Unravelling the impending tremors in China's property market

Do financing restrictions, delivery concerns, and debt issues present a systemic risk in China's property market?

6 minutes to read

China's ascent as a global economic powerhouse has been a defining phenomenon of the 21st century. The nation has experienced extraordinary economic expansion over the past few decades, and a pivotal contributor to this growth has been its thriving property market.

The interdependence between economic prosperity and a flourishing housing sector is crucial for China's sustained economic growth and financial stability.

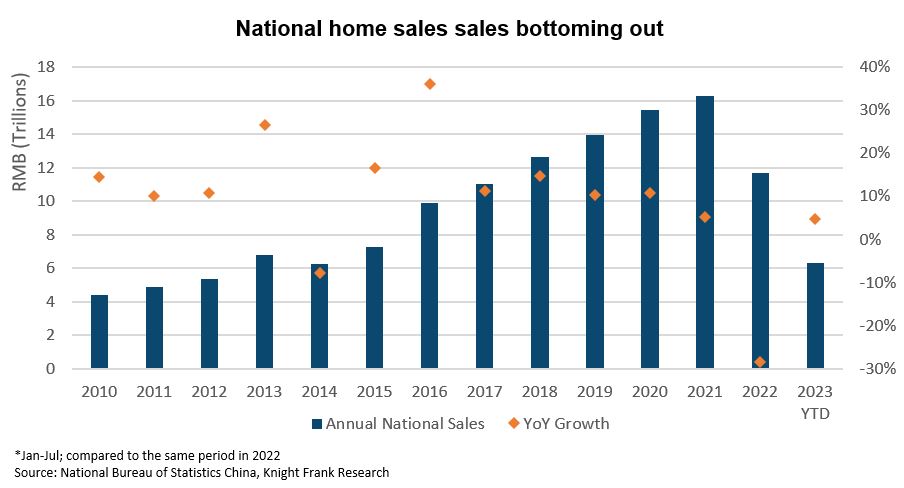

However, the housing market's path has grown convoluted in recent times, facing substantial challenges within the Chinese property sector. The confluence of pandemic-induced restrictions and shifting demographics have engendered a slump in home sales, inciting concern and trepidation among real estate developers and prospective buyers.

The debt crisis unfolding at Country Garden, formerly China's largest property developer until this year and once admired for its fiscal resilience, has triggered a fresh wave of contagion fears reminiscent of the China Evergrande Group's default just two years prior. Moody's reports indicate that the surge in defaults by private developers has propelled Chinese banks' non-performing loan ratios to a significant 4.4% by the end of 2022, a marked escalation from the 1.9% registered in 2020.

Is there a systemic risk?

Our recent "CEO speaks" webinar series, in partnership with multifamily office Franklin Medici, delved comprehensively into the Chinese residential market. The discussions traversed the market's historical trajectory, present challenges, and potential avenues for growth and opportunities that lie ahead.

Historical growth and role of the property market

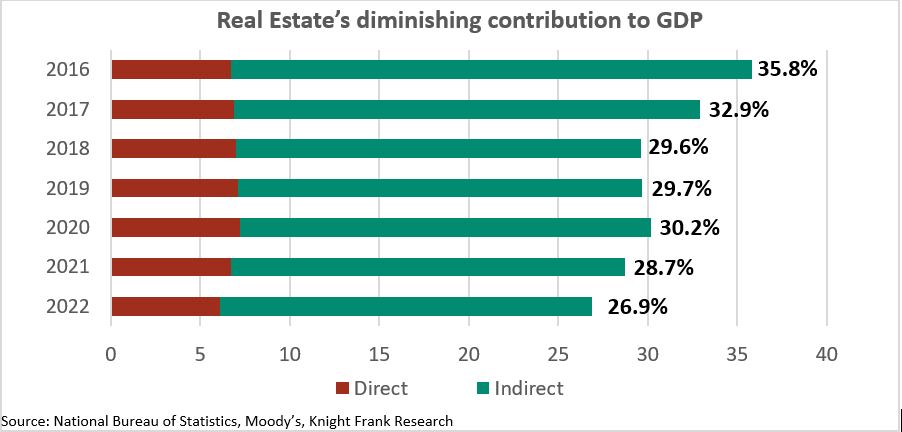

Since implementing market-oriented reforms in 1978, China's economy has experienced continuous growth, transforming the country into the world's second-largest economy. The property market played a vital role in this growth, especially after the establishment of a nationwide housing market in 1998. The property sector's integration with other industries, particularly construction, allowed it to contribute significantly to China's GDP, accounting for over a third of the economy.

Yet, in light of historical trends, the property market's influence on China's economic growth is predicted to wane. As GDP growth gradually decelerates, policymakers anticipate a reduced reliance on the property sector to fuel broader economic expansion.

The tipping point transpired over the past three years. The COVID-19 pandemic and regulatory crackdown impacted the housing market in 2020 and 2021. Property sales growth dwindled, liquidity constricted, and financial distress coupled with defaults among developers created a negative credit cycle.

Chinese property developers have relied heavily on high leverage and multiple financing channels. However, recent government clampdowns on financing methods, such as trust financing and bond issuances, have limited developers' access to funds. This, coupled with the high debt-to-equity ratio of the industry, has created liquidity pressures and distress among non-state-owned developers.

Homebuyers' confidence has been dented by unfinished projects and lax regulations, which allowed developers to divert funds from escrow accounts tied to home completions. Presale purchases have caused uncertainty, with concerns about delivery timelines and developers' financial stability. Buyers may opt for existing properties in the secondary market or state-owned developers for greater certainty.

The Chinese government has implemented policies to address the challenges in the residential market. Measures, such as the 16-point property relief plan, aim to stabilise the sector's liquidity stress. However, the focus is on supporting quality developers, which could lead to further consolidation and potential exit for struggling non-state-owned developers.

Hence, the property market grapples with elevated near-term challenges.

In July, new-home prices in key cities, including Beijing and Shanghai, remained stable for a second consecutive month, as per National Bureau of Statistics (NBS) data.

Nonetheless, tier-two and tier-three city prices decreased by 0.2% and 0.3%, respectively, signalling a housing market slowdown despite China's post-lockdown economic reopening.

Last week, the swift spiral of Country Garden into financial turmoil didn't take the market by surprise to the extent that Evergrande's did, given the increasing number of defaults among private developers. However, Country Garden's predicament materialised against the backdrop of a significantly weakened property market and economy.

While its total liabilities of 1.4 trillion yuan (US$191.7 billion) are 59 per cent smaller than those of Evergrande, the world's most indebted developer, Country Garden stands out with more than 3,100 projects spanning across all provinces of China, approximately four times that of Evergrande's 800 projects. Country Garden's default could disrupt the real estate supply chain, affecting suppliers, contractors, and leading to a domino effect in construction and home delivery, particularly at a time when buyer confidence is already diminishing, impacting broader economic activity.

This situation could potentially raise concerns about the financial health of other developers, possibly igniting a contagion effect if left unaddressed. However, given plausible government intervention, the systemic risk remains relatively remote.

Given the existing frailty in home sales, the debt crisis has the potential to defer any anticipation of revival in both the real estate market and the larger Chinese economy, where real estate holds a pivotal position.

China is also faced with demographic challenges in the years ahead. In 2022, China's population decline marked a significant shift, compounded by India overtaking it as the world's most populous nation in 2023.

China now faces the looming challenge of a rapidly growing retiree population, potentially shrinking its workforce and straining social safety nets and healthcare. Projections suggest a drop of over 100 million people by 2050 from a peak of 1.42 billion in 2021, with more pessimistic scenarios painting a future with less than 800 million or even 500 million people by the end of the century.

While challenges persist, certain opportunities and trends are shaping the future of the Chinese residential market:

- Public Housing Development - The Chinese government has emphasised the construction of public housing, including public rental housing, as part of its drive for "common prosperity." The development of 6.5 million homes for leasing purposes across major cities by 2025 presents opportunities for market growth and addressing housing affordability concerns.

- Multifamily Sector and C-REIT Market - The rapid growth of China's C-REIT (China Real Estate Investment Trust) market, with a focus on rental apartments, presents opportunities for institutional investment and the development of a significant multifamily sector. This could help resolve long-standing issues and potentially make China the largest institutional residential market globally.

- Premium Property Market - The demand for prime residential properties in China's tier-one cities remains strong, driven by wealth generation and an increasing number of ultra-high-net-worth individuals (UHNWIs). The scarcity of such properties and buyer profiles contribute to price growth, particularly in Shanghai's prime locations.

Conclusion

The Chinese residential market has undergone significant changes, experiencing periods of rapid growth, stability, and challenges. While the market faces hurdles, such as financing restrictions, delivery concerns, and debt issues, there are also opportunities emerging from public housing development, the multifamily sector, and the premium property market.

The government's focus on quality developers and measures to stabilise the sector's liquidity stress will play a crucial role in shaping the market's future. As China seeks sustainable alternatives to a slumping property market, the residential sector's evolution will remain a topic of interest and importance in the coming years.

To receive more insights like this, click here to subscribe to our newsletters.