The US is ripe for housebuilding as homeowners sit tight

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Prime London

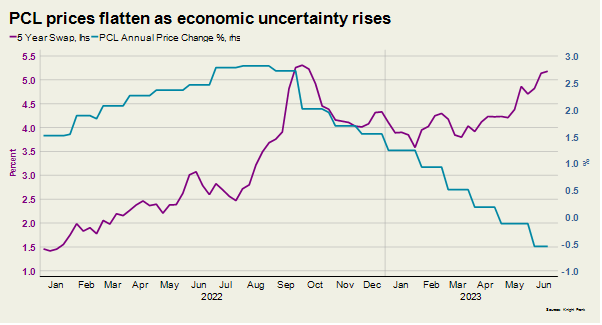

Annual house price growth in prime central London has been easing since late last year. Prices contracted 0.5% in the most recent twelve months as mortgage rates climbed and the Bank of England base rate moved up to 5% (see chart).

Sentiment has taken a hit in the most recent four weeks, but the market is proving resilient, according to Tom Bill's latest update. The number of new prospective buyers registering during the period was still about a quarter above the long run average.

The resilience is perhaps no surprise given that around half of sales inside zone 1 are typically in cash. The market will also be supported by greater levels of affluence, the relatively weak pound (depending on your timing) and the fact overseas travel is returning to pre-Covid levels. Despite these supports sensitivity around asking prices is higher than it was just a month ago and nervousness among lenders is rising. You can find our latest forecasts here.

Rising supply

Uncertainty in the prime central London sales market means more owners are letting out their property after failing to achieve their asking price. It's welcome news for tenants, who face rents that are more than 25% higher than they were at the start of the pandemic.

“The preference for many owners is still to sell,” says Gary Hall, head of lettings at Knight Frank. “But more are open to the rental option given the recent wobbles in the sales market. Tenant demand is strong and yields are very healthy, which adds to the appeal.”

The number of new prospective tenants registering was 31% above the five-year average in May, underlining the strength of demand from students and businesses. Meanwhile, gross yields reached 3.99% in prime central London (PCL) in June, which was the highest figure since 2009.

A market on the turn

The US housing market entered spring with a dearth of properties for sale. Listings amount to about half of what they were at the same point in 2019.

That's fuelling house price growth despite the 30-year mortgage rate running at 6.67%. House prices in all 20 major metro markets covered by S&P CoreLogic Case-Shiller index rose in April, according to figures published yesterday. Gains accelerated in twelve of those markets.

The big winners in these conditions are the housebuilders, who make up an increasingly large proportion of the available homes for sale. Purchases of new single-family homes increased 12.2% to an annualized pace of 763,000 last month, government data also showed yesterday.

UK inflation

Those hunting for silver linings in last week's UK inflation release were drawn to the reading of producer price inflation - the prices paid by manufacturers - which eased to the lowest level in two years.

The index is "one of the best leading indicators of the long-run evolution of prices in this country," and is one of several promising signals that inflation will decline more meaningfully this year, Bank of England setter Swati Dhingra told the Royal Economic Society yesterday. Her comments were picked up in the Times.

Dhingra is among the most dovish on the Bank of England's Monetary Policy Committee and was one of only two members to vote to hold rates at the June meeting that resulted in a bumper rise to 5%.

Median responses to a Reuters poll of economists taken after that MPC meeting shows the base rate peaking at 5.50% next quarter following 25 basis point hikes at the August and September meetings.

In other news...

Big bids for land plots in Singapore (Bloomberg), Christine Lagarde hints at more eurozone interest rate rises (Times), and finally, price discounts jump as rising mortgage costs ‘spook’ UK housebuyers (FT).