Rural Update: Support economic growth

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

7 minutes to read

Viewpoint

It is good news that Defra has been identified as a key economic growth department (see story below). After all, despite being considered a bit of a political backwater in the past, two of its main remits – producing food and protecting the environment – are pretty crucial to the UK’s economy.

However, it doesn’t take an economist to figure out that to encourage growth you shouldn’t alienate the people who are best placed to deliver it. Misjudged reforms to Agricultural Property Relief (APR), could hit confidence hard and, in the grand scheme of things, the £50 million allocated to help farmers affected by this year’s torrential rain and flooding is pretty small beer.

It’s a shame then that the government’s spending review means only a small proportion of the funds has so far reached those who really need it.

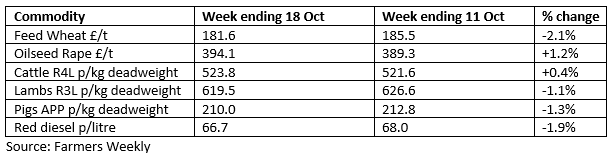

Commodity markets

Pork pressure

Pig prices are looking weaker following a long period of relatively firm values. Higher production numbers – the UK’s September kill was over 5% higher than the same period 12 months earlier – are applying pressure to the market. A stronger pound is also increasing imports as EU producers search for higher prices.

Sugar sours

British beet producers have been left with a not-so-sweet taste in their mouths after the new government said it would still be allowing the tariff-free import of over 250,000 tonnes of raw sugar cane in 2025 regardless of the country of origin. Cane-producing nations like Brazil are far less regulated than producers here, the NFU argues.

Wheat and OSR slump

Bad weather saw this season’s English wheat harvest slump by 22% to 10 million tonnes, according to the first provisional estimates from Defra. Oilseed rape production was down by a third to 687,000 tonnes.

The headlines

APR Review

Speculation is mounting that reforms to Agricultural Property Relief (APR) and Business Property Relief (BPR) will be on the menu as part of Chancellor Rachel Reeves’ nervously awaited first budget, which she will be delivering next Wednesday 30 October. According to reports in the weekend press, government sources have apparently confirmed that APR and BPR won’t be taken off the table for landowners completely. However, access to the reliefs, which prevent rural businesses from being ripped apart by huge inheritance tax liabilities, will be restricted to smaller or family farms. We’ll report back on what that actually means in reality once further details have been released.

Flooding fury

Baroness Hayman, Defra’s representative in the House of Lords, has confirmed that some of the money destined for farmers affected by flooding is on hold while the government sorts out its finances. In a speech to the Lords, she said: “All farmers eligible for the initial recovery fund set up in April have been offered a payment. Unfortunately, further commitments around spending and the rollout of schemes are down to the spending review.” A freedom of information request by Farmers Weekly has revealed that only £2.1 million of the £50 million allocated to the government’s Farming Recovery Fund has been dispersed so far. Affected farmers, some of whom had land underwater for months, are less than impressed.

News in brief

Defra review

The economist Dan Corry, who served as the Head of the No10 Policy Unit under the last Labour Prime Minister Gordon Brown, has been appointed to review the regulatory activities of Defra. The review is part of wider work to position Defra as a key economic growth department including the aspiration “to drive rural economic growth by cutting red tape for farmers and boosting Britain’s food security”.

New nature representative

The government has also this week appointed Ruth Davis as the first Special Representative for Nature as the UN Convention on Biological Diversity COP16 meeting in Colombia kicks off. Davis will report to the Environment Secretary and the Foreign Secretary and “will support ministers to raise global ambition on nature recovery and climate change. They will drive engagement with international leaders and build influence on the global stage to meet the UK’s strategic objectives.”

Tesco solar solution

The UK’s biggest grocer has just signed a deal with the UK’s largest solar farm to supply 10% of its power requirements. The Cleve Hill solar and battery storage project in Kent will boast 560,000 panels by the time it is finished in 2025 with 65% of its output going to Tesco. The supermarket aims to be carbon neutral by 2035. Please contact Chris Monkhouse for advice on renewable energy schemes.

Nature Finance opportunities

If you are interested in discovering how you can be part of the fast-emerging UK nature market, offering businesses and investors high-integrity UK nature-based solutions for net zero, climate resilience and a nature-positive future, why not head to the Nature Finance UK Conference 2024? Knight Frank is the main sponsor of the event, which takes place on 5 November at IET, Savoy Place, London. Book your tickets here.

Greenwashing claim

ClientEarth is taking on BlackRock, the world’s largest asset manager. In a regulatory complaint to the French finance authorities (AMF), the activist environmental law firm has challenged the misnaming of multiple BlackRock retail investment funds as ’sustainable’. It claims to have identified 18 actively managed retail investment funds marketed in France and across Europe and the UK with ‘sustainable’ in their names that collectively hold more than US$1 billion of fossil fuel investment.

2024 CLA Rural Business Conference

Join us at the CLA Rural Business Conference on 21st November at the QEII Centre, London. As Headline Sponsors, we are excited to hear from Steve Reed MP, Secretary of State for Environment, Food and Rural Affairs, who will share insights following the first autumn budget. Don’t miss the chance to connect with industry leaders and learn how to tackle key challenges facing rural businesses. Book your tickets here.

Biodiversity boost?

Meanwhile, more than 100 organisations, including Waitrose and the Wildlife Conservation Trust, have called for the widespread adoption of a new certification scheme that they argue will stop biodiversity greenwashing schemes. As reported by Edie, the Global Biodiversity Standard (TGBS) is set to issue its first certificates during the imminent COP16 conference in Colombia.

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of a new government. Find out more or request a copy.

Bluetongue update

Farmers in Bluetongue movement-restriction zones are receiving less for their animals as abattoirs pass on the cost of increased biosecurity measures. According to Farmers Weekly, some buyers are slashing 50p/kg off sheep prices. You can find the latest updates on the spread of the disease and what measures stock farmers are being advised to take here.

Research

Country houses Q3 – Market waits for budget

Discretionary buyers are holding back from a new country house purchase until they find out what Labour’s first budget at the end of the month holds. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales is also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

Development land - Market stays flat

The value of greenfield development sites remained static in the second quarter of the year, according to the Knight Frank Residential Development Land Index. Over the past 12 months, the index is down 2%. According to Anna Ward, who compiles the index, developers have welcomed Labour’s commitment to reinstate local housing targets and recruit more planning officers. But with interest rates failing to shift and build costs increasing, homebuilders still face significant headwinds, she adds. Download the full report for more insight and data.

Property of the week

Dorset delight

Equestrian enthusiasts looking for a property with a great racing pedigree and stunning amenities could well be interested in Locketts Farm, near Blandford Forum. The 215-acre property, which includes a 5.5-furlong woodchip gallop and a host of other facilities for its equine residents, has already produced one Gold Cup winner. The owners get a traditionally styled 6-bedroom house with fantastic views built using local Bath Stone in 2016. There is also a separate cottage and flat. The guide price is £6.75 million. Please contact Alice Keith for more information.