Office return places focus back on urban living

Demand has risen in UK regional town and city markets since Covid lockdowns.

2 minutes to read

City living is back in fashion

While the “escape to the country” trend calms down, the seasonal and geographical rhythms that shaped the UK market outside of London before the pandemic are reasserting themselves.

The recovery of town and city markets, which saw a fall in popularity in the first stages of the pandemic as interest in country living surged, has gathered momentum as pandemic restrictions have been lifted.

From Q3 2020 to Q3 2022 the number of exchanges in regional towns and cities increased by 10%, Knight Frank data shows. In the same period rural exchanges declined by 9%.

“The country market went completely crazy two and a half years ago,” said Tim Harriss, office head at Knight Frank Guildford. “Some buyers thought they could leapfrog the Home Counties and live much further out but the dawning reality for many is that even if they are hybrid- working, they’re in the office three days a week so their commutes need to be manageable.”

Our last sentiment survey found 57% of people were hybrid working, with only 19% working exclusively from home. With the unemployment rate edging up to 3.6%, there has been an increase in City workers returning to their desks as the economic outlook becomes more uncertain.

Escape to the country evolves

This shift back to more urban areas with a shorter commute can be seen right across the UK. Compared with the peak period for the “escape to the country” trend in Q3 2020, nine of the top ten areas in England and Wales that have seen the largest increase in properties under offer since are classified as majority urban (see table), OnTheMarket data shows.

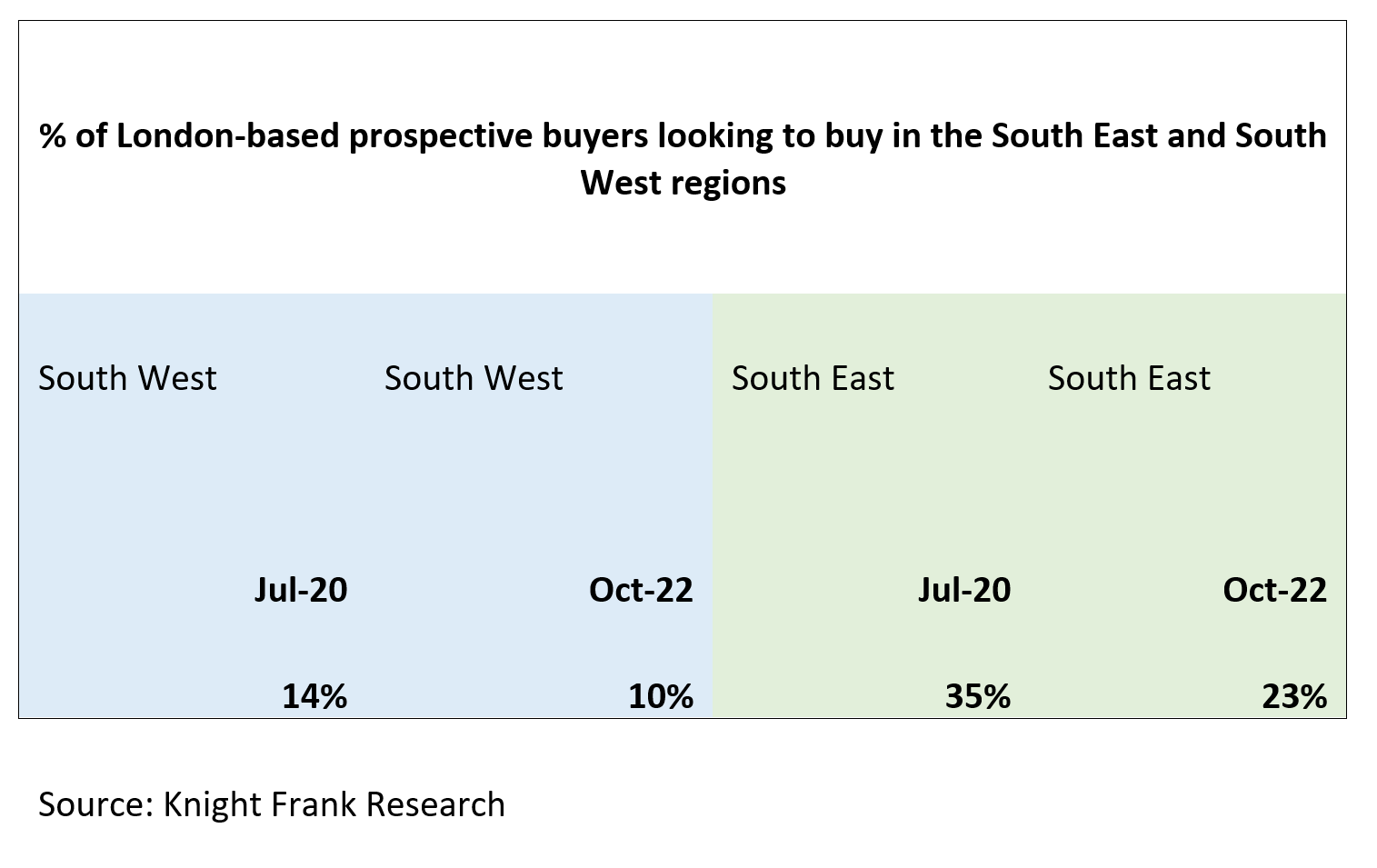

While the South West region saw a surge in interest after the first UK lockdown, attracting many Londoners to make a lifestyle change, demand has returned to levels similar to before the pandemic (see table).

Meanwhile, the South East has proved resilient since restrictions were lifted thanks to its proximity to London, and greater affordability compared with the capital itself.

“A big driver for activity remains families in their 30s and 40s looking to upsize, that are attracted by the schools, culture, restaurants and employment opportunities that cities offer,” said Robin Engley, city sales lead at Knight Frank Bristol.

“Since the pandemic buyers are looking for more space and greenery, and cities such as Bristol can offer this at a more affordable level than London property,” Robin added.

Sign up to receive the Prime Country House Index.