'Animal spirits' are back

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

The World Economic Forum in Davos always has a distinct theme. Last year, economists released rafts of forecasts of the eve of the event showing the global economy was barrelling towards a recession. Was 2023 going to be bad, or very bad?

This year feels different. Fine, we don't know whether major central banks will cut rates four or six times. We don't know if they'll begin cutting in spring or summer. And all of this could be jeopardised by some as yet unforeseen event, but CEOs in the Swiss alpine town are all singing from the same hymn sheet:

"The expectation that interest rates are going down is creating animal spirits again,” Blackstone CEO Steve Schwarzman told Bloomberg TV yesterday. "The recession fears are gone, interest rates are coming down almost certainly very soon, so I think you’ll see a lot more M&A activity and a lot more private equity activity,” Carlyle co-founder and co-chairman David Rubenstein said later the same day. “Sellers have conceded to lower valuations and the pressure to meet a certain return on investment is ticking,” KKR co-head of global private equity Pete Stavros told the FT.

The outlook is giving decision-makers the confidence to act, but a lot of this is down to the capitulation of investors that had been holding on to assets by their fingernails. Business leaders clearly take the view that 2024 will be the year that the yawning mismatch in expectations between buyers and sellers will close. That should transfer across various sectors and will undoubtedly be good for commercial real estate transaction volumes.

A brighter outlook

UK residential market sentiment continues to improve. Respondents to the RICS December survey of estate agents are increasingly positive on the outlook for both activity and property values.

The headline net balance for the new buyer enquiries, for which a reading below zero indicates a contraction, registered -3% in December, a fourth consecutive improvement and up from -13% the previous month. Near-term sales expectations rose to +12%, up from +7% the previous month. Respondents now foresee a solid recovery in residential sales volumes emerging over the year ahead, with the latest net balance climbing to +34%, up from +24% last month.

Metrics of supply are largely flat. The average estate agent has 39 properties listed, up from 34 at the start of 2023 but still well below the long run average of 51. The headline house price gauge posted a net balance reading of -30% in December, which compares with readings of -41% and -60% in November and October respectively. The December reading is the least negative since November 2022 and suggests that the downward pressure on prices is diminishing. Respondents now think house prices stabalise over the year ahead - that metric came in at zero vs -10% previously.

“The predictable result of mortgage lenders dropping their rates is that demand has increased and price declines in the UK housing market appear to have bottomed out," says Knight Frank's Tom Bill. "We expect UK prices to rise by 3% this year and sales volumes to increase from a low base in 2023 as the economic convulsions of recent years fade. Political instability has become the biggest risk facing the market, as we have seen this week, although if an election takes place in the second half of the year, activity should see a seasonal jump in the spring.”

Spreads will narrow

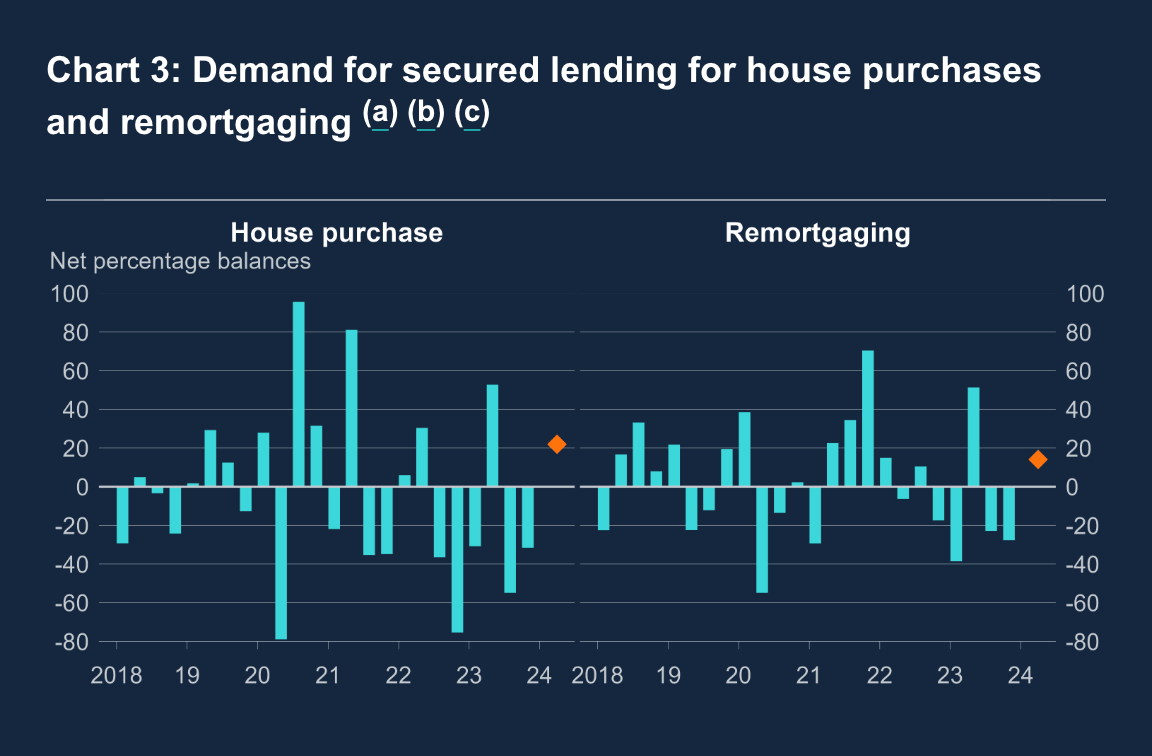

UK mortgage lenders are expecting a sizable jump in the demand for mortgages during the next three months, according to the Bank of England's latest Credit Conditions Survey (see orange diamonds on the chart below).

The lenders expect spreads on mortgages relative to the base rate or the appropriate swap rate to narrow over the course of the quarter, which would be consistent with more cuts to mortgage rates while we wait for the Bank of England to begin loosening monetary policy.

Indeed, the lenders appear largely unfazed by this week's inflation print showing the pace of rising prices actually ticked up in December. That news arrived at 7am on Wednesday. By 10:30 Santander had emailed mortgage brokers announcing reductions of up to 0.45% on a range of its residential products.

“Borrowers who had been putting off remortgaging are now choosing to act, and lenders are now extremely busy," Hina Bhudia of Knight Frank Finance told the Times this week. "We’re even seeing the first signs of strain. The trend for mortgage rates is down, but we have seen one or two lenders repricing deals slightly higher to avoid being inundated with calls while they are the cheapest on the high street."

The lab space crunch

London has a burgeoning biotech and life sciences sector, but entrepreneurs are struggling to find lab space. Demand for lab space in the capital stands at 793,000 sq ft, while availability is just 179,295 sq ft – less than a quarter of current requirements, according to Knight Frank data.

It's not the only specialist real estate in short supply. The rise in film and TV production spend in the UK is fuelling demand for studios. If production spending reaches the expected £8.7 billion by 2028, we reckon an additional 2.6 million sq ft of additional studio space will be required.

We devote our first Intelligence Talks podcast of the year to these topics. Anna Ward is joined by Knight Frank partner and life sciences specialist Jennifer Townsend and Deirdre O’Reilly, senior research analyst at Knight Frank and one of the authors of our UK Film and Television Studios market reports. Listen here, or wherever you get your podcasts.

In other news...

Hunt plots tax cuts as inflation crisis eases (Telegraph), and finally, Zara billionaire grabs chance to buy up discounted real estate (FT).