UK Housing and Economic Data Defy Gloomy Government Warnings

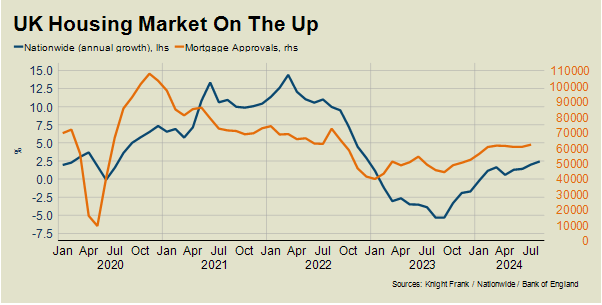

Latest figures show annual house price growth and transaction volumes are rising, which don’t indicate the economy is ailing.

3 minutes to read

For a market as reliant on sentiment as residential property, it hasn’t been a great seven days.

Prime Minister Keir Starmer told the country things would get worse before they got better last Tuesday and warned of a “painful” Budget next month.

Perhaps he was laying the ground for a second term in power, but it set a gloomy tone that doesn’t entirely chime with the data.

Last Friday, Nationwide said annual house price growth (2.4%) was the strongest since December 2022. On the same day, mortgage approvals reached their highest level since September 2022 and residential transactions in July were 5% above the five-year average.

It’s not just housing market data that is failing to support the theory of a deteriorating economy, according to Savvas Savouri, chief economist at QuantMetriks.

“Gilt markets have looked at the UK and are essentially saying ‘what’s the problem?’”, he said.

Gilt yields rise when there is weaker demand to hold government debt, which is linked to risks including creditworthiness. However, yields on ten-year UK government bonds dropped below 4% in August, which compared to a figure closer to 4.5% a year ago.

Savouri also pointed to the strength of the jobs market, the banking sector, and the pound as further evidence that UK PLC is not on its knees. He called the £22 billion black hole discovered by the new government as “a rounding error in the grand scheme of things”. The figure equates to about 2% of the UK’s annual tax revenues.

In a sign of confidence among foreign exchange investors, the pound was trading at US$1.32 last week, which was the highest level in more than two years. We explore the implications for prime central London property here.

Furthermore, the FTSE100 was trading within 1% of its highest-ever level last Thursday, while business confidence reached an eight-year high in July, according to Lloyds Bank.

“At some point the government might turn round and say ‘the economy is performing so strongly because we fixed it’ but in reality there was nothing to fix,” Savouri said.

The problem is that gloomy headlines can sway buyers and sellers. Tony Pidgley, the founder of Berkeley Group, regularly underlined the importance of the feelgood factor when buying property.

With the prospect of more sub-4% mortgages this autumn and another rate cut before Christmas, we expect UK prices will rise by 3% in 2024 and sales volumes will increase despite the pessimistic headlines.

However, talk of a “painful” Budget may cause a degree of hesitation among buyers and sellers, together with the fact more of them will continue to roll onto less favourable mortgage deals.

Such speculation is already dampening demand in higher-value markets, thanks to the combination of VAT on private school fees and uncertainty surrounding changes to capital gains tax, non dom rules, pension tax relief and inheritance tax.

While Knight Frank data shows the number of UK exchanges rose by 6% versus the five-year average in July, there was a 12% fall above £2 million.

It highlights a conundrum for the new government two months ahead of its first Budget.

Although £2 million-plus sales represented 6% of all transactions in the year to March 2023, they accounted for 22% of the £11.7 billion raised in stamp duty.

When introducing tax changes, the government will need to tread carefully to ensure new black holes don’t start appearing.