Western governments grapple with taxing the wealthy

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Raising money by taxing the wealthy isn't easy. Views on fairness vary, and it's difficult for ministers to determine how ambitious they can be before they cross a line and start losing money.

Chancellor Rachel Reeves needs to raise at least £22 billion and is clearly struggling. Treasury officials had hoped to raise at least £1 billion reforming the UK's non dom regime, but are reassessing their plans amid warnings that the initial proposals could cost the taxpayer £1 billion in 2027/28 as wealthy individuals leave.

Reeves has now turned her attention to raising the higher rate of Capital Gains Tax, the Guardian reported yesterday. The OBR is assessing how much money could be generated from a range of between 33% and 39% on assets including second homes.

How high can the government push CGT rates before assets are offloaded or owners opt to hold on while they wait for a new government? Again, it's difficult to say. Recent Treasury analysis dug out by the FT found that a single percentage point increase to the higher rates of CGT in April 2025 would raise an extra £110mn in 2027/28. An increase of 5 percentage points, however, would result in a loss of £140mn in 2027-28. A 10 percentage point increase would lead to a loss of £2bn.

Fed up

The UK government isn't alone in this quandary. Leaders of several Western economies say they want to repair public balance sheets after debt-to-GDP ratios spiked during the pandemic, and that means finding new ways to tax the wealthy.

In France, Prime Minister Michel Barnier's 2025 budget, unveiled yesterday, seeks to put a floor of 20% on the tax rate for individuals earning €250,000 annually or couples earning double that amount. That should, in theory, neutralise the use of tax shelters. The government says the proposal will affect about 65,000 households and raise €2 billion.

Experts are sceptical: "Some people will end up leaving," Hogan Lovells partner Xenia Legendre tells Bloomberg. "They are fed up with insecurity and instability, they will just go."

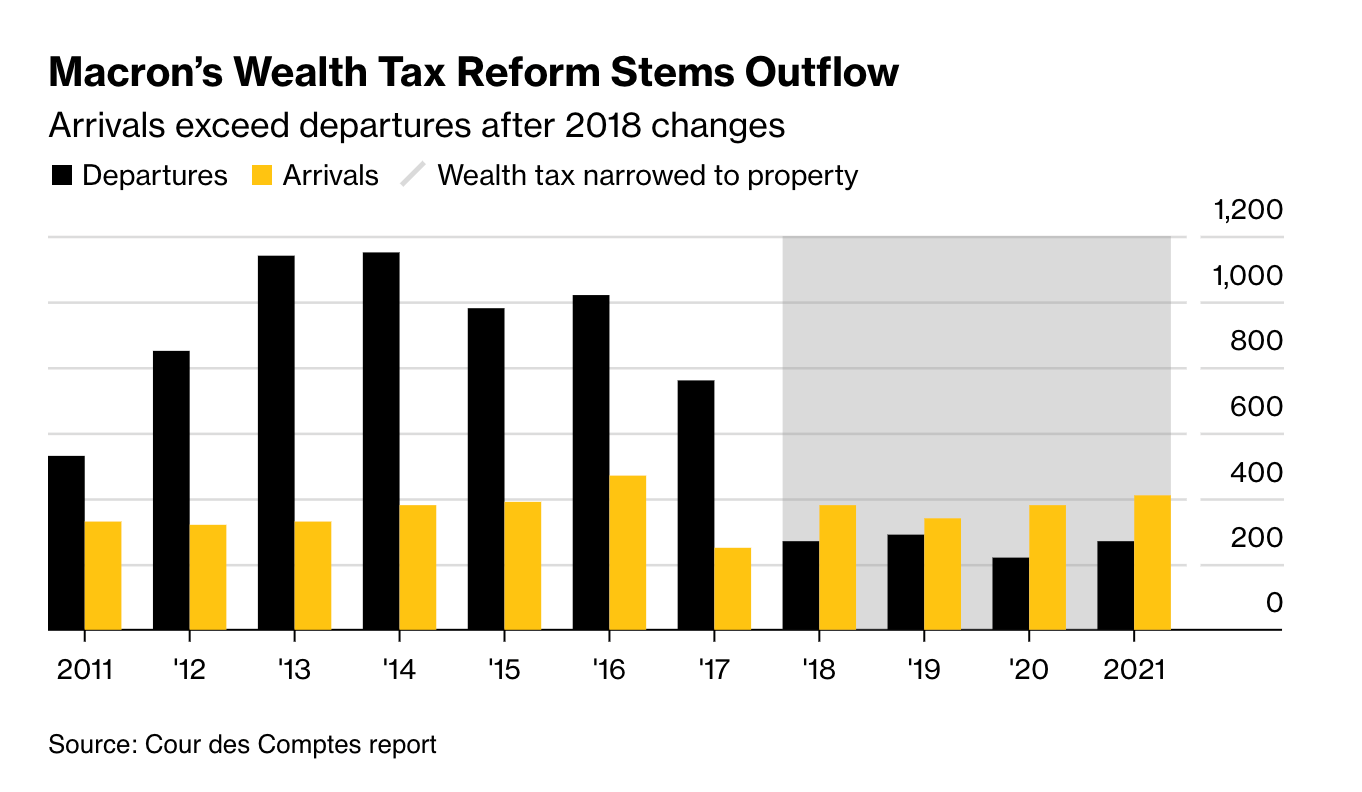

It's reasonable to be sceptical of these claims - the wealthy don't live in cities like Paris and London for their favourable levels of taxation - but France has form on this. The wealthy were leaving in droves a decade ago until Emmanuel Macron introduced a lighter touch regime - see the chart below from the Bloomberg piece linked above.

Conditions have only become more complex since then. The pandemic untethered people from the world's global gateway cities, fueling the rise of emerging wealth hubs like Miami and Milan. Governments including Italy, Portugal, Greece, the UAE and Singapore are simultaneously dishing out incentives for those willing to move. How this issue is managed will be a primary driver of prime property values during the next five years.

Too aggressive

The housing market continues to pick up, albeit slowly and from a low base. The September RICS Residential Market Survey showed measures of demand, sales and listings all on an upward trend.

The metric for house prices turned positive with a net balance of +11%, which is "now consistent with house prices rising at the national level, thereby ending a run of negative or flat returns for this indicator stretching back to October 2022," the report said.

The recovery remains fragile and will require further falls in mortgage rates to get out of first gear. We'' have to wait for a shift in the outlook for that - lenders including Barclays have withdrawn their cheapest deals following a rise in swap rates, likely due to last week's strong jobs report from the US.

It “does now look like some lenders have cut a little too aggressively in recent weeks," Hina Bhudia of Knight Frank Finance tells the FT. "Margins are so thin that a shift in the outlook for global interest rates can quickly mean that the lenders are doing business at rates that don’t meet their cost of funding."

Strong appetite

Build to Rent investment volumes were muted the third quarter of 2024 following a record- breaking first half of the year, according to a new Knight Frank update.

A quieter Q3 reflects a seasonal lull in activity over the summer period, as well as the fact that deals are taking longer to put together- The market also remains in price discovery mode, with a wide spread of bids on some assets. In total, 14 deals completed, with a combined value of £640 million. Investment in Q3 was 8% lower than the near £700 million that traded in Q3 2023.

Despite a quieter third quarter for investment volumes, there is still strong appetite among investors to acquire assets. Our agency and valuation teams are tracking a further £1.6 billion of transactions that are under offer or due to complete, of which 84% is for multifamily transactions. Outside of our investment figures, there has been a flurry of recapitalisations and equity raises, including a £755 million preferred equity commitment between Ares and Lone Star at Wembley Park, advised by Knight Frank, while Greystar raised €1.5 billion to invest in its European value-add fund focused on rental residential real estate. Such deals and commitments confirm the long-term attractiveness of the sector.

In other news...

Claire Williams on the brightening outlook for occupier demand in the logistics sector.

UK lenders see mortgage default rates rising (Reuters), Portugal seeks to become low-tax haven for young people (FT), and finally, Brookfield gazumps Segro in £1.1bn battle for warehouse giant (Times).