Zambia

All property sectors in Zambia are moving into a post-pandemic recovery phase, with the residential leasing market emerging as the most buoyant.

3 minutes to read

Outlook for office market brightens

Take-up and new requirements are both rising in the office market. This is being driven mainly by growing demand from international businesses who are increasingly active as the pandemic restrictions start to abate.

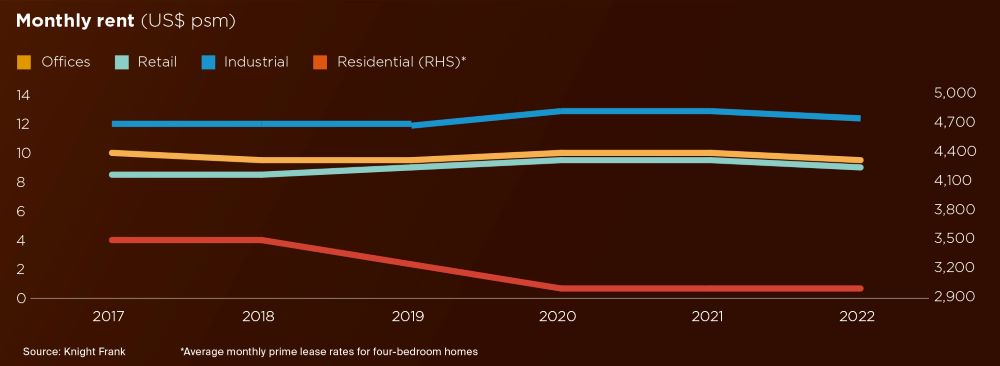

Monthly rents for Grade A offices are stable, ranging between US$ 15–18 psm, while average occupancy levels for prime offices stand at approximately at 65%, suggesting any meaningful return to rental growth is unlikely in the short term.

When it comes to requirements, fully serviced and furnished offices are growing ever more popular, just as they are globally as tenants carefully reflect on their exact office needs. A recent example is the 4 on Bishops development by Pylos in Kabulonga, Lusaka, where 50% of the 1,360 sqm space has been leased by AfricaWorks. We expect this to be rapidly absorbed by the market.

Retailers remain in the driving seat

In the retail market, tenants have continued to renegotiate their lease terms against the backdrop of a subdued economy. This includes hybrid leases (a mixture of US$ and Kwacha rates), more turnover-based rents, shorter leases, reduced rents and even temporary suspensions of previously agreed escalation clauses.

While some retailers have resorted to reducing their floor space in various mall locations, others such as LC Waikiki, the Turkish fashion retailer, have continued with their expansion plans by opening in Cosmopolitan Mall, Lusaka and Mukuba Mall in Kitwe. Shoprite also opened another supermarket in Lusaka at EastPark Mall and Pick n Pay opened a new supermarket at the Longacres Mall in Lusaka.

Low warehouse rents prompting upgrades

The prime industrial sector remains resilient, but has been under increasing pressure from the oversupply of warehouse space in the secondary market. This has been creating headaches for landlords due to the abundance of cheaper, albeit poorer quality, options for occupiers, even on a short-term basis. Prime space currently lets for c. US$ 4-4.50 psm per month, down from US$ 5-6 psm per month two years ago.

"After a period of oversupply, a recent surge in demand for prime warehouse space in Lusaka has resulted in a dearth of stock in this sector, albeit this is expected to be temporary."

- Tim Ware, Managing Director, Knight Frank Zambia

In the prime warehousing market, a different dynamic has emerged. High quality, international spec facilities are experiencing increasing levels of demand, which has resulted in near 100% occupancy of both the York and Krimanvi Warehouse Estates in Lusaka. Weak rents overall have also contributed to this trend as occupiers gravitate towards best-in-class stock, with many capitalising on the relatively low rents.

Housing demand returning

Prime residential rents are demonstrating greater stability, in part due to the return of demand by expatriates and executives of multinational companies. Landlords are still cautious following the virtual eradication of demand during the pandemic from the expat cohort, with some even offering Kwacha based leases, instead of the traditional US dollar contracts.

Demand for housing, which is still dominated by the self-build market, is expected to remain high for the long term. This will be underpinned by ongoing population growth averaging c.3% per annum, which by our estimates, will translate into a deficit of 1.5 million homes.

Asset Class to Watch

Zambia has the potential to become a regional agricultural hub and global exporter of processed agricultural products, thanks to its vast tracts of arable land, nutrient-rich soil and abundant water supply. Corporation Tax for agriculture is only 10% compared with 35% for other sectors.