Investment diversification benefiting Seniors Housing market

The UK Seniors Housing market is set to see investment levels rise as investors diversify their portfolios.

2 minutes to read

Our latest Seniors Housing Annual Review 2022/23 shows the volume of investment and capital targeting the UK Seniors Housing market continues to grow.

In the first nine months of 2022, more than £2 billion was committed to the sector, already surpassing the full year figure for 2021.

Rising investment volumes come despite rising geopolitical and economic uncertainty which include supply chain issues, a global energy crisis, high levels of inflation, and increases in build and operational costs, as well as the war in Ukraine.

The report examines the fundamentals of the private Senior Living market from the strong demographic landscape to sales and rental performance of the largest private operators.

Future investment set to rise

To get an idea of the scale of investment and future investment strategies in the market, we surveyed a range of different residential investment types.

Our latest residential investment survey represents the views of 54 institutional investors that manage £76 billion in residential assets across the UK (including student and BTR)

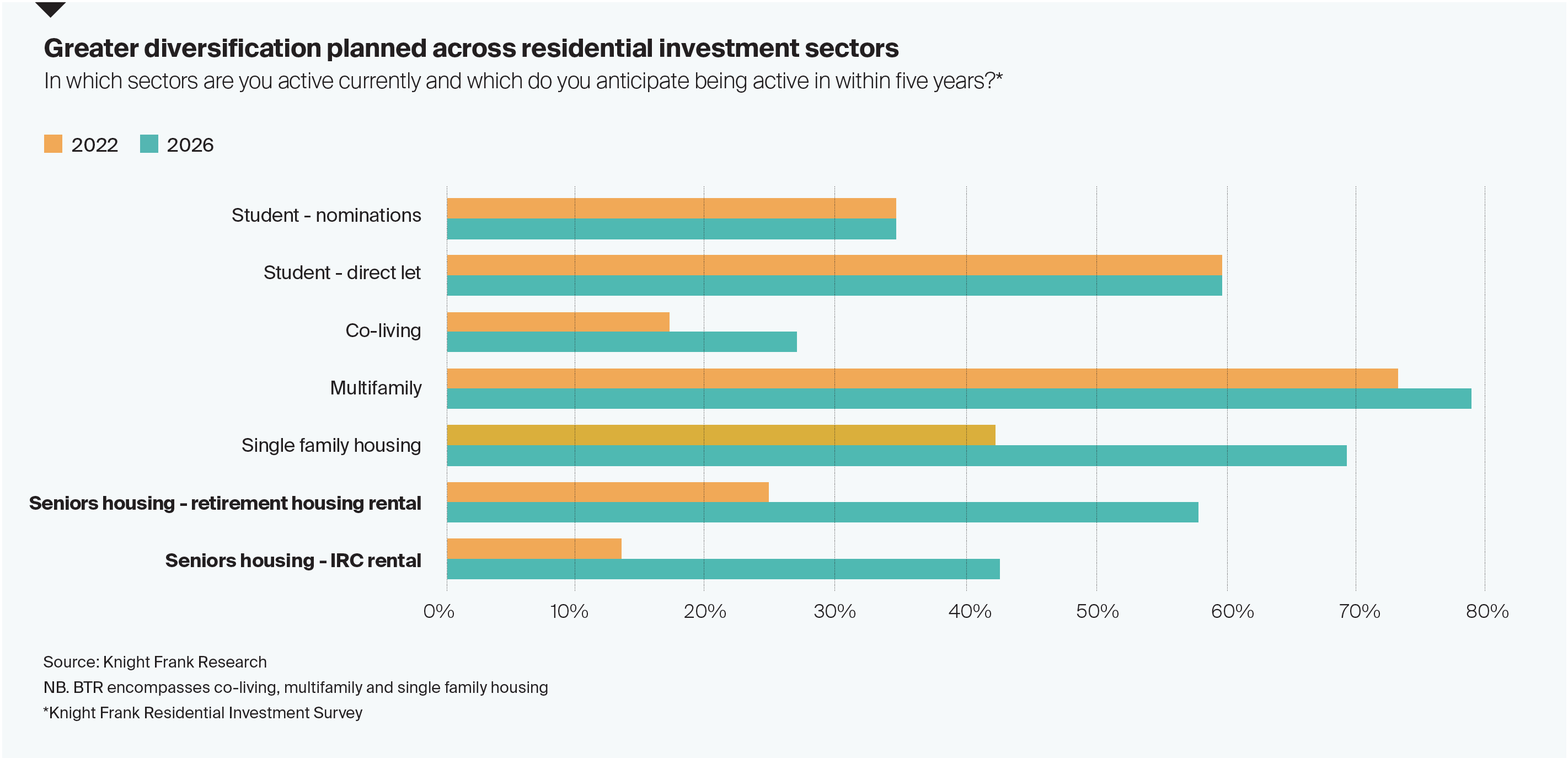

It showed that while only 31% of respondents are currently active in the Seniors Housing sector, 67% expect to be active in five years’ time, the largest projected increase of any sector in the survey.

Diversifying investment strategies

The Seniors market in particular is benefiting from a diversification of investment strategies.

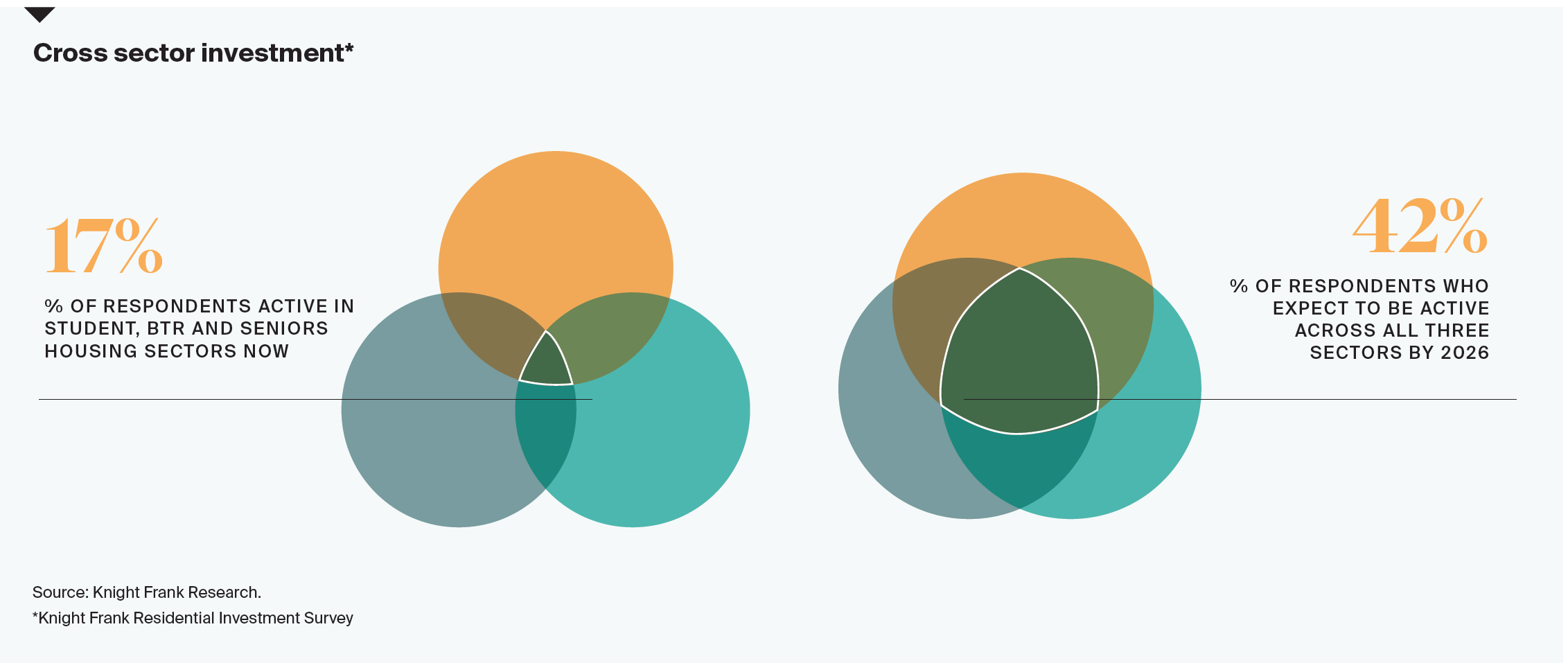

The survey showed that by 2026, 42% of respondents expect to move into all three sectors, up from the current 17%, highlighting the future importance of cross-sector investment.

A significant increase in seniors housing investment over the next five years, compared to current levels and against other residential investment sectors, was highlighted in our survey.

Why the increase seniors housing investment?

Retirement Housing optimises the development return.

Integrated Retirement Communities (IRCs) provide investors with a development return and long term cashflows underpinned by a Deferred Management Fee (DMF) on exit for-sale model and inflation linked tenancies on the rental model.

We expect to see yield compression for investors in the medium term driven by increased investment, the expansion of the sector, as well as maturing operational businesses.

Investors who can deliver on strong development pipelines are likely to benefit from first mover advantage in the race to scale and optimised operating performance.