Monthly UK residential property market update – June 2021

Residential property market accelerates as buyers target June stamp duty deadline.

3 minutes to read

Annual house price inflation reached its strongest level for almost seven years in May, according to both Halifax and Nationwide.

Bolstered by the stamp duty holiday, which from July will see the current tax-free threshold on purchases reduce from £500,000 to £250,000 as part of a taper, Halifax said prices increased by 1.3% month-on-month in May.

This took annual house price growth to 9.5%, with the lender suggesting people’s desire for larger properties was increasingly looking to be a permanent shift post-pandemic.

Nationwide added that while the stamp duty holiday was impacting the timing of transactions it did not appear to be the key factor behind the housing market’s momentum, which is being driven by people’s revaluation of their needs following successive lockdowns and desire for more space.

The lender said average prices increased by 1.8% on a monthly basis in May, taking the annual rate of change to 10.9%.

Mortgage approvals for house purchase rose for the first time since November in April as prospective buyers responded to the extension of the stamp duty holiday, data published in May showed.

Lenders granted 86,900 mortgages to homebuyers in April, up 4% on a month earlier, and well above historic norms. However, a shortage of homes to buy is placing a limit on the number of loans that lenders can grant.

Supporting the idea that there is a permanent change underway in people’s relationships with their homes, more money was spent in the housing market in England and Wales in the year to March than any 12-month period since before the global financial crisis.

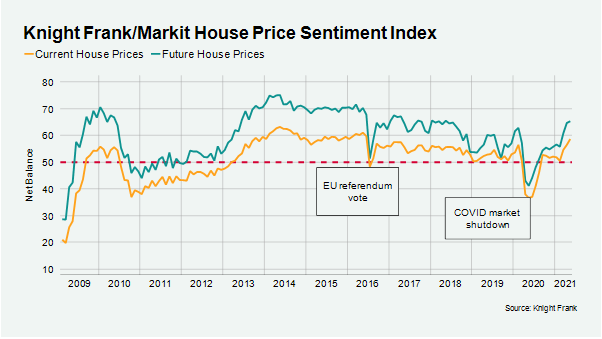

Consumer confidence continues to increase too. The vaccine programme’s success, increased freedoms and a brightening economic picture mean that households are now more confident about house prices than they were before the onset of the pandemic, as the chart (below) shows.

This was consistent with the findings of RICS latest sentiment survey, with a net balance of +45 of respondents expecting house prices to continue rising over the next year.

However, the survey found an increasing mismatch between demand and supply. While a net balance of +32 of participants saw an increase in new buyer enquiries in May, the net balance of new instructions was -23. This compared to -4 in April.

Prime London Sales

Prices in prime central London grew by 0.3% in the year to May.

While it wasn’t a large increase, it was the first rise in five years and underlines how the recovery of the property market in PCL is not reliant on the re-opening of international travel.

The last time prices increased on an annual basis was in May 2016, the month before the EU referendum. Subsequent political uncertainty, combined with a growing number of taxes on high-value property, meant average prices fell 17% in the intervening period.

Prime London Sales Report: May 2021

Prime London Lettings

Stronger demand is helping to reverse the rental value declines that have taken place in prime London property markets over the course of the pandemic.

Underlining the extent of the increase, the number of new prospective tenants in the three months to May was 76% higher than the first three months of 2020.

As a result, average rental values declined 12.2% in prime central London in the year to May, which compared to a fall of 14.3% in March. In prime outer London, the figure was -8.2%, compared to a decline that bottomed out at -11.7% in February.

Prime London Lettings Report: May 2021

Country market

Supply remained tight in the Country market in May, with some prospective sellers reluctant to list their own properties as they struggled to identify somewhere to purchase.

The number of new prospective buyers to new instructions was 12.7 in May, an increase on April’s 12.5. The ratio, showing strength of demand versus supply, remains at a historically high level having peaked at 16.2 in January.

This is likely to keep upwards pressure on prices in the short-term, despite the amount of market appraisals for sale having more than doubled in May compared to January, suggesting supply will start to increase.

Prime Country House Index Q1