UK inflation data tees up a late-2024 rate cut or two

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

UK inflation rose 2.2% in the year through August, unchanged compared to July and in-line with expectations.

The headline news is broadly positive and will have little impact on the consensus view that the Bank of England will cut rates once or twice before the end of the year. The negative aspects of the release are now well-rehearsed: growth in services prices picked up to 5.6%, from 5.2% in July. Economists had expected a rise to 5.5%.

For today at least, all eyes are on the US Federal Reserve. It's considered a virtual certainty that the Fed will execute its first rate cut since it embarked on a hiking cycle two-and-a-half years ago. Whether the central bank opts for a 50 or 25 basis-point cut is the subject of considerable speculation - 25 basis points was considered the most likely scenario until late last week, when both the FT and Wall Street Journal reported that policymakers were considering a more significant move.

US mortgage rates have declined for five of the past seven weeks. The 30-year rate is now at its lowest level since February 2023.

The budget

Inflation and its impact on mortgage rates is still the only story that matters in most housing markets, but not all.

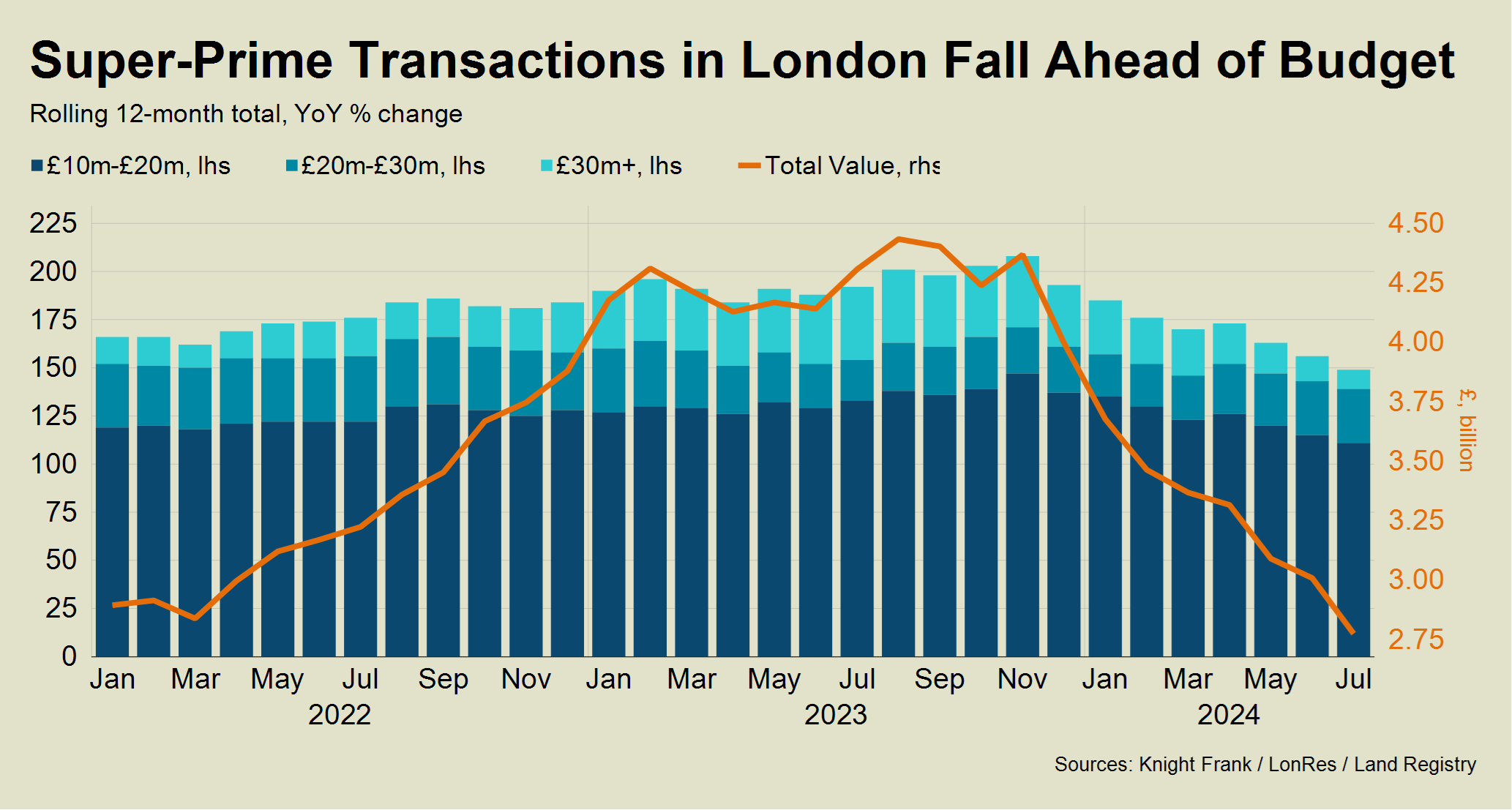

Next month's budget is weighing on activity in London's super-prime (£10 million-plus) market. Many buyers and sellers switched off early for the summer ahead of July’s election, but some have stayed on the sidelines.

Others have been more active, particularly under £20 million, driven by the long list of evergreen reasons people choose to live in London, like the relative value on offer and the fact they would be unaffected by any future non dom rule changes.

In addition to new non dom rules, changes the Chancellor could announce next month relate to capital gains tax, inheritance tax, carried interest for private equity funds and pension tax relief. That’s on top of new VAT rules for private schools from January. Tom Bill has more on the Intelligence Lab this morning.

Student satisfaction

Investors like the student accommodation sector despite the well-publicised funding challenges that universities are currently navigating.

The sector continues to be defined by an imbalance between supply and demand, with the delivery of new beds not keeping pace with student numbers. Fewer than 17,500 new purpose-built student beds will be added to supply in the 2024/25 academic year. Longer-term, just 258,000 new purpose-built student accommodation (PBSA) beds have been added across the UK since 2012. Over that same period, almost 470,000 full-time students have joined the student population.

Different markets are seeing varying levels of new supply, and of student number growth. But at a headline level such disparity points to ongoing pressure on an already undersupplied market. It also puts the quality and value of existing accommodation under the spotlight.

In this context, understanding and identifying the changing needs of students is important if the sector is to maintain occupancy and drive lease-up. Our Student Accommodation Survey, now in its fifth year, provides unique insights into the opinions and preferences of students about where they live and what they want from their accommodation. You can read it here.

Office work

Amazon sent a memo to staff this week stating they must return to the office five days a week from the start of next year.

“We’ve decided that we’re going to return to being in the office the way we were before the onset of Covid,” chief executive Andy Jassy wrote in the memo later published in the FT. “We’ve observed that it’s easier for our teammates to learn, model, practice, and strengthen our culture; collaborating, brainstorming, and inventing are simpler and more effective."

These cases attract a lot of publicity however in the US at least, the percentage of days worked from home has been flat since early 2023. Stanford University professor Nick Bloom unpacked that data and published a a few more interesting thoughts over on Linkedin.

We got a little more UK context this week via the latest KPMG survey of 1,325 chief executives. Of the UK respondents, 83% said they believe there will be a return to pre-pandemic ways of working within the next three years, up from 64% a year ago. A similar proportion of international respondents said they would probably reward employees who came into the office — up significantly from 56% in 2023.

In other news...

London’s mayor announces plan to pedestrianise Oxford Street (FT), and finally, Legal & General announces sale of CALA Group (L&G).