the same place. I could pick up a pair of sneakers and show them to you and you could say, ‘It’s just not you,’” says Republic Realm chief executive Janine Yorio.

Still, to what extent is land in the metaverse actually real estate? And why, as the FT reports, do plots close to 'Vegas Land' sell for more when you can teleport at the touch of a button? And shouldn't it cost more than $450,000 to be Snoop Dog's neighbour?

Some important questions remain unanswered and, so far, much of it feels like speculation - the price of land in some locations is up 500% since Facebook's 'Meta' announcement. However, should investors continue to commit in greater numbers, the Metaverse's place in the attention economy will become increasingly entrenched.

Hybrid working

Will Matthews and Lee Elliott consider the impact of inflation and the tight labour market on hybrid working:

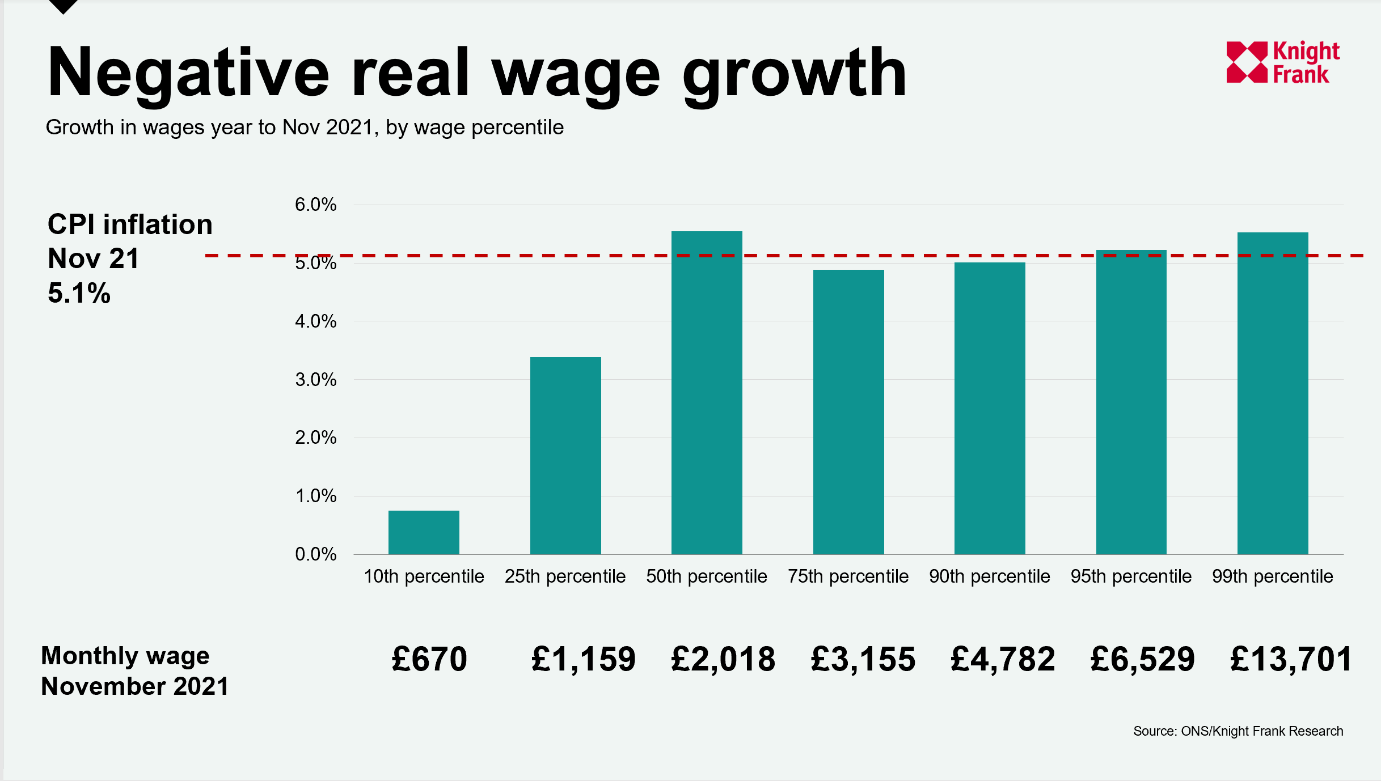

For some income bands, notably those at the lowest end, wage growth has fallen a long way short of inflation (see chart). For higher income bands, wages have largely been able to keep pace with, or exceed, inflation. Understanding these nuances gives an indication of the strength of bargaining power in different sections of the labour market. It may, given the significant expense of travel costs, have a bearing on the desire of different employee groups to return to the physical workplace. The inequalities of real wage growth are likely to receive greater attention in the coming months should inflation continue to rise as predicted.

The tightening of the labour market has swung the balance of power towards the employee. It is against this backdrop that leaders are attempting to grow their businesses. More than 70% of UK CEO’s surveyed in PwC’s 2022 CEO Survey expect to increase their headcount over the next 12 months – and almost one third of those are planning to increase headcount by more than 10% of existing levels.

Whilst financial benefits still figure highly, there is growing evidence that the purpose, culture and flexibility of the organisation are increasingly important considerations for the employee.

The US economy

The US economy grew at the fastest pace in four decades during 2021, according to data published yesterday. The economy expanded by 1.7% in the final quarter after adjusting for inflation, capping annual growth of 5.7%.

Comments from Fed chair Jerome Powell eclipsed the numbers. "The economy no longer needs sustained high levels of monetary policy support," and "it will soon be appropriate to raise" rates, he said.

Nomura analyst Robert Dent tells Bloomberg that the Fed may opt for a "shock and awe" approach by hiking 50 basis points in March. Investors are now pricing in about 30 basis points of tightening for the March 15-16 meeting, reflecting a roughly one-in-five chance of a half-point move, according to Bloomberg's report.

What next for UK house prices?

We’ve seen a sharp rise in inflation and the Bank of England is expected to hike interest rates next week. What does this mean for UK house prices? We hear from Knight Frank head of UK residential research Tom Bill and Toscafund chief economist Savvas Savouri.

But Savvas suggests that while inflation is likely to breach 6%, these rates won’t persist and predicts that inflation will ease off to around 2.5% by the summer of 2023. Against this backdrop, Tom anticipates UK house price growth to ease off somewhat, ending the year in single digit growth territory after last year’s unusually strong year. However, he adds that Prime Central London could outperform the overall UK rate of growth as overseas buyers return to the market.

Finally, they discuss the tech disruptors entering the mortgage market, with Savvas suggesting the likes of online bank Monzo, digital mortgage broker Habito and London-based fintech Perenna, could have a major impact to the extent that mortgage rates could even fall as disruptors buy up market share, leading to more competitive rates for homebuyers. Listen here, or wherever you get your podcasts.

In other news...

London retains global financial crown in new Brexit boost (Telegraph), UK spending edges up after more people go out as Omicron eases (Reuters), and finally, UK retailers report disappointing January sales (Reuters).

Photo by Richard Horvath on Unsplash