Navigating the recovery

Against a backdrop of global economic and geopolitical tensions, 2023 was a year of softer trading conditions for commercial real estate investment – but investors are positioning themselves for a recovery, argues Antonia Haralambous

4 minutes to read

Global commercial real estate (CRE) investment fell by 46% in 2023 to US$698 billion as investors grappled with elevated interest rates and higher debt costs. Much of the contraction in investment was due to a retrenchment among US investors. Outbound US investment declined by 52% year-on-year in 2023, as investors tried to reconcile elevated domestic debt and navigate the perception that conditions in the US CRE market reflected global real estate trends.

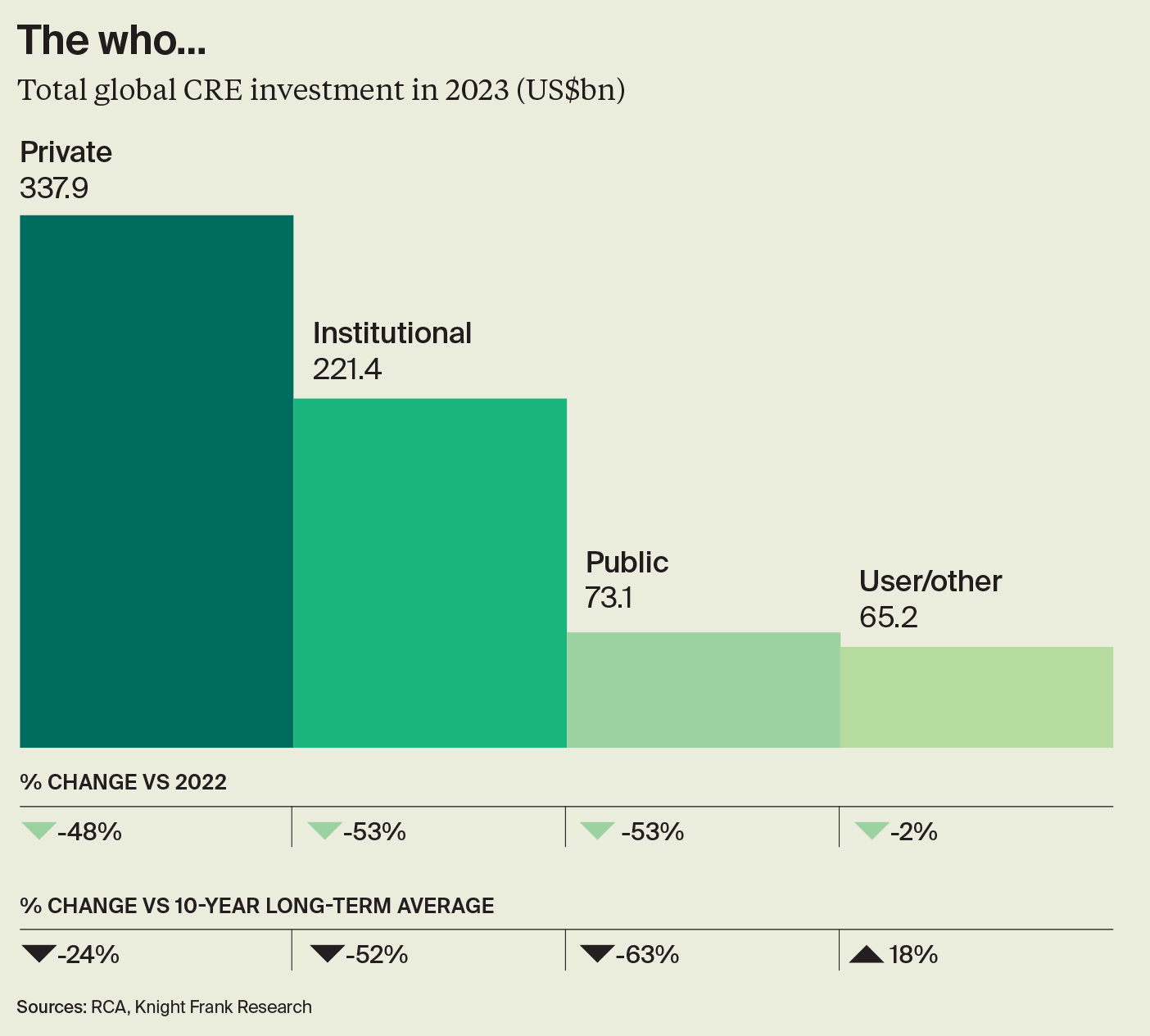

While global investment was relatively soft, private investors remained the most active global CRE buyers for the third consecutive year. Private capital invested US$338 billion globally in 2023, equating to a 49% share of total investment, slightly up on 48% in 2022 and the highest share on record.

Although private investment in 2023 nearly halved on 2022 volumes, this was a smaller contraction than institutional and public investment, both falling by 53%. Meanwhile, investment from HNWIs in global CRE saw the smallest year-on-year decline at 19%.

The fact that private buyers, including HNWIs, were the most active in 2023 is perhaps unsurprising. This group is relatively well positioned to transact in a higher interest rate environment, as private capital is typically less reliant on debt than other investors.

Sectors in demand

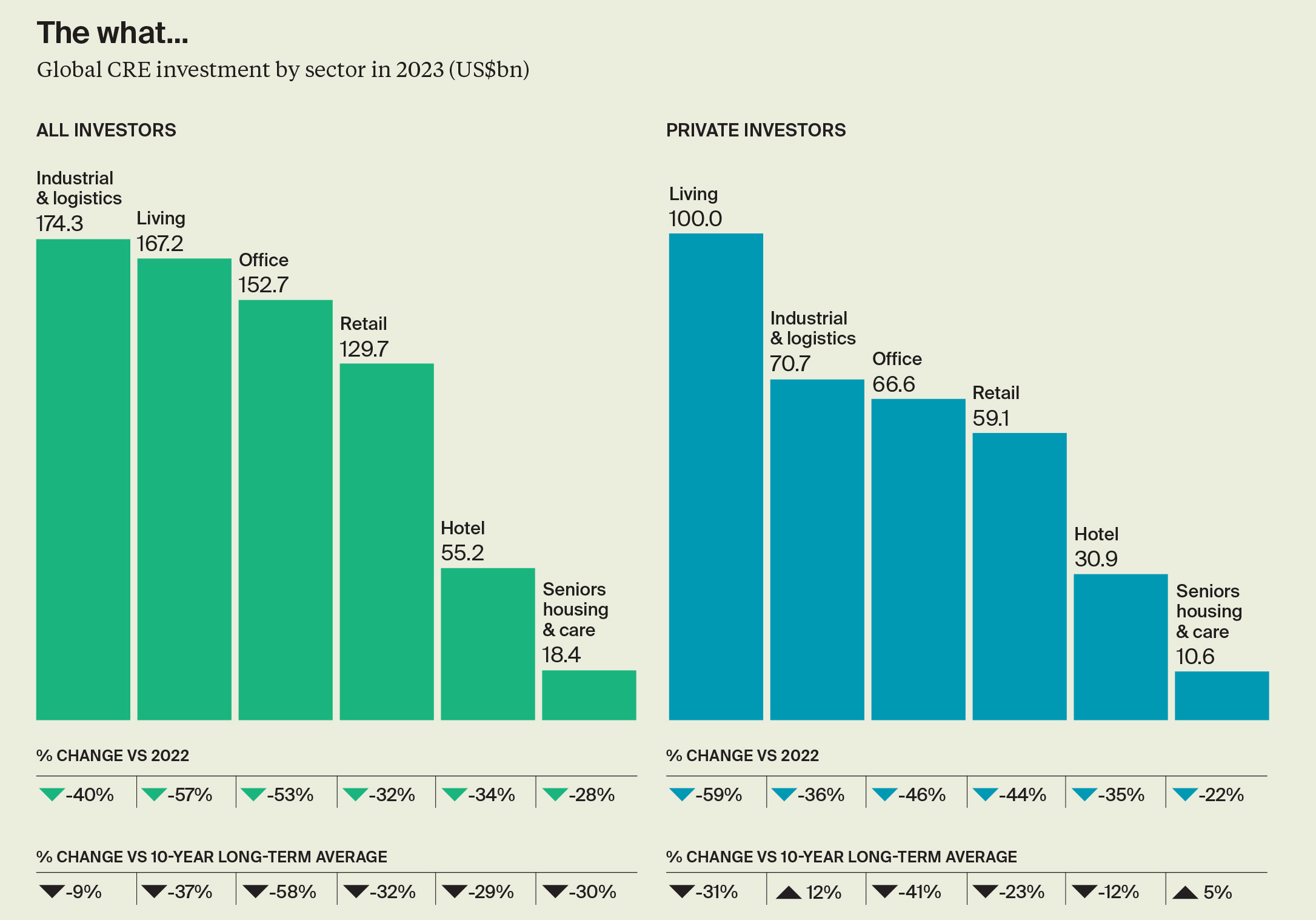

Industrial and logistics was the most invested CRE sector for the first time on record, taking a quarter of all global investment at US$174 billion. While industrial and logistics, retail, hotel and seniors housing and care all increased their share of total investment in 2023, the office market fell from 25% in 2022 to 22%, and the living sector share contracted from 30% to 24%. All sectors recorded an annual decline in total investment in 2023, with seniors housing and care (-28%) seeing the smallest decline.

However, the story was slightly different for private buyers in 2023. Living sectors were the most targeted by private capital, followed by industrial and logistics, and offices. For HNWIs, offices reclaimed its place as the top sector for investment having trailed living sector investment in 2022. Here, it is likely that HNWIs capitalised on reduced competition, potentially seeking trophy assets in a sector with a less time-intensive operational model.

Who’s been active?

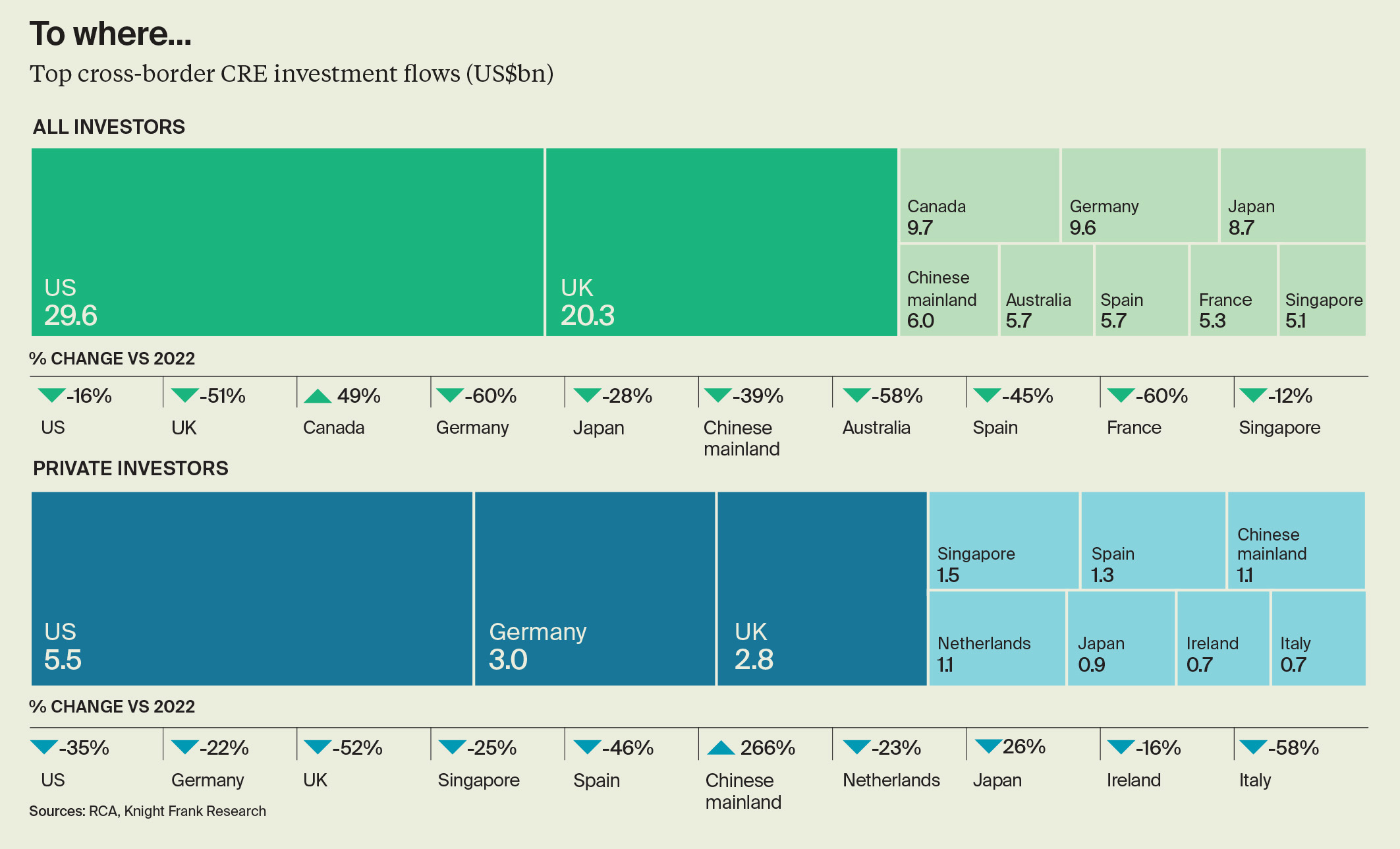

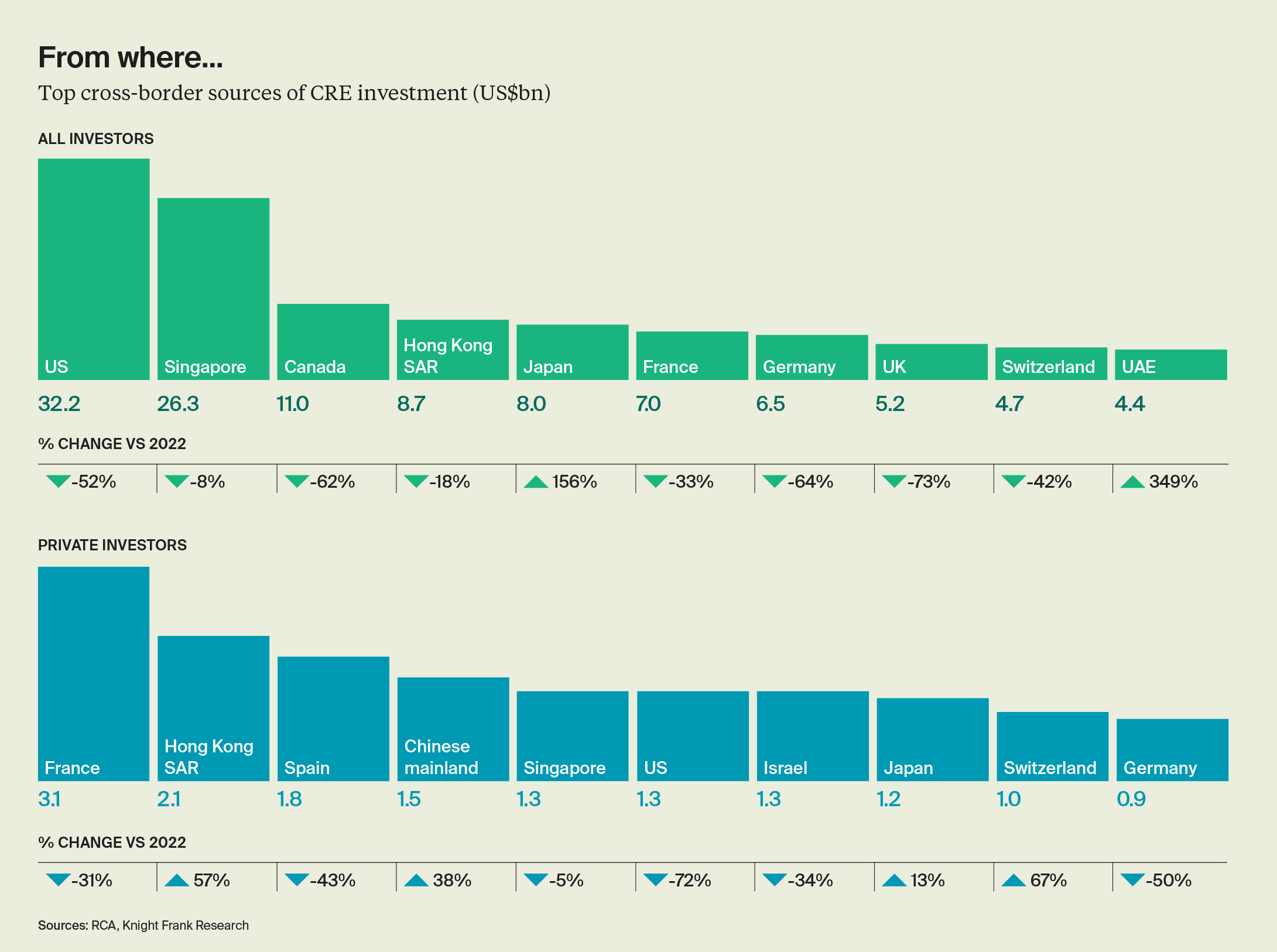

Investors from the US, Canada and Singapore accounted for just under half of all cross-border global CRE investment in 2023. However, of the top 10 global cross-border capital sources, the only investors to increase investment in 2023 were from UAE (+349%) and Japan (+156%). For Japanese capital, 2023 was a record year for cross-border investment at US$8 billion, with buyers taking advantage of a significantly lower cost of domestic debt, a slower speed of transactions and a reduced global competition pool. In fact, Japanese investors were the fifth largest source of cross-border capital in 2023, their first ever appearance in the top 10.

Investors from France were the largest source of private cross-border capital in 2023, with US$3.1 billion invested. Private French capital mainly targeted European assets in 2024, particularly in Germany, Spain, Italy and the UK. Investors from the US dropped from pole position in 2022 to sixth in the top 10 sources of private cross-border capital in 2023, with investment moderating -72% year on year to US$1.3 billion. Meanwhile, cross-border capital from Spain was the largest source of HNWI investment in 2023, targeting CRE in the US, Ireland, the Netherlands and the UK.

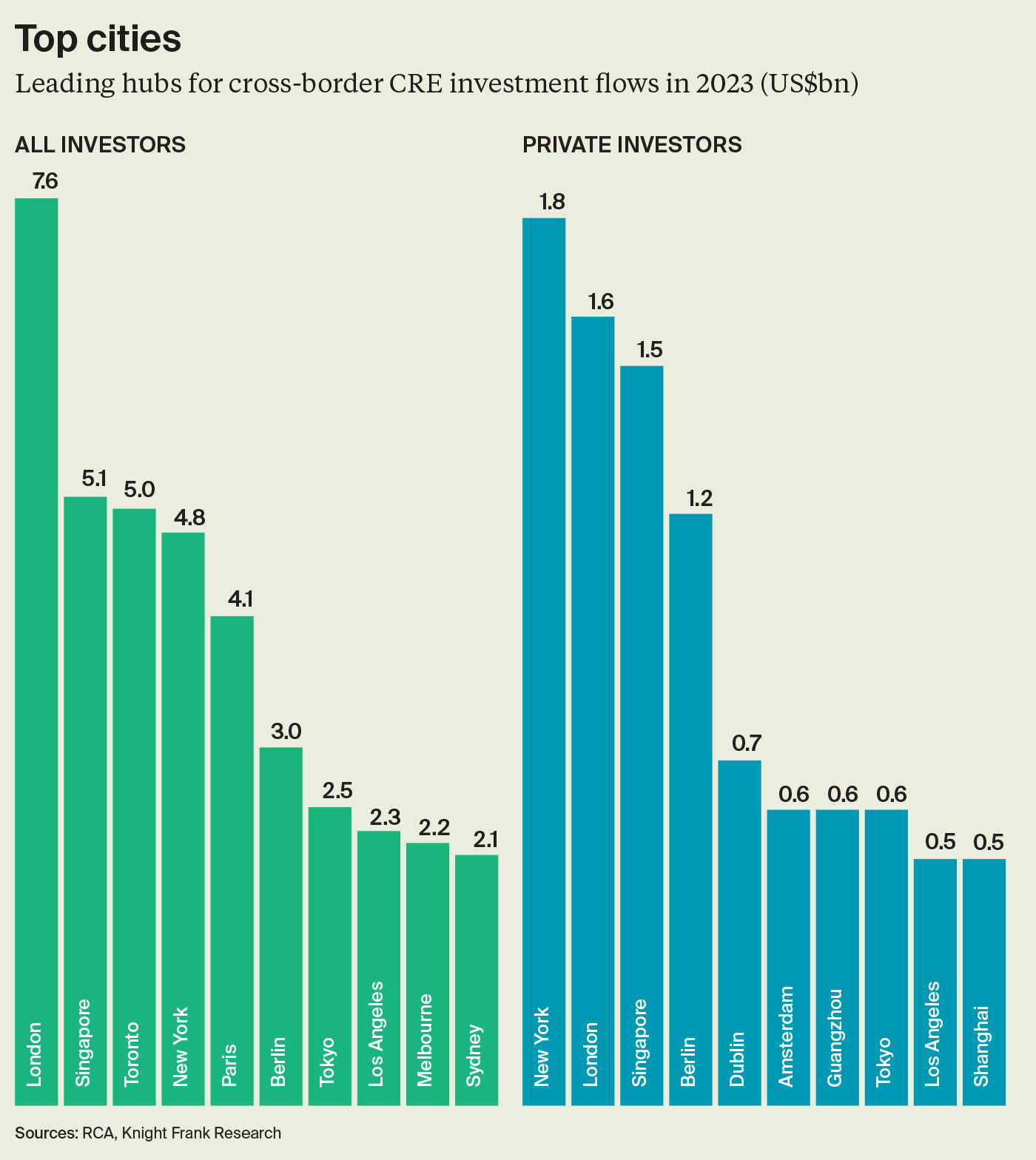

London was the top city destination for total cross-border investment in 2023, with US$7.6 billion invested. However, New York was at the top of the list for overseas private capital, surpassing London for the first time since 2016. For HNWIs, the 2023 target list looked slightly different, with Singapore, Berlin and Dublin the most invested urban centres.

Looking to the future

With interest rates expected to remain elevated globally into the second half of 2024, we anticipate private capital to remain active. Indeed, during previous times of dislocation, private capital has typically rotated back into CRE. Following the global financial crisis, the private buyer share of global CRE investment grew from 30% to 38% and in 2021, following the first year of Covid-19, its share grew to 45% from 39% pre-pandemic. We expect this trend to continue in 2024: 19% of respondents in our Attitudes Survey were looking to invest directly in CRE in 2024, with investors from the Middle East (23%) and Asia (21%) likely to be the most active.

What will they be targeting?

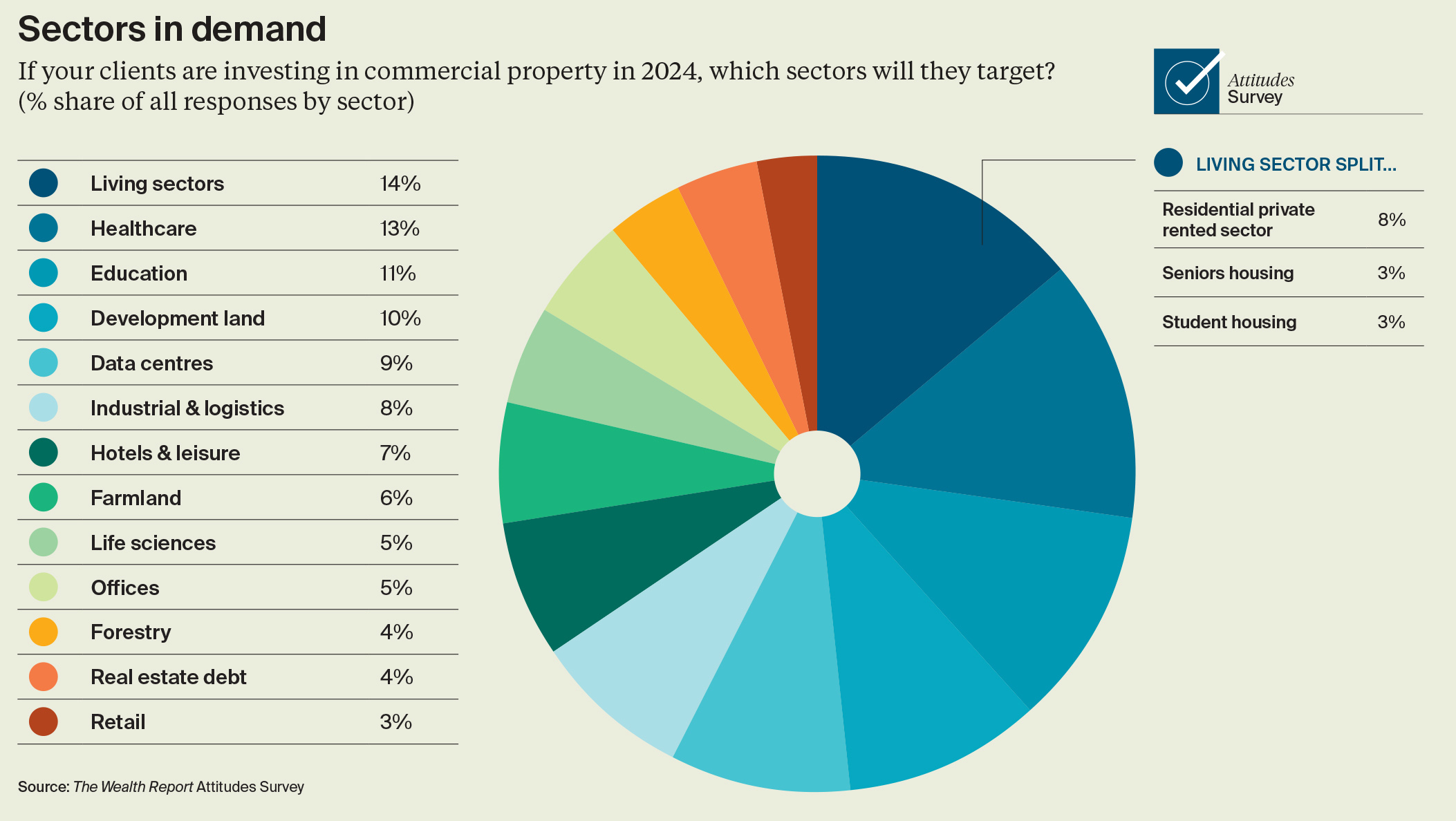

For the first time in four years, a new sector has topped the investor wish list. The living sectors are the most in demand in 2024, with 14% of Attitudes Survey respondents looking to target the asset class. Interest is strongest in Europe, the Middle East, North America and Asia. Healthcare is not far behind, with 13% of respondents interested in the asset class.

However, intentions do not necessarily equate to transactions, due to factors including availability of stock, market size and competition. For HNWIs, the traditional sectors, including offices, retail and hotels, have usually been the most transacted over the past 10 years. More specialist sectors such as healthcare and student housing are often high on investors’ wish lists due to their strong rental growth prospects and counter-cyclical nature. However, in practice, some investors may hesitate to transact due to the specialised management and operational expertise required for these assets, alongside strict regulatory and compliance challenges.

Download the full report here