Slower hotel revenue growth amidst continued rising costs puts profit margins under pressure

Tempered yet resilient trading performance as ADR growth weakens, putting pressure on hotel margins and weaker GOPPAR growth as cost pressures persist.

3 minutes to read

This article was co-written with Henry Jackson, Partner and Head of Hotel Agency at Knight Frank.

For further analysis, download Knight Frank’s UK Hotel Dashboard. We provide a detailed overview of key performance indicators for both London & Regional UK, summarising trends in revenues, expenses, and profitability. In this month’s edition, we spotlight on the performance of Upper Upscale Hotels for both London and Regional UK.

Key Headlines:

- The UK hotel sector’s resilience continues, but with slower growth in July’s KPIs, off the back of a strong recovery in trading in July-2022.

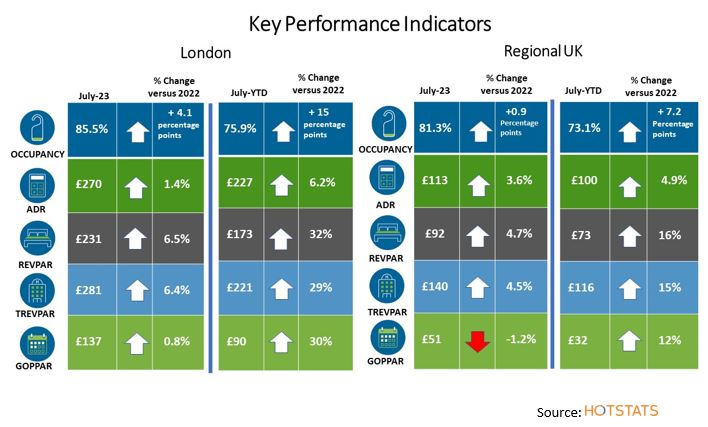

- London hotels achieved occupancy of 85.5% in July, with strong growth of 4.1 percentage points versus July-2022, but with ADR growth slowing to 1.4% over the same period. Whilst the pace of ADR growth has fallen, July-22 was an exceptionally strong month, with the London hotel market having benefitted significantly from the return of the Farnborough Air Show.

- Supported by another strong surge in overseas visitor arrivals to London, the city achieved its highest occupancy performance since October 2019, but remains four percentage points below July 2019 occupancy.

- London’s ADR continues to track ahead of inflation with July’s ADR 26% ahead of July-19 and 23% ahead on a YTD basis.

- London’s Upper Upscale hotel class has outperformed the London market in terms of occupancy. At almost 77% as at July YTD, occupancy was just two percentage points below its 2019 performance over the same period, but with the share of Rooms revenue rising to 80% (77% in 2019). Whilst YTD RevPAR growth is up 17% versus 2019, TRevPAR growth was lower, as F&B revenues were 3% below 2019 levels at £38 PAR.

- Regional UK recorded occupancy of 81.3% in July, an uplift of approximately one percentage point versus the previous year and its highest occupancy performance since September-19. ADR increased 3.6% versus July-22, whilst in real terms ADR was 4.6% ahead versus July-19.

- With 13% RevPAR growth achieved in June 2023 across Regional UK, month-on-month, the uplift in July’s trading was resilient, but with RevPAR growth far more moderate, rising by just 2%.

- For Regional UK’s Upper Upscale Hotels, July YTD RevPAR is up 14% versus 2022, but the differential versus YTD-2019 is just 7% due to significantly lower occupancy levels. YTD F&B revenues are also 11% lower PAR than in 2019, with the share of F&B revenue falling to 29% of total revenue (33% in 2019). Consequently, no growth was recorded in YTD TRevPAR, which is now on par with 2019 levels.

- Despite ongoing cost pressure and slower revenue growth, resilience in terms of departmental operating income has been achieved, with London recording 4.2% growth for the month, versus July-22 and regional UK seeing 2.3% growth. YTD, both London and Regional UK are recording departmental operating income ahead of YTD-2019, up by 8% and 13% respectively.

- Utility costs increased by 45% in London and by 27% across regional UK as at July YTD, versus the same period in 2022, equivalent of 4.7% and 7.6% of total revenue respectively.

- Total payroll costs in London increased by 2.8% PAR in July versus the previous month, whilst a 1.5% reduction was recorded across Regional UK. Year-on-year, total payroll costs PAR in London have increased by 26% versus July-2022 and by 14% in regional UK.

- The continued rise in costs and slower RevPAR growth has impacted July’s GOPPAR performance throughout the UK. London, saw GOPPAR growth of less than 1% versus July-22 and its GOP margin falling to below 49%, (2.7 basis points lower than July 2022). Across Regional UK, GOPPAR was at its highest since July-22, but suffered a y-o-y decline of 1.2%.

- On a YTD basis, both London and Regional UK have made a full recovery in GOPPAR versus 2019. GOPPAR in London as at July YTD averaged £95 PAR and is ahead of YTD-2019 by 3.6%. Meanwhile, Regional UK secured YTD GOPPAR of £33, an increase of 6.7% versus 2019.

Download the latest hotels dashboard here

UK Hotels Trading Performance Review - 2022

The market leading report provides detailed insight into the operational revenues, costs, profitability and KPIs of the UK hotel sector. Despite rising cost pressures, in 2024 the UK Hotel market delivered another strong and profitable year of trading, with improved profit margins.

Download now