Mixed Messages for Prime London Markets Ahead of Budget

September 2024 PCL Sales Index: 5,280.1

September 2024 POL Sales Index: 274.9

3 minutes to read

The unfortunate irony for the UK property market in recent weeks has been that both mortgage rates and confidence levels have been falling.

The appearance of a sub-4% two-year mortgage shows how the outlook for borrowers has improved as inflation comes under control. The average equivalent rate was over 6% last summer, Bank of England data shows.

However, at the same time, a range of surveys shows how the prospect of tax rises in the Budget has led to hesitancy among consumers. Business confidence fell for the second consecutive month in September, according to the most recent Institute of Directors survey.

The result is that lower rates are not sparking the sort of rise in demand and transactions that might be expected.

The number of offers made in the three months to September in London was 10% below the five-year average (excluding 2020), Knight Frank data shows.

In the more discretionary £10 million-plus market, there was a 22% decline in the number of deals done in the year to July, according to our most recent super-prime report.

That said, there may be some better news on the horizon.

There have been reports the government may soften its Budget proposals for non doms, the 74,000 individuals who live in the UK and don’t pay tax on their non-UK income and assets.

Under plans published in its election manifesto, Labour had proposed charging UK inheritance tax on their global assets, which led to speculation that a number would leave the country and thereby reduce the amount of tax ultimately raised.

Recent media reports suggest the government may rethink or broaden its plans, presumably to capitalise on the fact many non doms would willingly pay more tax to remain in the UK provided their worldwide income was protected.

We don’t know what the government will eventually do in this month’s Budget, but it appears to be asking the right questions.

Any reversal of the recent decline in investor confidence would certainly help drive activity in prime London property markets.

With average prices down by 18% in prime central London (PCL) since the last peak in mid-2015, a period of price growth is overdue. There will no doubt be buyers who will be watching the Budget closely for a sign of how quickly it may materialise.

Prices declined by 2.1% in the year to September, which was the 17th month in a row that they have fallen on an annual basis.

The performance has been better in Prime outer London (POL), which is driven by domestic and needs-based buyers to a greater degree. Prices are 7.3% below their mid-2016 peak, having grown by 0.5% in the 12 months to September.

It was the highest rate of growth in POL since May 2023 and was the result of falling borrowing costs over the summer months.

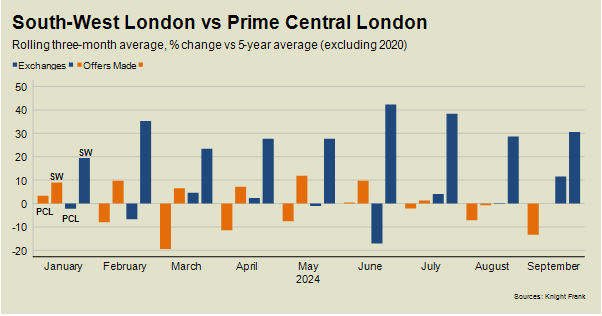

A greater reliance on needs-driven buyers also means south-west London has outperformed prime central London in terms of offers made and exchanges since the start of the year, as this chart shows.

How long this pattern continues will depend on the content of this month’s Budget.