Insight 3: How will London recover this time?

The third insight paper in our London Series, outlining the recovery path of London's office investment market.

9 minutes to read

How will London recover this time?

Despite facing a global environment marked by rising interest rates, heightened inflation, and geopolitical shifts, London was the number one metropolitan area globally, for inbound real estate capital flows last year. The reasons for the capital city's ability to navigate these challenges, while still experiencing a reduction in investment volumes and adjustments in pricing, are explored here.

This article delves into the future recovery of London’s commercial real estate sector, focusing on the interaction between a peak in debt maturities and the crucial process of price discovery. We further examine the role of private buyers in spearheading recovery capital and identify potential followers. Lastly, we set out the significance of performance outlook in shaping the market’s path forward, the message being, while not yet clear of headwinds, we forecast evolving opportunities, across the risk spectrum over the year ahead.

Price discovery: a critical phase of market realignment

Price discovery in London's commercial real estate market is a pivotal phase where market realities are confronted head-on. This process is initially centred around vendors, particularly those under pressure to sell due to looming loan maturities.

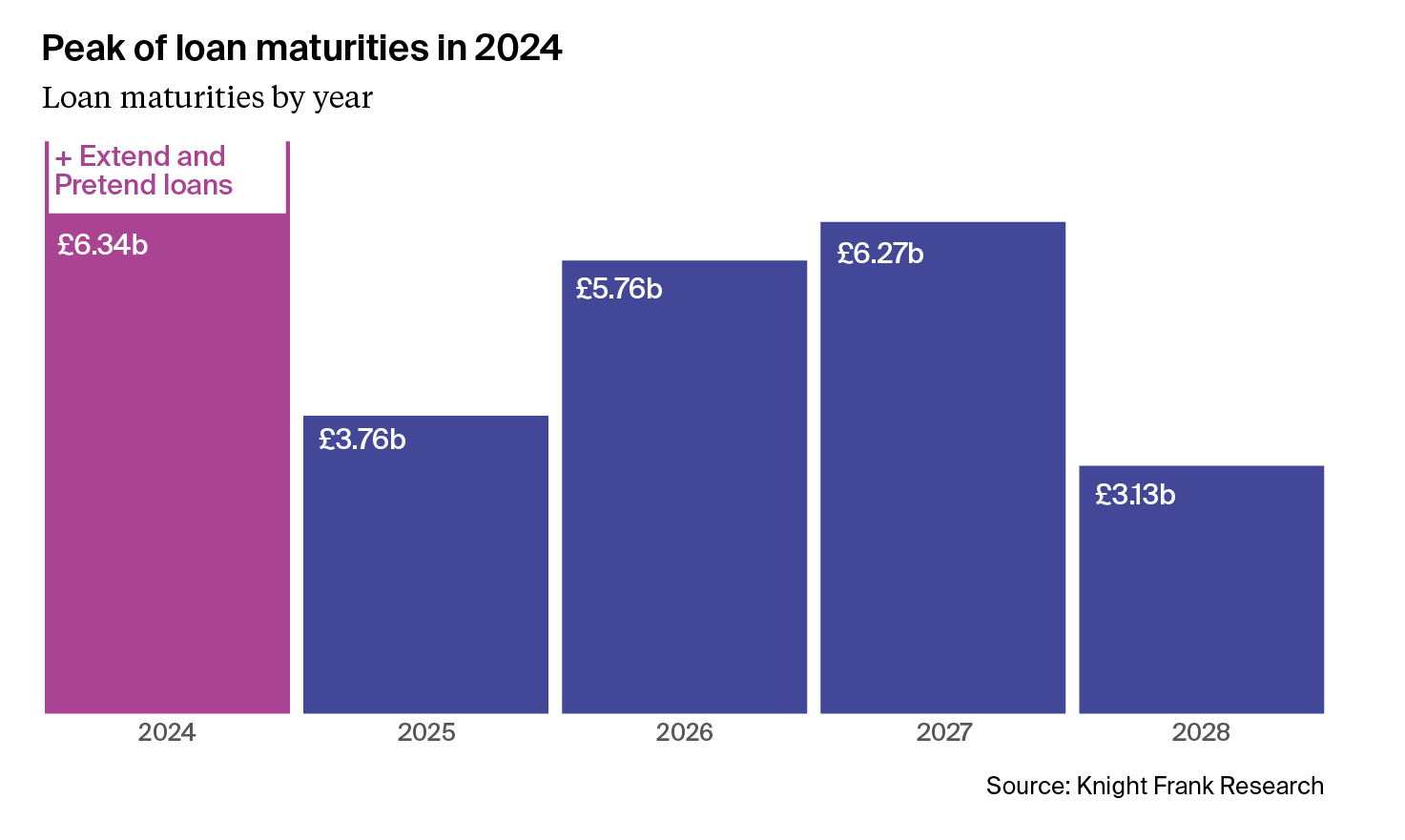

We anticipate that loan maturities for London offices will reach their peak this year.

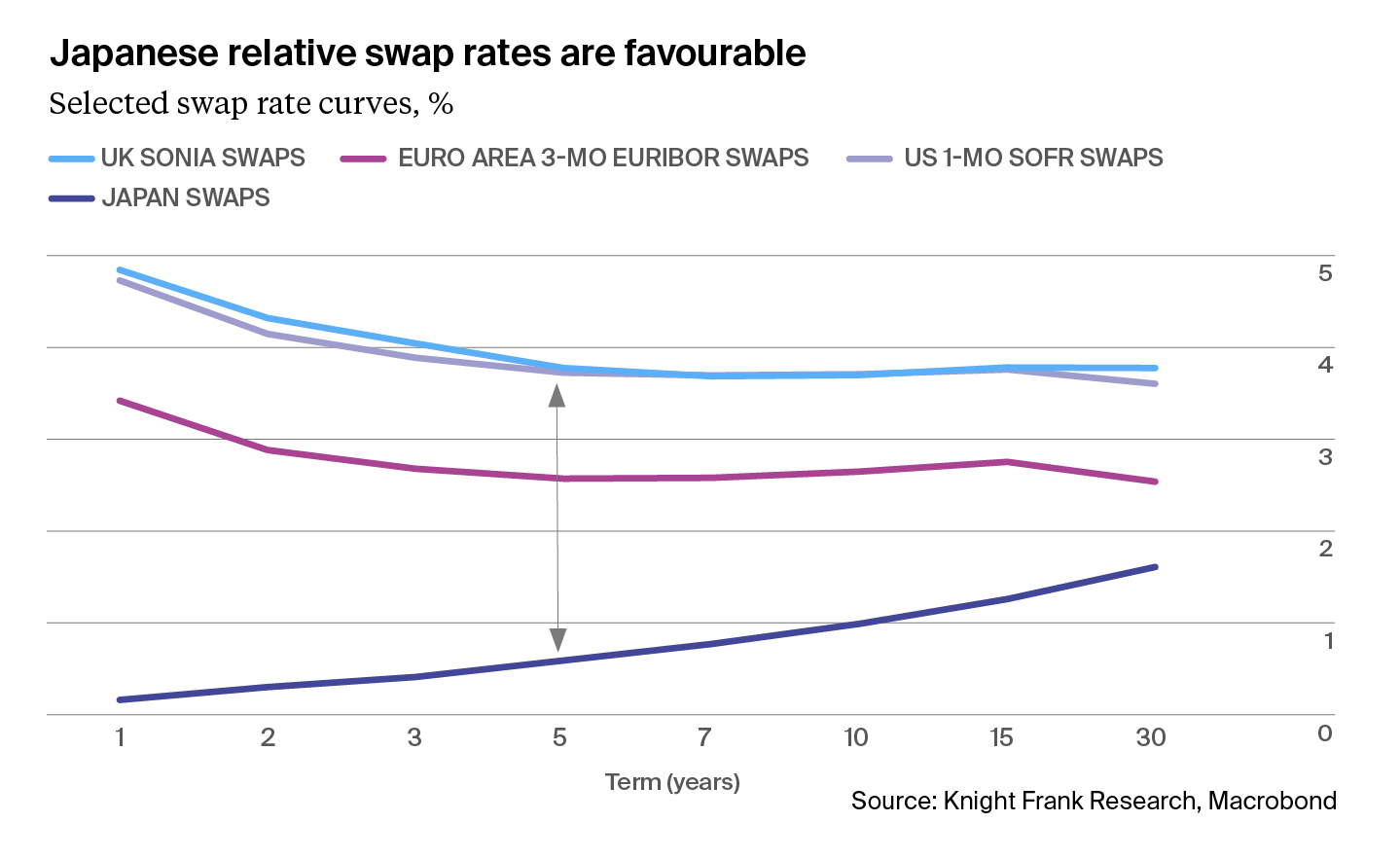

A significant portion of this peak can be attributed to acquisition financing. Traditionally, these loans are structured on a five-year term basis. However, what is particularly noteworthy in the current scenario is that many of these loans are maturing at a time when swap rates are significantly higher than when the loans were originated, as a result of ratcheting monetary policy driven by global economics and geopolitics.

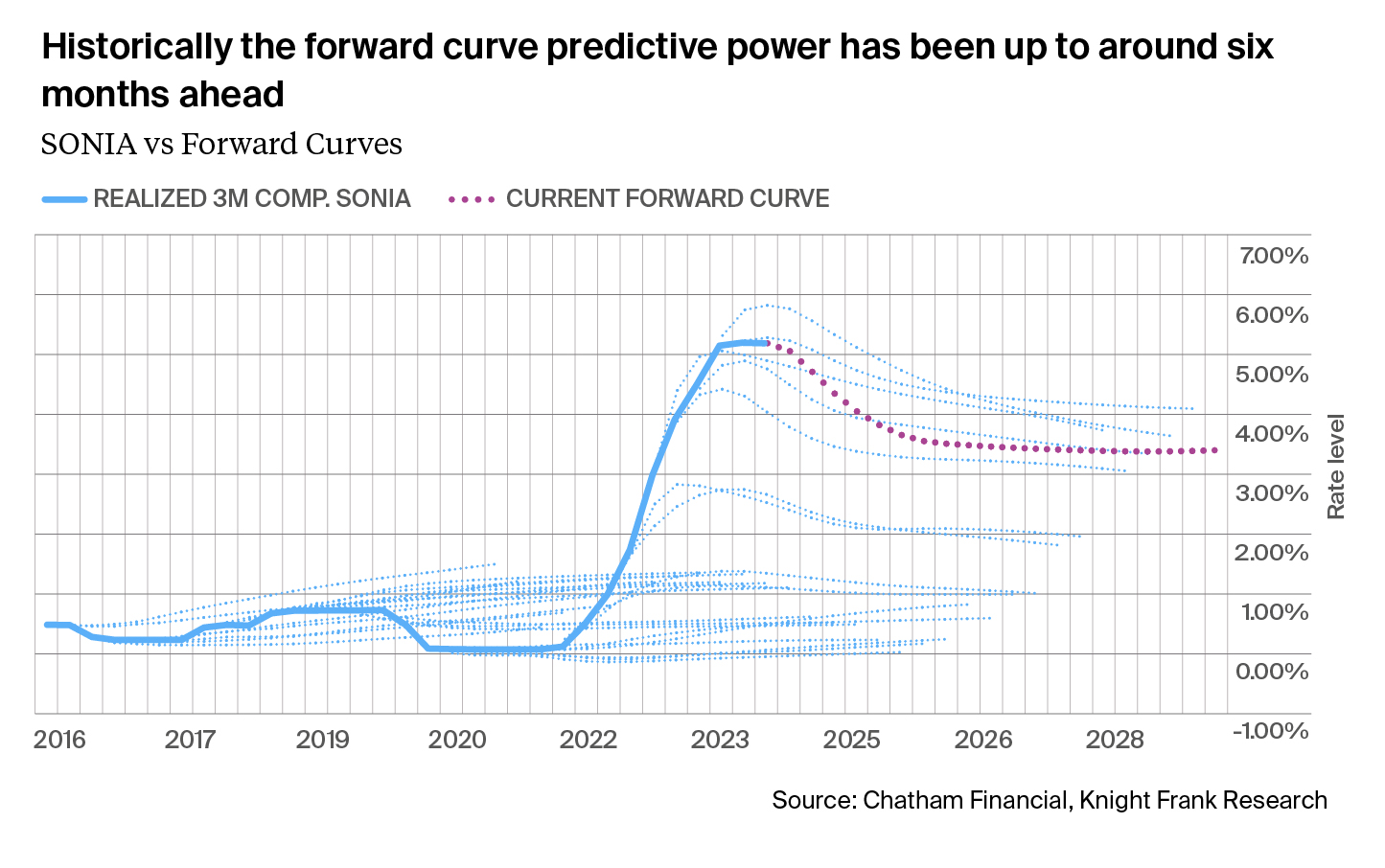

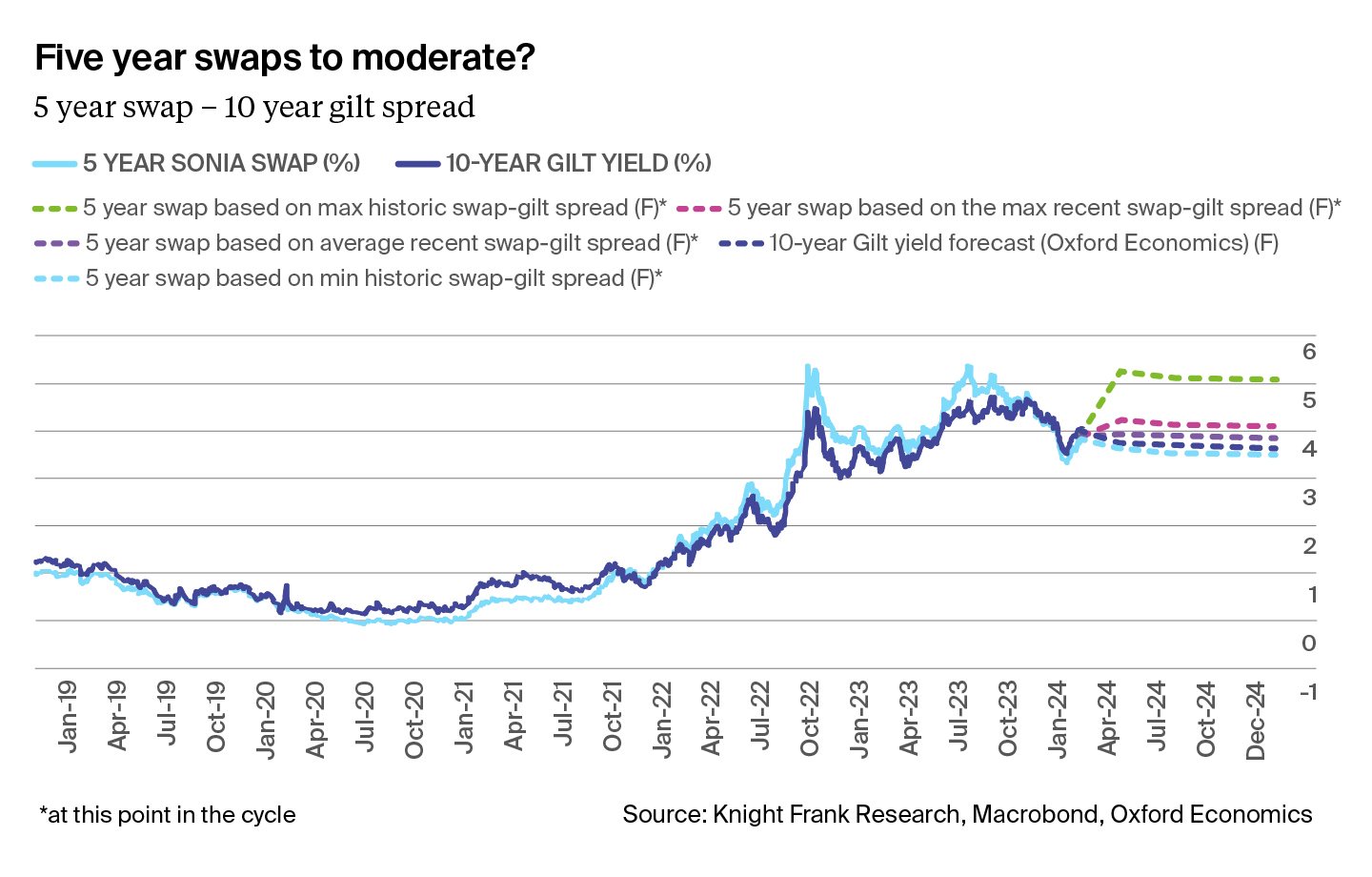

We are now at a point where we have started to see swap rates moderate from their peak as the conversation increasingly turns from when will central banks end rate increases, to when will they start to reverse.

Forward curves are most indicative of the following six months, but another way of assessing where swap rates might settle is looking at the historic spread between swap rates and government bond yields.

If the 5 year swap to 10 year gilt spread doesn’t exceed recent levels, based on Oxford Economics 10 year gilt forecasts for 2024, we could see a moderation of swap rates, but still at a rate higher than loans originated in 2019, assuming a 5 year loan term.

These higher swap rates at the time of loan maturity, as we saw last year, are likely to influence investment decisions, asset valuations, and liquidity. As part of this, we anticipate an increase in asset sales as a result of proactive strategies by property owners to manage their portfolios in anticipation of the refinancing challenges as well as potential loan defaults.

Adding to this, are the loans that were initially due to mature in 2023 or so but were granted an extension by incumbent lenders, otherwise known as ‘extend and pretend’. This practice, essentially a temporary extension of the loan terms, has been a common strategy among lenders and borrowers to avoid immediate financial stress. However, it is a short-term solution that potentially masks underlying financial challenges. As these extended loans reach their new maturity dates, we again expect an increase in refinancing activity, particularly as some banks are retrenching their lending, which is reflected in reduced appetite for higher LTV positions. However, this is likely to provide opportunity for non-bank lenders and the emergence of new debt funds, including those who can offer short term mezzanine positions in lieu of equity injection.

We also foresee an increase in equity injections and potential for the formation of joint ventures, especially with an anticipated increase in some investors from further afield (see below). These collaborative efforts can be a strategic way to pool resources, share risks, and capitalize on the diverse expertise of different stakeholders. Joint ventures could become particularly appealing in larger projects or developments where the financial and operational complexities necessitate a collaborative approach.

All of the above should aid price discovery.

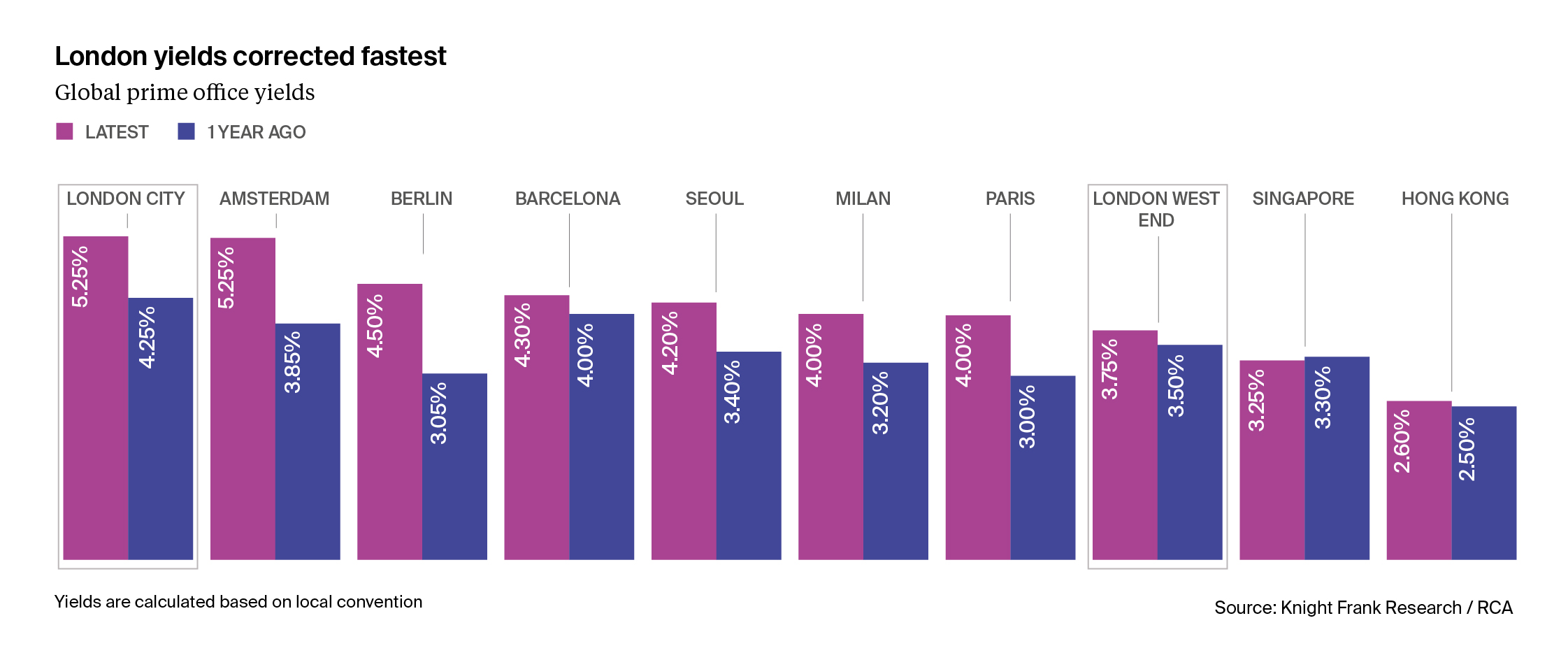

As we transition into 2024, there has already been a noticeable shift in the prime yields landscape, especially in areas like the City and Docklands. Indeed, the UK has acted as a forerunner for Europe in terms of yield shifts, although this is certainly not uniform across markets, risk spectrums and sectors.

The West End, in contrast stands out for its relative resilience. The pricing in this area has sustained itself, potentially paradoxically when juxtaposed with recent borrowing costs. This resilience can be attributed to several factors, including a tight supply side and familiarity or awareness of the market to, for example, private individuals who have been able to act as cash buyers.

This phase of Price Discovery is critical in setting the stage for the market’s next cycle. It involves a recalibration of expectations among sellers and buyers, leading to a more balanced and realistic view of property values and investment potentials. The outcome of this phase is crucial in determining the market’s direction in the short to medium term and stimulating recovery capital.

Recovery capital: stimulating market demand

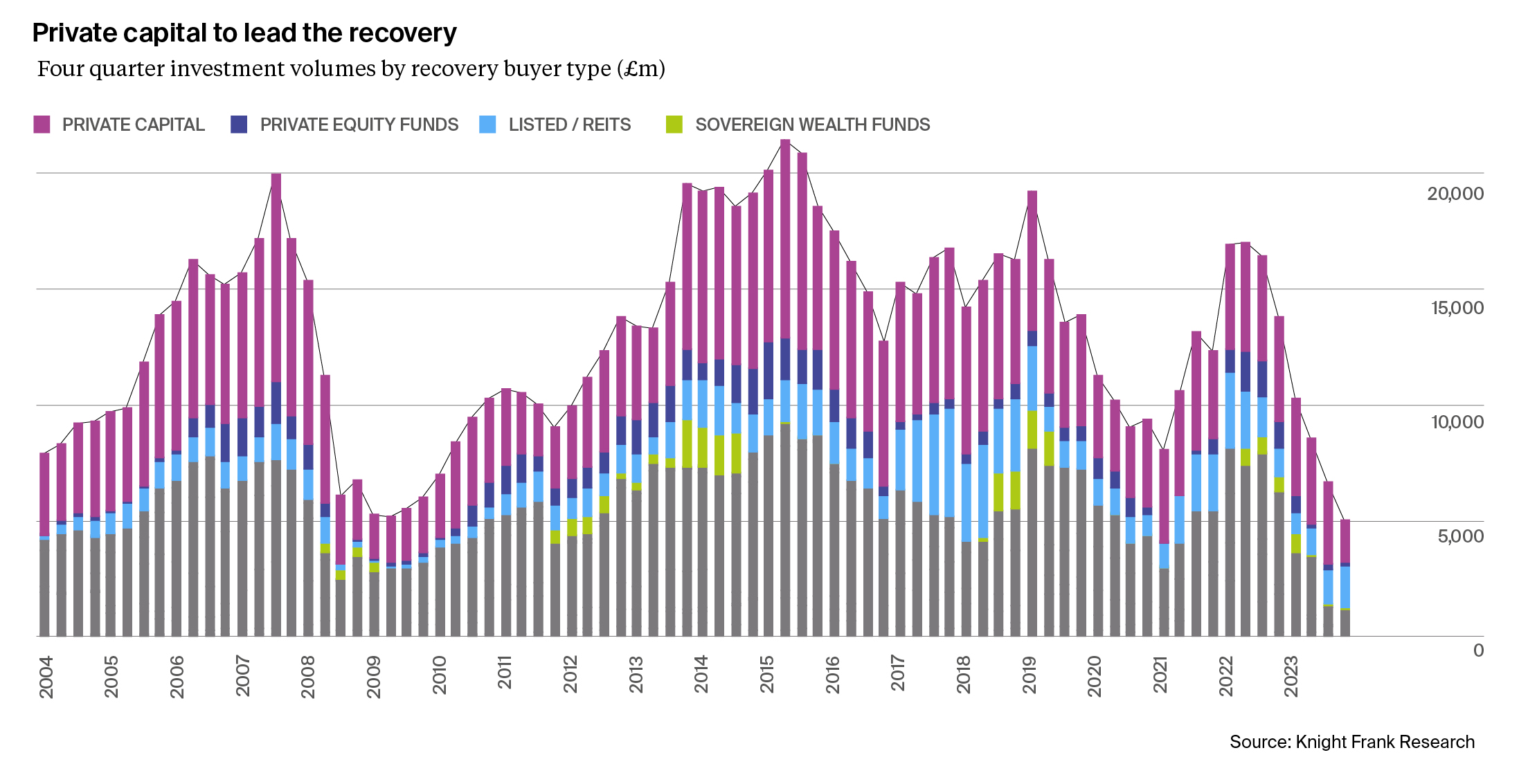

We have looked back at previous cycle shocks to the London commercial real estate investment market; Lehman’s collapse and the Global Financial Crisis, the Brexit Referendum and Covid to identify patterns of investors to gauge who will lead the market’s recovery in this cycle?

Historically, private investors, including High Net Worth Individuals have often been the vanguard of recovery in London’s real estate market. Their agility, lesser reliance on upfront debt, and quicker decision making capabilities position them advantageously to benefit from the current levels of thinner competition. Private buyers, including high net worth individuals, made up 53% of purchases last year, the highest proportion on record and we expect this to continue.

Private equity firms have traditionally been at the forefront of capitalising on short-term recovery opportunities. Their structured approach and capacity to mobilise significant capital have enabled them to leverage market downturns effectively. However, the more recent recoveries present a different scenario. This time, many private equity firms are contending with more strained conditions in their base markets, particularly the US, where the office occupier market faces considerable challenges. This situation may result in a more measured re-entry into the London market. UK Real Estate Investment Trusts (REITs) are currently outpacing private equity in seizing market opportunities, having already invested £1.5bn in 2023 into the London commercial market versus £500mn for private equity.

Sovereign Wealth Funds (SWFs), traditionally slower in market re-entry, requiring greater market evidence and due diligence are expected to show renewed interest in liquid, gateway cities such as London, later in the year.

We also expect an uptick in different geographical investors, as some, such as US investors, have retrenched.

Our Active Capital research suggests a significant increase in activity from Japanese investors supported by a favourable differential in swap rates, opportunity to take advantage of thinner competition and expectations of an appreciating yen. Even last year, from a position outside the top 10, Japanese investors increased to become the second largest global cross-border investors in the office sector.

Middle Eastern investors are also likely to intensify their focus on overseas diversification into commercial real estate, underpinned by robust oil and gas revenues and a return to favourable hedging benefits for dollar denominated investors.

We do also expect an increase in interest from US investors, even if not back to pre-reflationary levels.

Performance outlook: setting the pace for recovery

The Performance Outlook for London’s commercial real estate market is a vital determinant of the recovery’s pace and momentum. Contrarian and opportunistic investors aside, many are now more cautious and discerning, looking for clear evidence of performance potential from assets, focusing on aspects like income growth and exit liquidity. In a departure from what we have seen at this stage in previous cycles, we are also seeing strength in the occupier market.

Prime rents are on an upward trajectory, and the future supply pipeline, in part as a result of the significant cost-push inflation we have faced – is insufficient to meet the ongoing demand – a situation not witnessed in previous market cycles and will support the recovery.

In terms of the Investment market, prime office pricing in London reached its floor late last year. This segment was the first to respond to market changes, aligning most transparently with borrowing costs and gilt yields. This 20%+ price adjustment has already drawn interest from the better advised private buyers, provided the asset is genuinely prime and of a lot size that maximises liquidity.

The picture is less clear for core+ and value-add assets. These segments are likely to see further correction as more evidence is created, possibly not stabilizing until the latter half of the year, when the occupier market dynamics will help it achieve more balance.

Overall, and we expect an increase in office sector activity this year, even if not back to 2022 levels.

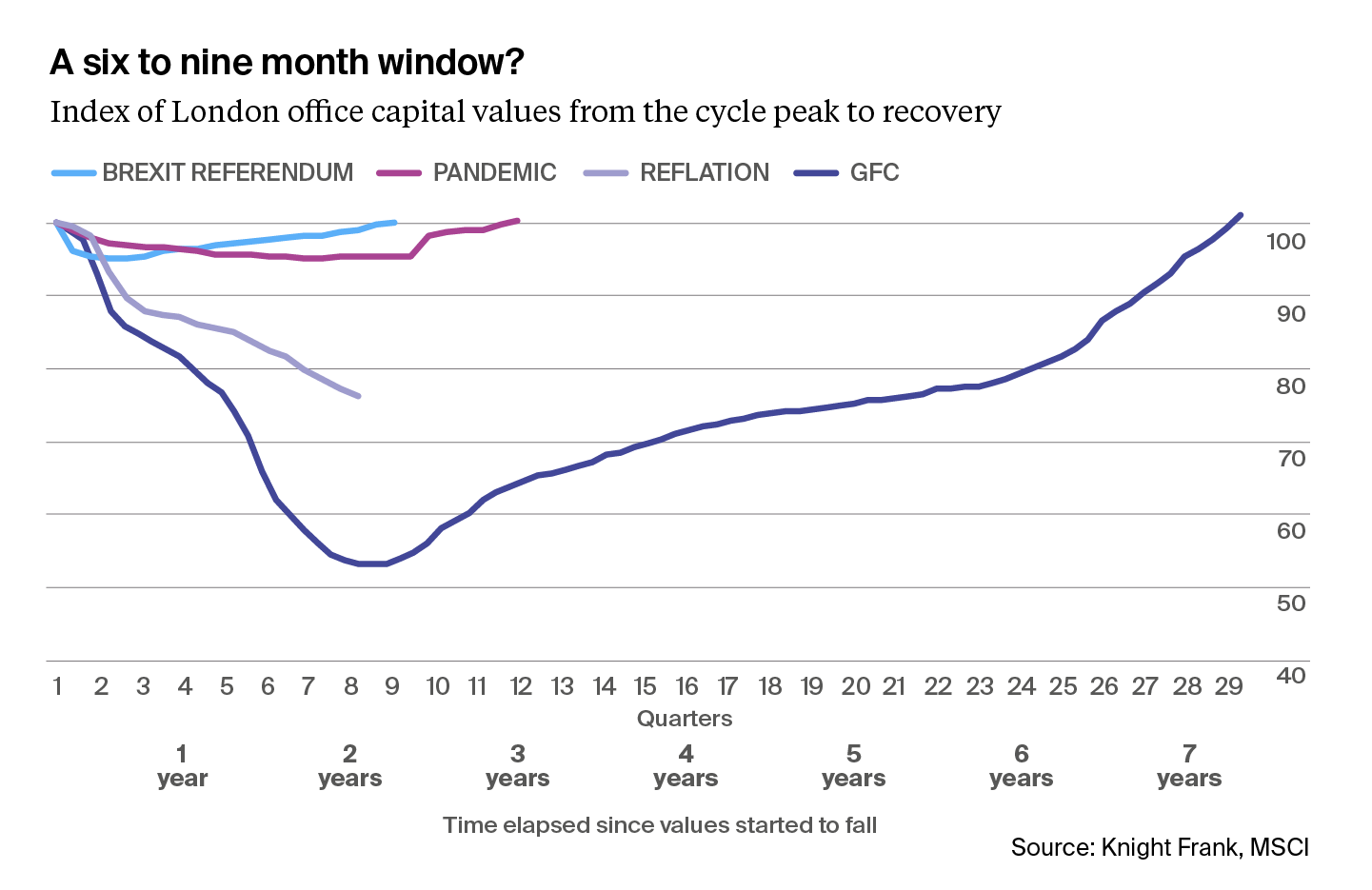

So how long will the recovery take? Looking at the at the timeline of past London recoveries and when capital values started to bottom out and recover, we can see that so far, for London offices, we are most closely tracking the Global Financial Crisis, which started to see a recovery of capital values after 8-9 quarters. We are now currently 6 quarters since the autumn 2022 shock and reflationary environment which suggests a 6–9- month window, if we continue to follow the GFC. However, with known dry powder looking to step in once repricing is sufficient, we may see this window shorten even further. In fact, if we instead just looked at the most prime London offices, we are already seeing implied capital values start to rise as a result of higher rents.

Bringing this all together, the recovery of London's commercial real estate is poised to be driven by key elements like Price Discovery, Recovery Capital, and Performance Outlook. The market is navigating through complex loan maturity landscapes and a shift in lending practices, presenting opportunities for non-bank lenders and new debt funds. Investor behaviour, especially from private investors, UK REITs, and international investors, is expected to continue to play a crucial role in shaping the market’s recovery. While the recovery trajectory appears to mirror past patterns like the Global Financial Crisis, with a projected 6–9-month recovery window post the 2022 reflationary shock, the presence of significant dry powder and readiness of investors to engage upon suitable repricing may potentially accelerate this timeline. This dynamic market environment, underpinned by London’s resilience and strategic investor response, suggests a cautiously optimistic recovery outlook for the London office investment market.