Inflation falls below target for the first time in three years

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

The UK's annual rate of inflation fell to 1.7% in September, the first below-target print in more than three years. Economists had expected a reading of 1.9%.

That puts a November rate cut almost beyond question, and we might get another in December. A separate set of figures, also published by the ONS, showed wage growth slowing to its weakest pace in more than two years. Sterling dipped 0.5% against the dollar following the inflation data release and is now down 3% from the two-year high set last month, according to Bloomberg.

Services inflation is still a cause for concern, having dipped to 4.9% from 5.2%. Plus, the Bank of England does expect the headline rate to begin ticking up again as distortions from the energy crisis drop out of the annual comparisons. Still, everything we're seeing is consistent with BoE Governor Andrew Bailey's interview with the Guardian earlier this month, in which he said that continued good news on inflation would enable the Bank to be "a bit more activist" in its approach to cutting interest rates.

People on the street

An improved outlook for interest rates will sustain what has so far been a tentative recovery in housing market activity. Bellway's reservation rate surged 48.5% to 147 per week in the nine weeks to August 1st, albeit from a low base, the company said in results published yesterday.

Chief executive Jason Honeyman said improving trading conditions meant the company is "well-placed to deliver a material increase in volume output" in the 2025 financial year. The company is stocking up on land, having agreed heads of terms on about 8,100 plots as of September 29th.

We should see a "stronger spring selling season once we get through this period of politics," Honeyman said in an interview with the FT: “Not everyone is familiar with IHT, CGT or NI,” he added. “The noise is that tax rises are on the way. That is what has hit people on the street.”

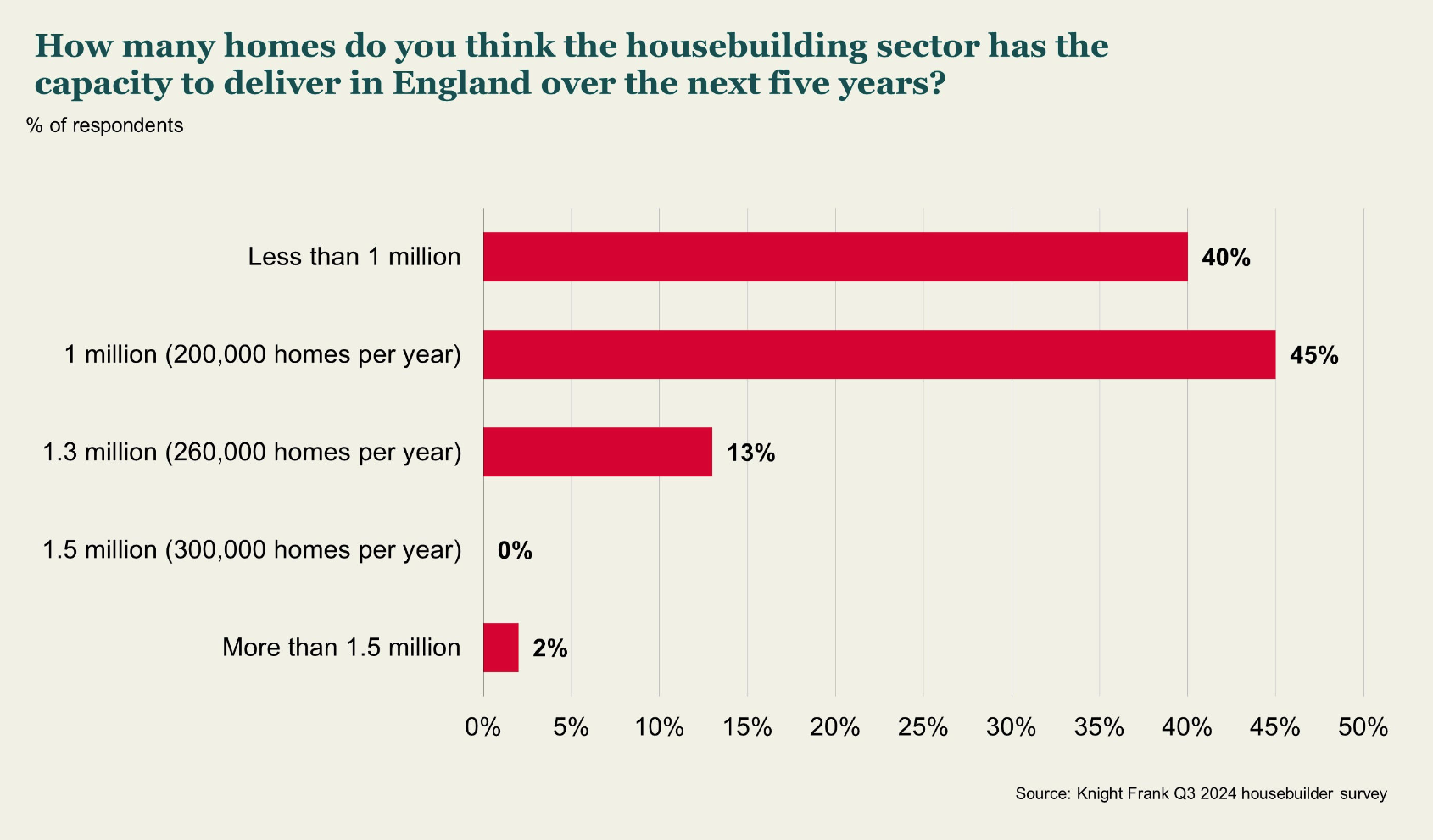

Bellway reckons completions will hit 8,500 in the year to July 2025, which is still some way short of the 11,000 homes it completed in 2023. This is, to a greater or lesser degree, replicated across the housebuilders, which makes Labour's pledge to deliver 1.5 million homes this parliament look a bit ambitious. In fact, none of the housebuilders believe the government's pledge will be met, according to a sneak preview of our latest survey, published in the Telegraph (see chart). Anna Ward will publish the rest of the results next week.

Tax losses

If the government opts to raise the higher rate of Capital Gains Tax to somewhere between 33% and 39%, as is reportedly being considered, would it raise any money? In Friday's note, I touched on Treasury analysis shared by the FT that found that a single percentage point increase to the higher rates of CGT in April 2025 would raise an extra £110mn in 2027/28. However, an increase of 5 percentage points would result in a loss of £140mn in 2027-28. A 10 percentage point increase would lead to a loss of £2bn.

Raising capital gains tax has been floated many times in the past five years - it's often been suggested that the rate should match income tax, which could mean higher and additional-rate taxpayers having to pay a rate of up to 45% on house sales instead of the current rate of 24%. The proposals being considered by Chancellor Rachel Reeves aren't as punitive as that, but the Times on Monday dug out research from Capital Economics, originally published back in February 2022, that found bringing the rate of CGT in line with income tax would result in a 910,000 shortfall of BTL properties in ten years, with 790,000 more properties sold and 120,000 fewer purchases during that period.

A rise in the tax take of £16.2 billion would be negated by a £26.1 billion loss in income tax as landlords exited the business. There would be a further net loss of £3.6 billion in corporation tax and stamp duty. It looks unlikely that raising CGT will go far in plugging what now appears to be a £40 billion funding gap.

Many landlords have already opted to sell up, and the outlook for renters looks dire unless we see more policy support for institutional-grade BTR products. Around a fifth of homes currently for sale were previously available to rent, the highest proportion on record and a jump from around 14% over the past five years, according to September data from Rightmove published by Bloomberg.

Incentives

Reeves has a very long list of things people don't want to see in the budget, but it is worth touching on a few interesting policies that people do want to see.

In an open letter to Reeves, shared with the Telegraph, lenders including TSB, Leeds Building Society and Coventry Building Society urged the Government to offer bigger incentives to help homeowners make green upgrades to their homes. Homeowners should either receive their stamp duty bill back in full once they have completed works, or get a rebate for the cost of any works that they undertake, the letter said.

Meanwhile, the lobby group Foreign Investors for Britain have urged the government to consider a tax regime modelled on Italy's flat tax - see the write up in the FT. The tiered regime would exempt non-doms from inheritance tax on non-UK assets and free from UK tax on foreign income, gains and certain UK investments for up to 15 years. They would pay a tiered annual charge for access, ranging from a £200,000 charge for net wealth up to £100mn to a £2mn charge for net wealth over £500mn.

In other news...

From our team - Film and TV lettings demand outpaces supply thanks to tax breaks, writes Tom Bill.

Elsewhere - luxury group LVMH hit by sales slowdown in Japan and China (Times).