Zoom's pivot to office working

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

Shares in WeWork fell by a third in after hours trading yesterday following publication of its Q2 results.

"As a result of the company’s losses and projected cash needs, combined with increased member churn and current liquidity levels, substantial doubt exists about the company’s ability to continue as a going concern," the company said. Our "ability to continue as a going concern is contingent upon successful execution of management’s plan to improve liquidity and profitability over the next 12 months."

That plan includes cutting rent and tenancy costs via restructuring and negotiating more favourable lease terms, increasing revenue by reducing churn and increasing new sales, controlling expenses and capital expenditure, plus seeking additional capital via issuance of debt, equity securities or asset sales.

As of June 30, 2023, WeWork's systemwide real estate portfolio consisted of 777 locations across 39 countries. Those locations include 906,000 workstations and 653,000 physical memberships, equating to physical occupancy of 72% and a decrease in physical memberships of 1% year-over-year.

A structured hybrid approach

Zoom, the video-calling platform that shot to prominence during the pandemic, told employees this week that it intends to enforce a “structured hybrid approach." Employees who live near an office “need to be onsite two days a week” because it’s “most effective” for the video-conferencing service, the company said.

While the story is clearly dripping in symbolism and I can see the temptation to declare it as the moment remote work died, nothing here makes Zoom an outlier. As Knight Frank's head of occupier research Lee Elliott has noted previously, we've known for some time that the 'Martini Syndrome' of working anytime, anyplace, anywhere, is not the desired outcome for most companies.

Just 3.4% of the 650 corporate real estate leaders we surveyed for (Y)ourspace during March and April said they would have a 'remote first' workstyle three years from now. That compares to 55.7% that said they would opt for hybrid, and a further 23.2% who said they'd be 'office first'.

What hybrid really entails is still being ironed out during a period of massive change and upheaval. Almost 60% of (Y)ourspace respondents said the complexity of operating would be ‘increased’ or ‘much increased’ during the next three years. Our survey respondents were also clear that workstyles will become more complex over the period. This is a process still in its early phases and Zoom clearly sits alongside huge numbers of businesses that view real estate as an important tool to boost collaboration - a factor that has only grown in importance with each edition of (Y)ourspace.

Not as high, but for longer

I talked last week about Bank of England forecasts that pointed to a prolonged period with the base rate at 5% or more. The Bank hinted that it thinks the current period of monetary policy tightening is coming to its peak, but that inflation would only return to target by Q2 2025.

The National Institute of Economic and Social Research (NIESR) issued similar forecasts this morning, but with the addition that it believes inflation could average just above the 2% target as far out as 2027. It believes the base rate will peak at 5.5%, but that wage growth will slow the path of inflation back to target, resulting in a period of higher interest rates and very meagre growth, 0.4% this year and 0.3% in 2024.

Mortgage rates have eased in recent weeks on the back of better inflation figures, but that will soon reach a natural plateau. Forecasters including Capital Economics don't think we'll see base rate cuts until the second half of next year.

Stress testing

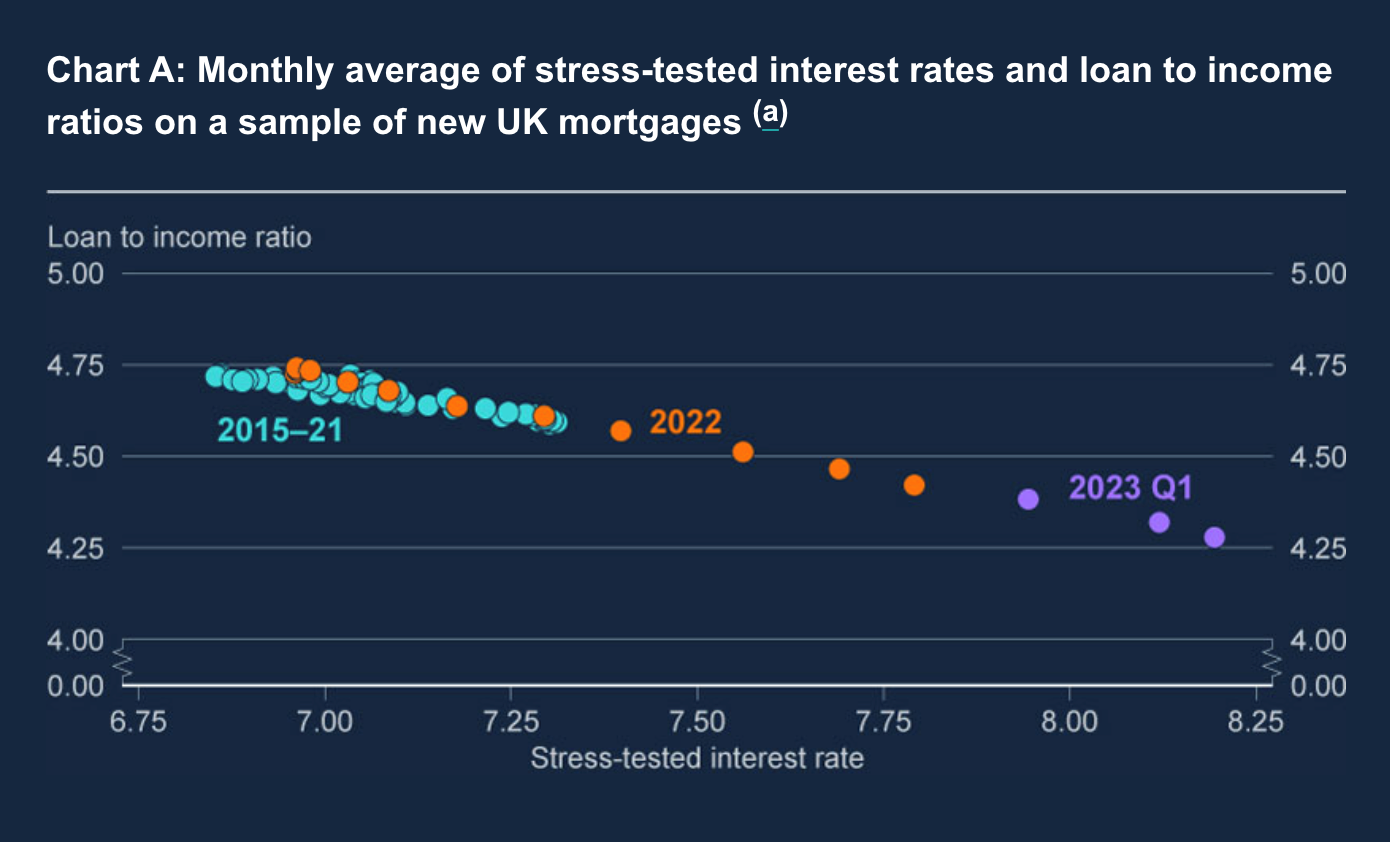

As interest rates have climbed, lenders have stress tested borrowers at higher interest rates.

Those stress tests take into account a borrowers' income, spending and their potential mortgage repayments. Lenders generally don't allow mortgage payments to take up more than 40% of a borrower's income, for example.

The stress tests mean that rising interest rates steadily cut into the amount people can borrow relative to their income, as revealed by the Bank of England chart below - blog here. The average loan to income (LTI) of new mortgages has fallen from around 3.4 in 2021 to 3.2 in 2023 Q1. The share of new mortgages at an LTI greater than or equal to 4.5 has fallen from 9.6% in 2021 to 6.0% in 2023 Q1.

This prices buyers out of the market, which will lead to a rebalancing of supply relative to demand and will weigh on values until interest rates start to come down. There are few workarounds beyond extending your mortgage term - I talked on Friday about data from Taylor Wimpey showing 27% of first-time buyers took on mortgage terms of more than 36 years in the first half of the year, compared to just 7% in 2021.

The share of new lending with mortgage terms greater than 35 years has increased from 5% in 2021 to 11% in 2023 Q1, according to the BoE figures.

In other news...

What are buyers prioritising as mortgage rates rise? Chris Druce has the results of Knight Frank's biannual Residential Property Sentiment Survey.

Elsewhere - Hopes of turning Cambridge into ‘science capital of Europe’ collide with reality (FT), and finally, landlords ‘in the dark’ on new rules for energy efficiency in buildings (Times).

Photo by Compare Fibre on Unsplash