Wealth creation limits, and super-prime homes surge

The latest insights and trends in global wealth markets as super-prime homes sales bounce back.

4 minutes to read

Here we take a look at the latest data and news in global wealth markets from 2023 to bring you up to date with global wealth trends.

Wealth creation limits

Relatively benign economic conditions and ultra-low interest rates fuelled a remarkable period of wealth creation during the five years to 2022.

The global population of ultra-high-net-worth individuals, those worth at least US$30 million, grew 44% during the period, led by a record breaking 9.3% expansion in 2021.

That period of growth ended last year as interest rates surged, weighing on the values of scores of asset classes. In the US, the traditional investment portfolio comprising 60% stocks and 40% bonds, a 30-year cornerstone of asset allocation due to their inverse correlation, endured its worst performance since the 1930s. The global UHNWI population shrank 3.8%.

There were nuances to the story - both at a regional and country level, as well as across wealth bands. The Middle East was the standout region, with 16.9% growth in its UHNWI population. The UAE saw growth of 18.1%, making it the fastest growing UHNWI hub (see chart). Africa also proved resilient, with 6.3% growth.

Still, the overall contraction left many asking whether 2022 was a blip, or has the global economy changed in a manner that will endure, capping its ability to create wealth? We believe the former, and we outline why in a Wealth Populations update that forms part of our new Wealth Report Series. While we don't believe the rate of growth in the previous five years will be matched over the next five years, we forecast that the UHNWI population will expand 28.5% as the world adapts to the new economic environment. You can read more here.

Super-prime sales

Global super-prime ($10m+) residential sales bounced back in Q1 2023, with 417 sales across the 12 markets tracked in Knight Frank’s new Global Super-Prime Intelligence report. That's up 11% on the 376 recorded in Q4 2022 and the highest volume since Q2 last year.

The biggest market in Q1 this year was Dubai (88 sales), followed by Hong Kong (67), New York (58), Los Angeles (46), Singapore (37) and London (36). While volumes rose in Q1, the total value of sales fell 4% to $7.2 billion. The most expensive average super-prime sales took place in Geneva ($23.8m) and London ($20.4m)

The role of Dubai in supporting the global super-prime market cannot be overstated. The Emirate accounted for just 2% of all super-prime sales across our 12 markets in 2019. That's surged to 17% in the most recent twelve months. Second placed London managed 14%.

Cross border demand continues to support markets. Notable trends include a rise in demand for Swiss super-prime property from Scandinavia, with Norway’s wealth tax cited as a particular driver. London and Paris have highly diverse markets which were boosted by the arrival of more Asian, Middle Eastern and US buyers in 2022 and Q1 this year as travel normalised following the pandemic. Meanwhile, Hong Kong’s delayed covid reopening saw a notable uptick in Mainland Chinese buyers.

We think we'll see more subdued conditions compared to the recent 2021 peak, with transactions likely to total $25- $27 billion for the full year. You can read more on the outlook in the full release.

Prime cities

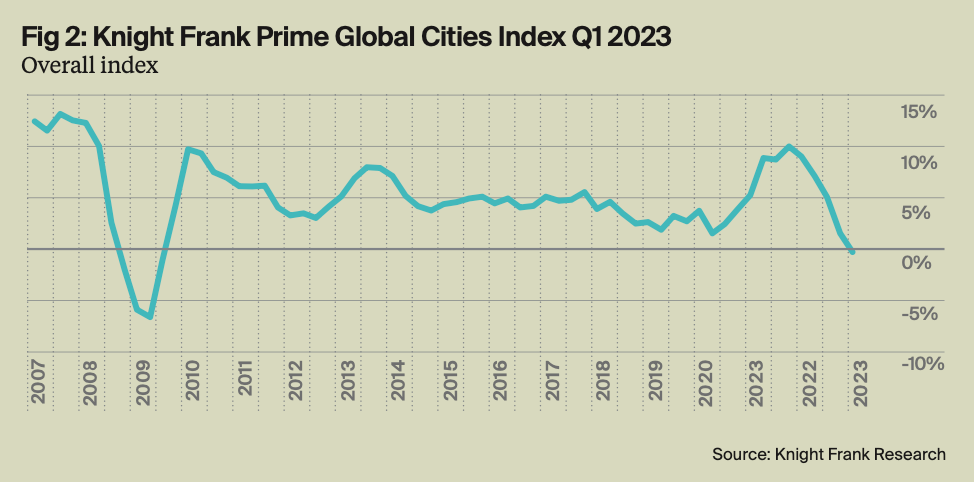

The first quarter of 2023 saw annual price change in the world’s luxury housing markets turn negative for the first time since the Global Financial Crisis as rising interest rates started to feed through.

Our Prime Global Cities Index, which tracks the movement of prime residential prices across 46 cities, fell 0.4%, a sharp reversal from a peak of 10.1% growth in the twelve months to the final quarter of 2021. Two thirds of markets are still seeing positive growth, but the large size of the declines in the weakest markets pulled the overall index negative.

Again, Dubai’s 44% annual growth remains a substantial outlier, with second place Miami the only other city to reach double digit growth. Zurich (9.4%), Berlin (5.7%) and Singapore (5.5%) complete the top five markets - pointing to the resilience of wealth and, in Berlin’s case, investment hubs.

New Zealand dominates the lower ranks of the index with Wellington seeing prices fall more than 27% over the past year, followed by Auckland (-17%), and Christchurch (-15.3%). Other weak performers include Stockholm (-11%) and Vancouver (-9.4%), reflecting weakness in their broader national markets.

Discover more

Download

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report

Subscribe

Subscribe for all the latest insights and additional content.

Subscribe