Global residential update - February 2023

The EU’s ambitious zero-emissions target, Manhattan rents, the cost of living and more.

4 minutes to read

Europe & ESG

All new buildings in the EU will need to be zero-emission by 2028, according to a new directive passed by the European Parliament last week. Plus, all existing buildings will need to be zero-emission by 2050. Estimates suggest this move will affect 75% of all EU buildings.

Additional measures include:

- New buildings occupied, operated or owned by public authorities should be zero-emission by 2026

- All new buildings should be equipped with solar technologies by 2028

- Residential buildings will have to achieve at least energy performance class E by 2030 and D by 2033. Non-residential and public buildings would have to achieve the same classes by 2027 and 2030, respectively

The EU will loosen subsidy rules enabling its 28 member states to offer more support to green tech firms and ease red tape to speed up the approval of state-aid.

The challenge will be greater for some member states than others. As React news points out three quarters of buildings in Italy were built before 1981, pre-dating the first energy laws. Residential upgrades in the next ten years could cost c.€400bn.

The draft legislation will be put to a vote by the full House in mid-March.

Inventory

We’ve talked a lot about how low levels of prime listings are supporting prime prices in global cities, but how low are inventory levels?

We’ve looked at four key cities to gauge where sales listings sit now, and how far they’ve travelled south since economies reopened after the pandemic.

The data reveals that Manhattan has seen the biggest fall in total listings since 2020, down 24%, followed by Vancouver (-14%) and Paris (-13%). Conversely, Toronto, where prices have fallen 10% from their peak in Q1 2022, has seen a jump in listings, up 10% over the two-year period.

To understand what impact low inventory is having on price performance sign up here to The Wealth Report 2023. Published in the coming weeks, it will include the Prime International Residential Index (PIRI 100) tracking 100 of the world’s top prime markets – cities, sun and ski resorts.

Manhattan rents

New York’s rental boom isn’t over yet but momentum is slowly shifting from the landlord to the tenant.

New data from my colleague Jonathan Miller, who produces research for our US partners Douglas Elliman, shows luxury rents increased at a rate of 13% per annum in January 2023, compared to a high of 30% in Q2 2022.

A holding pattern is beginning to emerge as landlords and tenants wait to see if the US dips into recession and unemployment increases. In the meantime, leasing has slowed, with new signings down almost 30% in January compared to three months earlier but new listings are largely static over the same period.

Our latest Prime Global Rental Index shows the strength of the New York rental market on a global stage.

We expect rental growth to slow in 2023, as stock constraints ease with some sellers choosing to rent out their properties while watching the market and looking to mitigate higher mortgage rates.

Cost-of-living

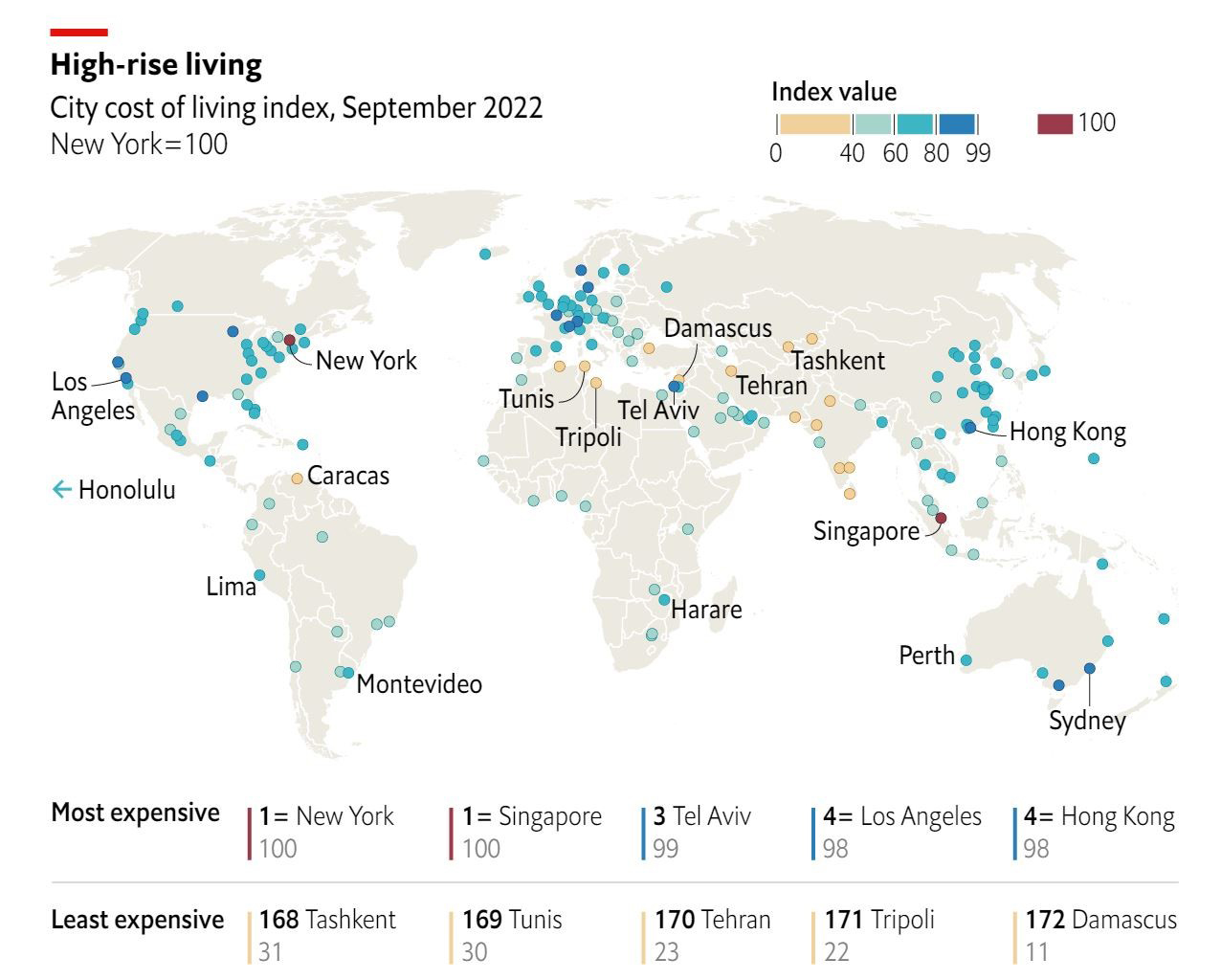

Singapore and New York are the world’s most expensive cities, according to the EIU’s latest Cost-of-Living Index, a platform used by HR teams to benchmark relocation packages.

But Asian and US cities are moving in opposite directions, with US cities shooting up the rankings due to the strong dollar and Asian metropolises sliding in 2022.

On average prices in key cities are up 8.1% in local-currency terms over the past year, according to the survey, which compares the price of more than 200 products and services in over 170 cities.

The rising cost of energy, food and the impact of China’s Covid-19 restrictions on supply chains are behind the index’s biggest leap in 20 years.

In Europe, Zurich, Geneva, Paris, Copenhagen and Oslo lead the rankings.

The three UK cities surveyed all dropped down the rankings, with London now 28th from 17th in 2021. Edinburgh came in at 46th, down from 27th, while Manchester was 73rd most expensive compared with 41st last year.

In other news…

Remote working is costing Manhattan more than US$12 billion a year (Bloomberg), four more countries are to be added to the EU blacklist of non-cooperative tax jurisdictions (International Investment) and the Hang Seng slips almost 10% since 27 January (Bloomberg)